Ethereum Could Flip Resistance to Test $3,500, Here’s How

Ethereum has continued to rebound from a 4-month low as technical indicators hint at a potential bullish trend continuation.

Ethereum (ETH) is closing the week with a strong rebound, firmly back above the $3,000 mark, although it has already lost by about 1% in the last 24 hours.

The altcoin is up roughly 10.8% on the week, with today’s trading confined to a relatively tight daily range between $2,986 and $3,042. That consolidation near the top of the recent move hints at ongoing buying interest, even as short-term traders begin to lock in profits around psychological resistance.

Notably, the second largest crypto by market capitalization is down 5.9% in the last 14 days and down over 25% in the last 30 days. The latest price action shows buyers gradually regaining control after November’s volatility, but key resistance and support levels will determine whether this recovery can extend or fade into consolidation.

Where is Ethereum’s Momentum Skewed?

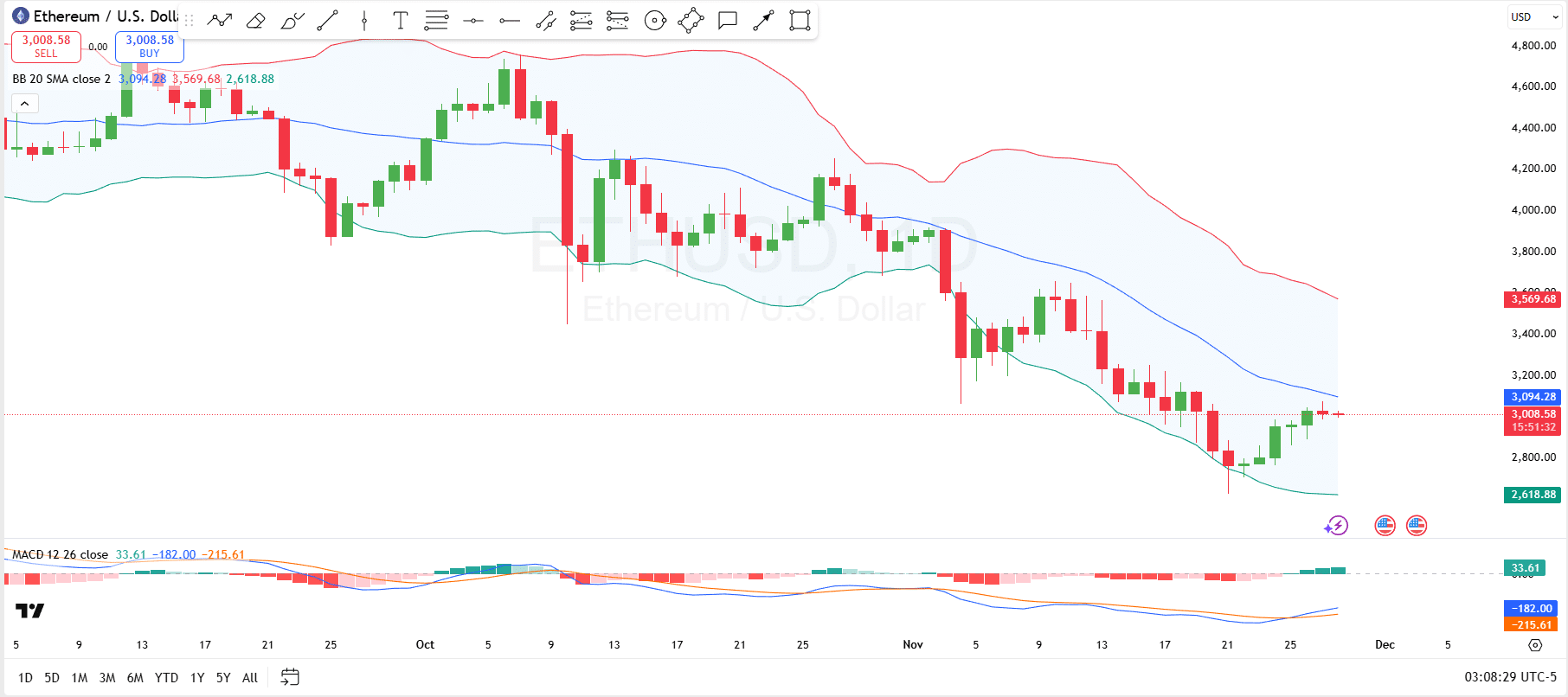

Looking at the technical end, Ethereum’s daily chart shows a market trying to stabilize after a prolonged downtrend. Price has bounced from the lower Bollinger Band at $2,619 and is now pressing against the mid-band, the 20-day simple moving average, at $3,094.

