Hedera Price Stays Weak While Its Fate Remains Tied to Bitcoin

Hedera’s price has struggled to recover over the past week, even as broader market conditions briefly improved before turning bearish again. HBAR attempted to climb back toward recent highs, but the market-wide pullback dragged it down, revealing how heavily the altcoin relies on Bitcoin’s movement. Hedera Has A Problem Named Bitcoin HBAR’s correlation with Bitcoin

Hedera’s price has struggled to recover over the past week, even as broader market conditions briefly improved before turning bearish again.

HBAR attempted to climb back toward recent highs, but the market-wide pullback dragged it down, revealing how heavily the altcoin relies on Bitcoin’s movement.

Hedera Has A Problem Named Bitcoin

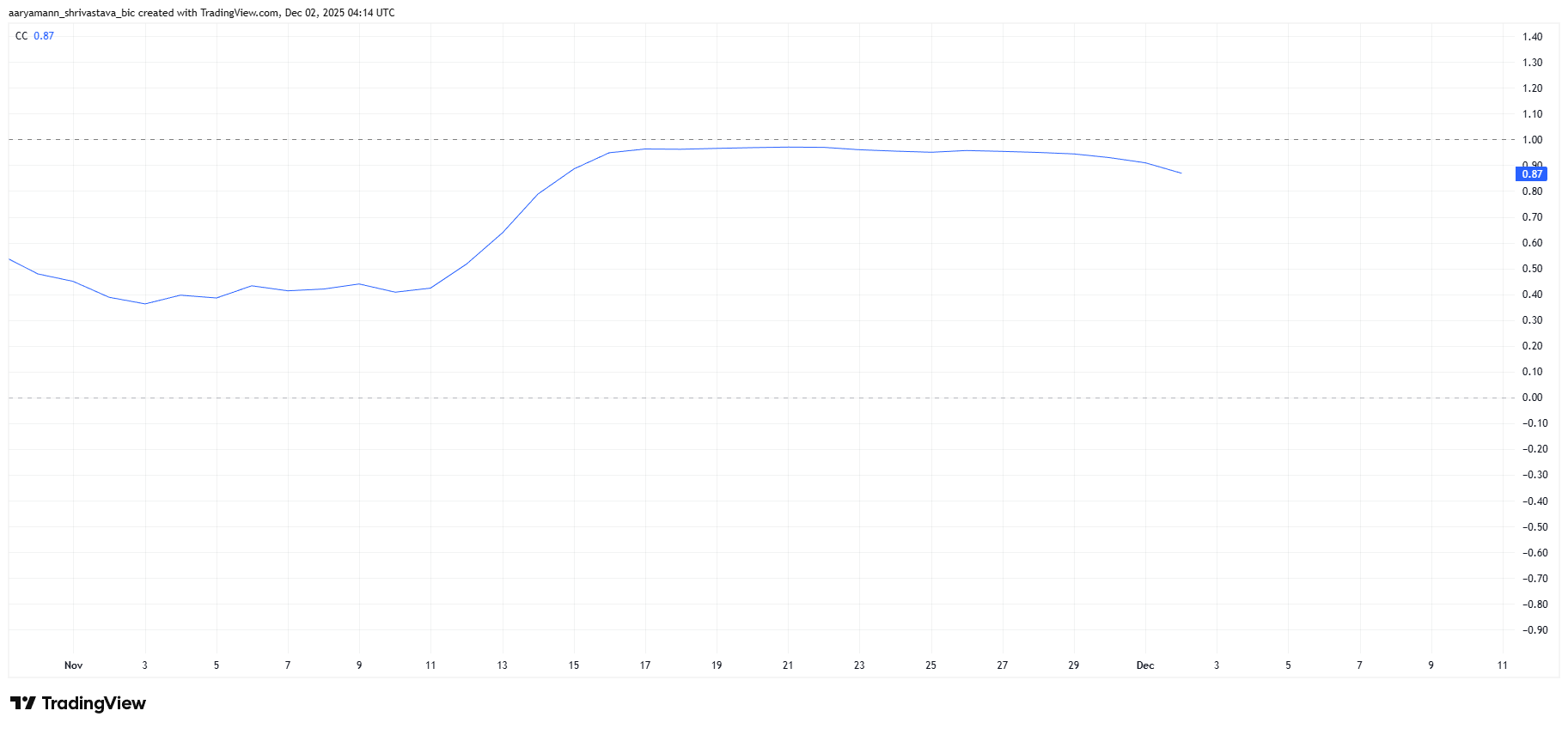

HBAR’s correlation with Bitcoin remains extremely strong at 0.87, dipping only slightly from last week’s peak. This tight correlation means Hedera is closely shadowing BTC’s price action, which is not ideal at a time when Bitcoin itself is stuck near $86,000.

