Bitcoiners accuse JPMorgan of rigging the game against Strategy, DATs

Members of the Bitcoin community and supporters of Strategy, the largest corporate holder of BTC, are criticizing JPMorgan’s proposed Bitcoin-backed notes, accusing the bank of spreading fear, uncertainty and doubt about Strategy and other crypto treasury firms.

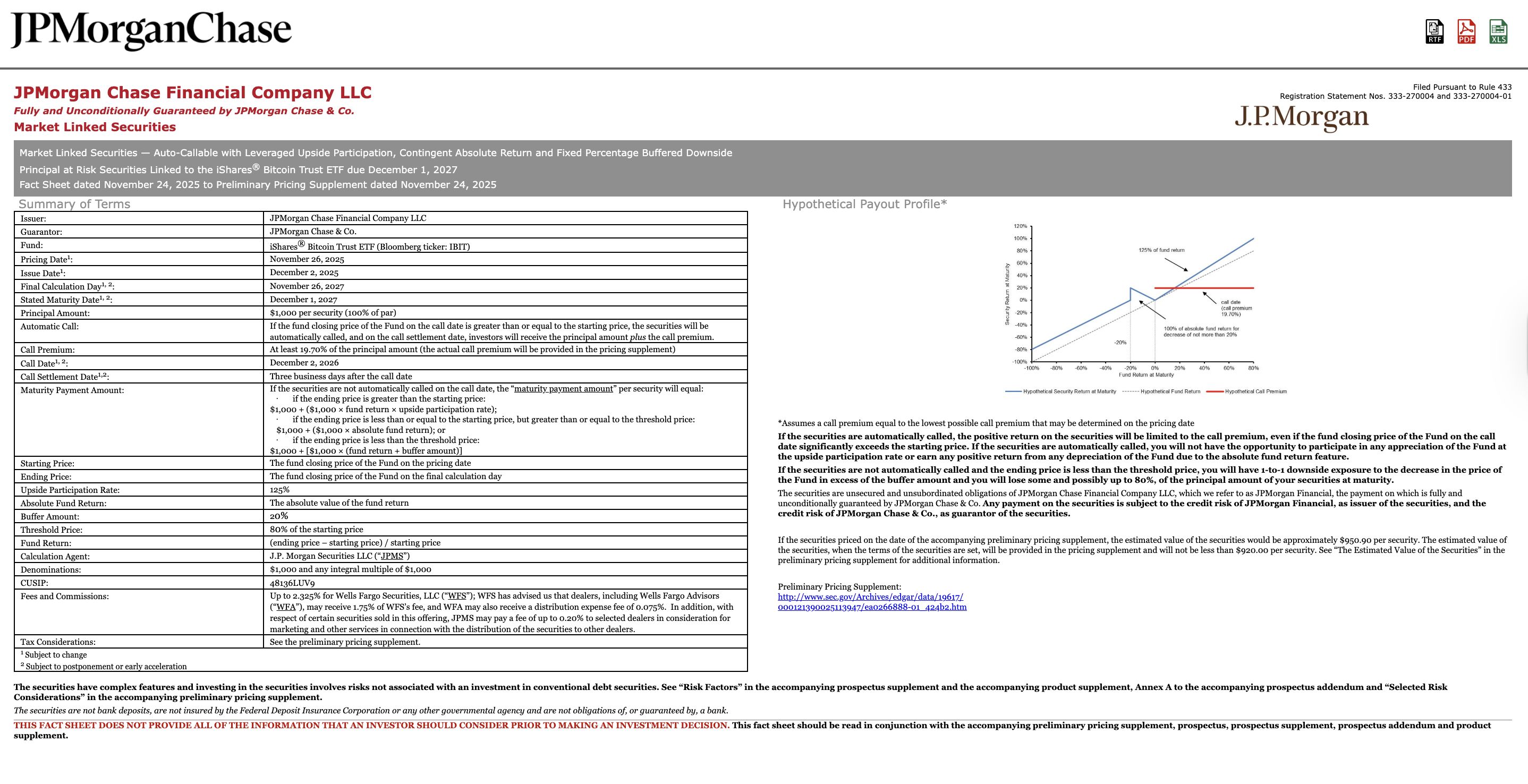

JPMorgan’s notes are a leveraged investment product tied to the price of Bitcoin (BTC). The product tracks BTC but amplifies the outcome, giving holders 1.5 times the gains — or the losses — through December 2028. The notes are slated for a December 2025 launch, according to an SEC filing.