This mid-band currently acts as the first key resistance, capping the continuation of the trend. Meanwhile, the upper Bollinger Band near $3,569 forms the next resistance area if bulls manage a clean breakout above the 20-day SMA.

On the downside, initial support sits around the recent cluster of candles just above the lower band, with stronger backing at the band itself near $2,620. Also, a contraction in the volatility may be on the brink, as broader bands often precede a “squeeze” phase where price consolidates before the next major directional move.

Elsewhere, the MACD indicator has just printed a bullish crossover, and the histogram has moved into positive territory, signaling that bearish momentum is fading and short-term buyers are gaining some traction.

A sustained move above the mid-band would open the door for a continued grind toward the upper band, while a rejection here could see ETH slide back toward the lower support zone to retest the durability of this rebound.

Higher Ethereum Timeframes

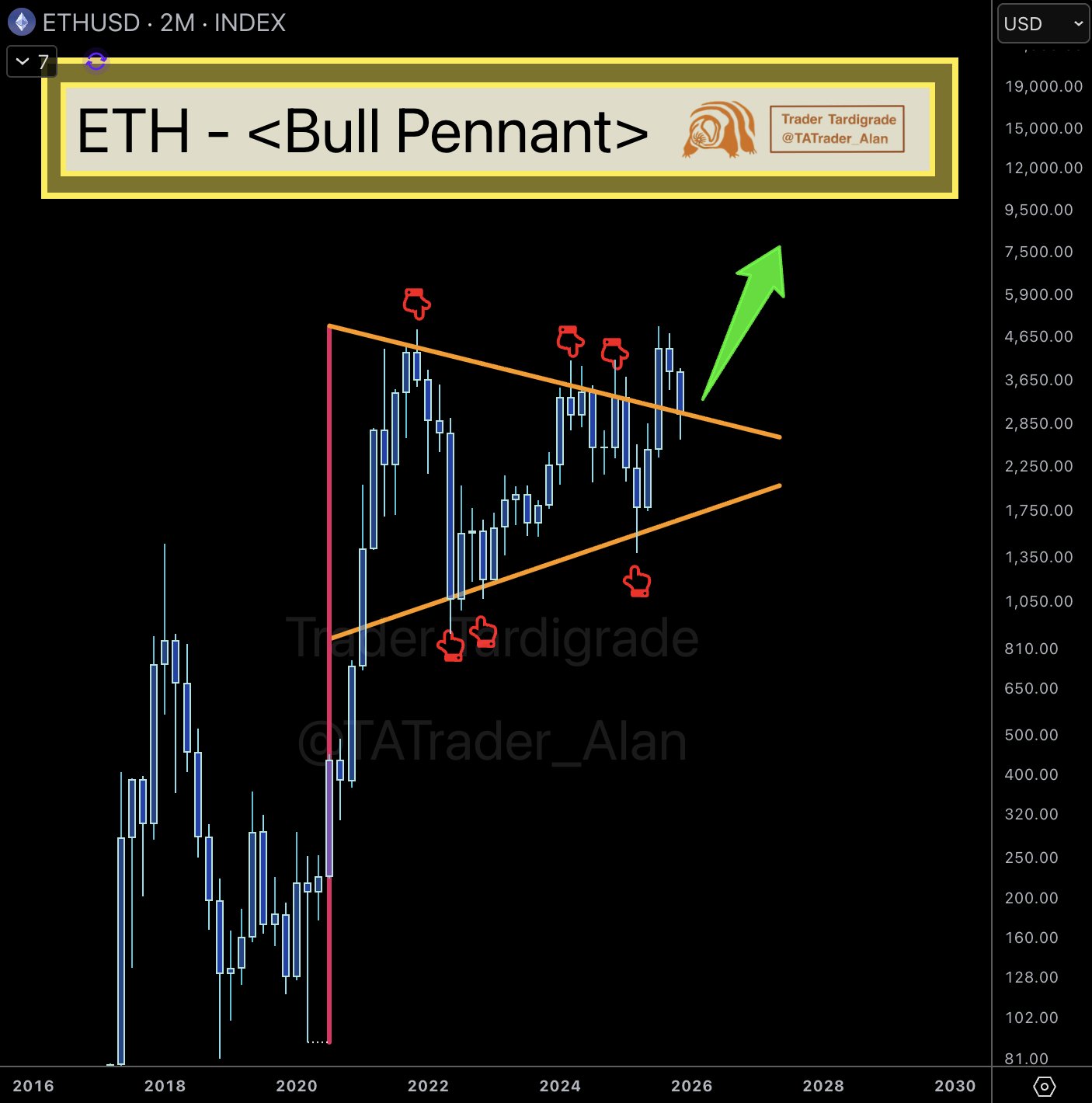

On the higher time frames, Ethereum’s structure looks much more constructive than the day-to-day volatility suggests. Trader Tardigrade’s 2-month chart frames ETH inside a large bull pennant that has been forming since the explosive rally off the 2020 lows.

The pattern is defined by fluctuations that compress price into converging trendlines, a classic consolidation after a strong “flagpole” advance.

According to the analyst, ETH has recently retested the upper boundary of this formation from above, turning former resistance into support. A sustained hold above the upper trendline would support Tardigrade’s view of an “upward trend only vibe,” that targets levels like $7,500. To reach $7,500 from the current $3,023, Ethereum must surge by about 148.1%.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Avail's Intent-Driven Nexus Addresses the Issue of Fragmented Liquidity Across Chains