Bitcoin’s struggle to reclaim bullish momentum has directly impacted Hedera, preventing any meaningful rebound. The lack of independent strength makes HBAR more vulnerable to Bitcoin-led volatility.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

HBAR Correlation To Bitcoin. Source:

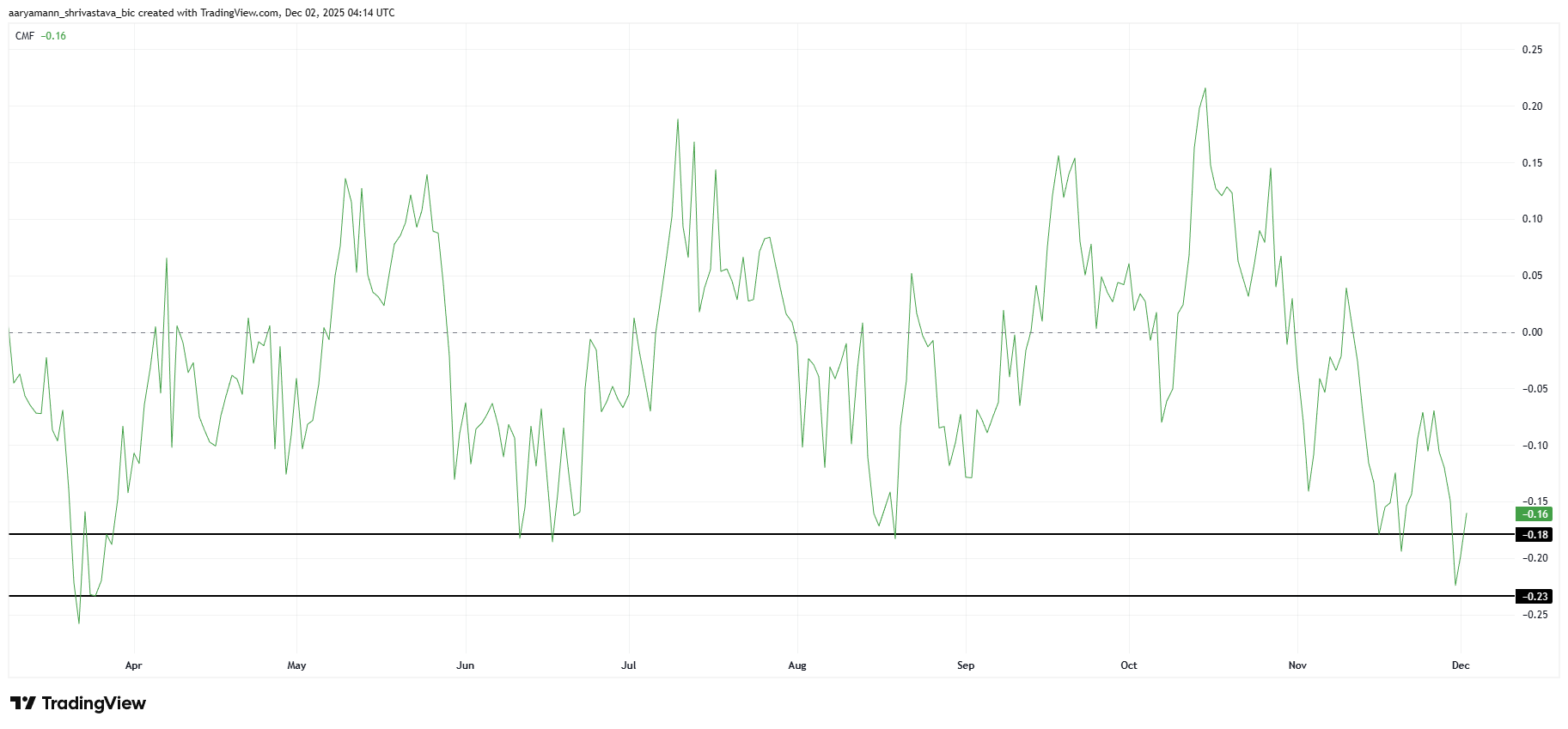

HBAR’s macro momentum shows further weakness, particularly in the Chaikin Money Flow (CMF), which recently dropped to a seven-month low. The indicator slipped into the 0.18 to 0.23 range, typically an area where outflows slow and inflows begin, offering altcoins a chance to stabilize.

HBAR Correlation To Bitcoin. Source:

HBAR’s macro momentum shows further weakness, particularly in the Chaikin Money Flow (CMF), which recently dropped to a seven-month low. The indicator slipped into the 0.18 to 0.23 range, typically an area where outflows slow and inflows begin, offering altcoins a chance to stabilize.