The move drew sharp criticism from the Bitcoin community, with many saying that JPMorgan is now a direct competitor to BTC treasury companies and has an incentive to marginalize companies like Strategy to promote its own structured financial product.

“Saylor opened the door to the $300 trillion bond market and $145 trillion fixed income market. Now, JP Morgan is launching Bitcoin-backed bonds to compete,” said a Bitcoiner on X, adding that “the same institutions attacking MSTR are copying the strategy.”

Bitcoin advocate Simon Dixon also noted that JPMorgan’s upcoming product exists “to trigger margin calls on Bitcoin-backed loans,” claiming that it will “force sell pressure from Bitcoin treasury companies in down markets.”

On X, crypto enthusiasts and Strategy supporters are now calling for a boycott of JPMorgan, encouraging fellow Bitcoiners to close accounts at the financial services giant and sell any shares in the company they might own.

MSCI rule change proposal triggers clash

The backlash against JPMorgan began when MSCI, formerly Morgan Stanley Capital International, a company that manages stock indexes and sets the criteria for index inclusion, proposed a policy shift excluding treasury companies from its products.

The proposed shift, set to take effect in January, bars crypto treasury companies with 50% or more of their assets in cryptocurrencies from inclusion in the index.

JPMorgan shared the proposed policy shift in a November research note, drawing sharp criticism from the BTC community and Strategy investors.

Excluding crypto treasury companies from stock indexes deprives them of passive capital flows and could force these companies to sell off their crypto holdings to qualify for index inclusion, driving asset prices down further.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Today: Institutional ETFs and Derivatives Indicate a Positive Shift for XRP Above Crucial Support Levels

- XRP rebounds above $2.20 as buyers defend key support, supported by $107.92M in ETF inflows and rising institutional confidence. - Technical analysis highlights a bullish "Staircase to Valhalla" pattern, with $2.26-$2.52 resistance levels and Fibonacci targets signaling potential for $2.69. - Derivatives data shows aggressive long-positioning (OI: $4.11B), with Binance's 2.56 long-short ratio and 57% options OI surge reinforcing bullish momentum. - Institutional ETF conversions (e.g., Grayscale Zcash) an

Why Switzerland's Temporary Halt on Crypto Highlights Worldwide Regulatory Disunity

- Switzerland delays crypto tax data-sharing until 2027, highlighting global regulatory fragmentation amid CARF adoption challenges. - Two-phase approach prioritizes domestic law alignment before reciprocal agreements with key economies like U.S., China, and Saudi Arabia. - 75 CARF signatories progress unevenly, with U.S. and Brazil proposing alternative frameworks, complicating cross-border compliance. - Swiss crypto firms face operational risks during transition, as critics warn of regulatory arbitrage b

Thailand’s Bold No-Crypto-Tax Move: Shaping a Future Southeast Asian Crypto Center

- Thailand imposes 0% capital gains tax on local crypto trading (2025-2029) to boost its digital economy and attract investors. - The policy aligns crypto profits with tax-exempt stock trading, supported by a 2024 Bitcoin ETF and Tourist DigiPay pilot for foreign visitors. - Regulatory caution is evident through biometric data shutdowns and PDPA compliance, balancing innovation with security amid regional competition. - Projected $1B annual economic gains aim to position Thailand as a top Southeast Asian c

The Transformation of Webster, NY: Targeted Property and Infrastructure Initiatives After the Xerox Era

- Webster , NY, secured a $9.8M FAST NY grant to transform the former Xerox campus into a shovel-ready industrial hub, part of Governor Hochul’s upstate revitalization strategy. - Infrastructure upgrades, including road and sewer improvements, aim to attract advanced manufacturing and logistics firms by reducing development risks and costs. - The Xerox campus redevelopment includes mixed-use projects, projected to create 250 jobs and boost property values through residential and commercial integration. - W