- Avail launches Nexus Mainnet, a cross-chain solution unifying liquidity across Ethereum , Solana , and EVM networks. - The intent-solver model enables seamless asset transfers without technical complexities, streamlining user experiences. - Developers gain modular tools for multichain integration, reducing costs as cross-chain liquidity demand grows. - Nexus abstracts execution layers, offering unified balances and execution while addressing fragmentation challenges. - With $50B+ in cross-chain activity

From Guesswork to Practical Answers: Remittix's Wallet Highlights Crypto's Move Toward Real-World Use

- Remittix launched an App Store wallet, enhancing crypto accessibility with a user-friendly interface and cross-platform development plans. - The wallet's crypto-to-fiat module and CertiK/KYC verification aim to bridge digital assets with traditional finance, boosting investor confidence. - A $250,000 giveaway and 15% referral rewards drive community engagement, positioning Remittix as a utility-focused competitor in a consolidating market. - Analysts highlight its alignment with crypto's shift toward rea

Blockchain Faces a Quantum Countdown: Will Networks Adapt in Time?

- Major layer-1 blockchains prioritize quantum-resistant upgrades as NIST finalizes post-quantum (PQ) standards, addressing long-term risks from quantum computing advancements. - Networks like Algorand deploy lattice-based signatures (e.g., FALCON), while Cardano and Ethereum test hybrid solutions to protect ECDSA-based infrastructure from future quantum decryption threats. - Migration challenges include larger key sizes, complex key management, and incentivizing users to rekey dormant accounts, complicati

XRP News Today: XRP ETFs Attract Unprecedented Investments, But Price Remains Stuck Under Key Resistance

- XRP ETFs attracted $628M in inflows but token price remains below $2.22 resistance despite regulatory progress. - Solana ETFs saw $156M outflows vs XRP's $89M inflows due to technical issues and higher perceived risk. - Analysts highlight ETFs' role in liquidity but stress macroeconomic factors and technical barriers limit price breakthroughs. - XRP's 60-day range ($1.85-$2.15) contrasts with $3 price targets requiring sustained ETF demand and rate cut optimism.