Ripple RLUSD stablecoin surpasses $1b in supply on Ethereum

RLUSD recently surpassed $1 billion in supply on Ethereum, as the token gains regulatory approval in Abu Dhabi.

- Ripple’s RLUSD stablecoin surpassed $1 billion on Ethereum

- The token grew to this level in less year since launch

- RLUSD recently secured regulatory approval in Abu Dhabi

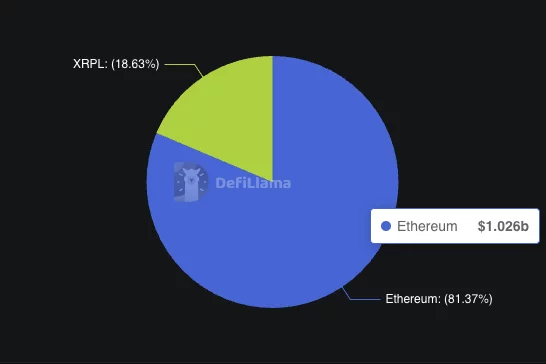

While the rest of the crypto markets are seeing increasing volatility, stablecoin adoption is growing consistently. On Friday, November 28, the supply of Ripple’s RLUSD stablecoin surpassed $1.026 billion on the Ethereum blockchain, making it one of the fastest-growing stablecoins.

The total supply of RLUSD, on both Ethereum (ETH) and XRPL, reached $1.261 billion at a time when demand for regulated stablecoins is growing. The stablecoin achieved this growth in less than a year since its launch in December 2024.

Ripple USD on Ethereum and XRP chains pie chart, displaying its market cap | Source: DeFiLlama

Ripple USD on Ethereum and XRP chains pie chart, displaying its market cap | Source: DeFiLlama

Unlike many other stablecoins, RLUSD is issued through Standard Custody & Trust Company, a New York-chartered trust company affiliated with Ripple (XRP) . Notably, the stablecoin focused on compliance from day one, making it attractive for institutional investors.

RLUSD secures regulatory approval in the UAE

RLUSD recently secured another major regulatory victory in the United Arab Emirates. Namely, on November 27, Abu Dhabi’s Financial Services Regulatory Authority recognized the stablecoin as an Accepted Fiat-Referenced Token. This recognition means that regulators approved its use within the Abu Dhabi Global Market, the UAE’s financial center.

“The FSRA’s recognition of RLUSD as a Fiat-Referenced Token reinforces our commitment to regulatory compliance and trust – two non-negotiables when it comes to institutional finance,” said Jack McDonald, Senior Vice President of Stablecoins at Ripple.

Regulatory approval in Abu Dhabi is part of Ripple’s increasing efforts to expand in the Middle East and Africa. Recently, Ripple announced a strategic partnership with Bahrain Fintech Bay, the country’s leading fintech incubator. Through the partnership, Ripple and Bahrain Fintech Bay will work together to develop the country’s crypto ecosystem.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Trust Wallet Token's Latest Rally and Growing Institutional Interest: Driving Sustainable Value

- Trust Wallet Token (TWT) surged in 2025 due to institutional partnerships, utility upgrades, and real-world asset (RWA) integrations. - Collaborations with Ondo Finance (tokenizing $24B in U.S. Treasury bonds) and Onramper (210M+ global users) expanded TWT's institutional-grade utility. - Governance upgrades, FlexGas payments, and Binance co-founder CZ's endorsement boosted TWT's credibility and institutional appeal. - Analysts project TWT could reach $5.13 by year-end, driven by cross-chain integrations

Clean Energy Market Fluidity and the Emergence of REsurety's CleanTrade Solution

- CFTC's 2025 approval of REsurety's CleanTrade as a SEF marks a regulatory breakthrough for clean energy trading infrastructure. - The platform addresses $16B+ in pent-up demand by providing liquidity, transparency, and institutional-grade safeguards for VPPAs, PPAs, and RECs. - CleanTrade's integration of carbon tracking analytics and ESG alignment tools enables institutional investors to quantify environmental impact alongside financial returns. - By resolving counterparty risks and enabling cross-asset

Altcoin Season Set Up Again? Bitcoin Dominance Rejection Signals Potential 250%+ Rally for 5 High-Risk Picks

Solana Must Hold $120 Support to Keep $500 Upside Path