XRP Ledger Activity Suddenly Exploded This Week, What Is It Signalling

The XRP Ledger saw an unusual spike in AccountSet and AMM Bid transactions this week, raising questions about new institutional activity and potential links to recent XRP ETF inflows.

The XRP Ledger recorded an abnormal surge in AccountSet and AMM Bid transactions this week, triggering widespread discussion across crypto Twitter. The ledger processed more than 40,000 AccountSet transactions in late November, marking its highest configuration activity in years.

The activity continued even after BitGo ended its batch updates. This indicates new actors are preparing or reconfiguring large numbers of accounts, rather than routine custodial adjustments.

What the AccountSet Surge Indicates

AccountSet transactions update settings, including security flags, AMM (Automated Market Maker) permissions, and multi-sig configurations. They are typically used when institutions prepare accounts for new services or liquidity operations.

Someone is doing a lot of AccountSet TXs on the XRP Ledger recently. Even after BitGo stopped. pic.twitter.com/rhdYGqFzLr

— Vet (@Vet_X0) November 29, 2025

Therefore, a spike of this magnitude suggests structured onboarding. Analysts believe this may involve custodians, market makers, or automated systems configuring XRPL accounts at scale.

The pattern resembles network preparation rather than retail behavior.

Previous spikes linked to custodial maintenance did not reach current levels, reinforcing the view that new participants are entering the network.

🚨 Something’s happening on the XRP Ledger.According to XRPL Metrics, activity just exploded:📈 Over 40,000 “AccountSet” transactions, the highest in years.💧 A sharp spike in AMM bids right after November 23.Imo, it’s network preparation.With RLUSD approvals, AMM rollout,… pic.twitter.com/g1a5fUKYT9

— Arthur (@XrpArthur) December 1, 2025

AMM Bid Activity Signals Liquidity Positioning in XRP

AMM Bid transactions also surged after November 23. These transactions help liquidity providers bid for AMM auction slots and position themselves within XRPL’s automated market-maker pools.

The sharp rise suggests liquidity actors are preparing to secure early positions. Early bids often capture the most profitable rewards, making the timing significant.

The AMM spike coincides with broader XRPL developments. RLUSD approvals, AMM rollout progress, and institutional onboarding have all accelerated in recent weeks. This offers a possible explanation for the sudden liquidity movement.

PODCAST: Tokenization is just step one, now what do we do with the assets?@RippleXDev's Jasmine Cooper explains why the next wave for the XRP Ledger is on-chain collateral management, repos and credit origination turning RWAs into real value for institutions. pic.twitter.com/S2MTJ0j7pm

— BeInCrypto (@beincrypto) December 1, 2025

XRP ETF Inflows Add Another Layer of Context

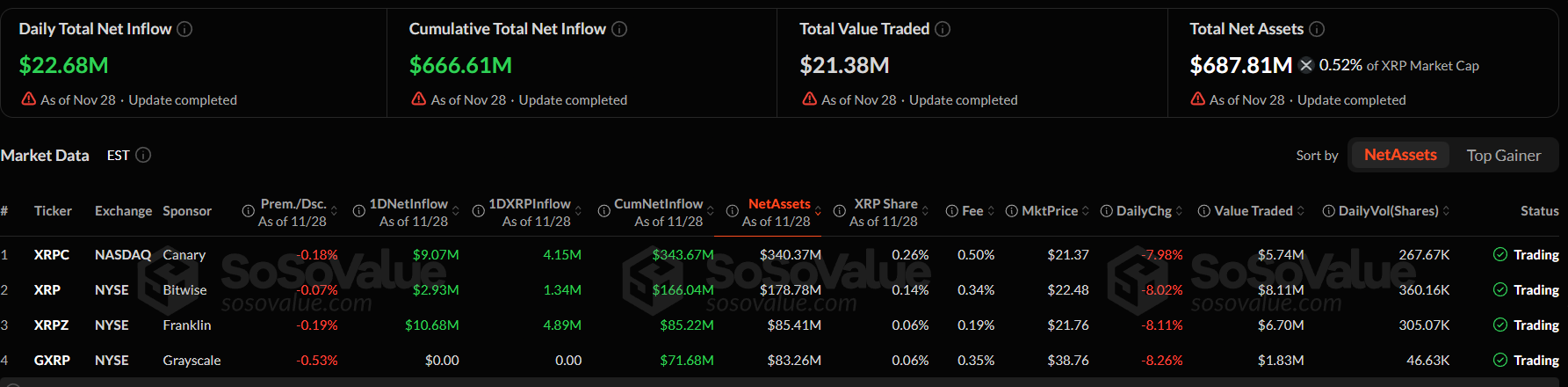

The surge also follows the debut of spot XRP ETFs in the United States. The products accumulated $643.92 million in net inflows and reached $676.49 million in total ETF assets.

Inflows increased on nine of the last ten sessions, showing strong institutional demand.

While ETF inflows do not directly interact with the XRP Ledger, they influence how custodians manage XRP storage and security.

Large ETF demand can trigger new institutional custody accounts, reconfigured storage systems, expanded wallet infrastructure, and preparation for higher settlement activity. These processes often involve AccountSet transactions.

Therefore, the ETF wave may be indirectly contributing to the configuration spike.

Spot XRP ETF Performance in November 2025. Source:

Spot XRP ETF Performance in November 2025. Source:

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Trust Wallet Token's Latest Rally and Growing Institutional Interest: Driving Sustainable Value

- Trust Wallet Token (TWT) surged in 2025 due to institutional partnerships, utility upgrades, and real-world asset (RWA) integrations. - Collaborations with Ondo Finance (tokenizing $24B in U.S. Treasury bonds) and Onramper (210M+ global users) expanded TWT's institutional-grade utility. - Governance upgrades, FlexGas payments, and Binance co-founder CZ's endorsement boosted TWT's credibility and institutional appeal. - Analysts project TWT could reach $5.13 by year-end, driven by cross-chain integrations

Clean Energy Market Fluidity and the Emergence of REsurety's CleanTrade Solution

- CFTC's 2025 approval of REsurety's CleanTrade as a SEF marks a regulatory breakthrough for clean energy trading infrastructure. - The platform addresses $16B+ in pent-up demand by providing liquidity, transparency, and institutional-grade safeguards for VPPAs, PPAs, and RECs. - CleanTrade's integration of carbon tracking analytics and ESG alignment tools enables institutional investors to quantify environmental impact alongside financial returns. - By resolving counterparty risks and enabling cross-asset

Altcoin Season Set Up Again? Bitcoin Dominance Rejection Signals Potential 250%+ Rally for 5 High-Risk Picks

Solana Must Hold $120 Support to Keep $500 Upside Path