However, this cycle has been different. Broader market bearishness appears to be overriding usual reversal signals as CMF dipped below 0.18 before climbing only slightly. This demonstrates that investors are still pulling capital from HBAR despite historically favorable conditions for a bounce.

HBAR CMF. Source:

HBAR CMF. Source:

HBAR Price Needs A Push

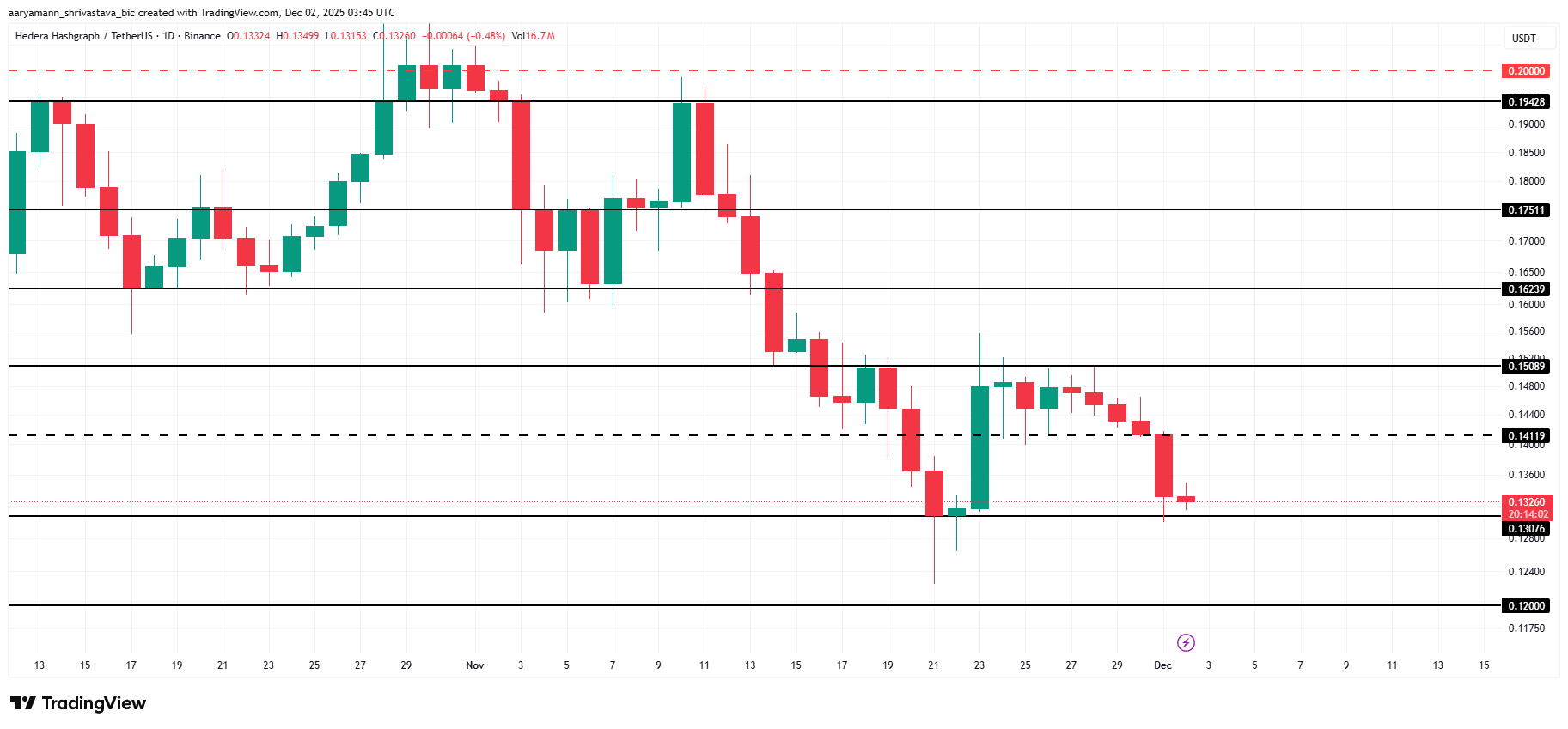

HBAR is trading at $0.132 at the time of writing, holding slightly above the $0.130 support level. This level has acted as a critical floor and remains essential in preventing a deeper decline.

If market weakness persists — especially if Bitcoin drops further — HBAR could continue consolidating between $0.130 and $0.150. A breakdown below $0.130 would likely send the price toward $0.120, extending the bearish trend.

HBAR Price Analysis. Source:

HBAR Price Analysis. Source:

However, if Bitcoin manages to recover, HBAR could rebound as well. A bounce off $0.130 may send the altcoin back to $0.150. Flipping this resistance into support would open the path toward $0.162, invalidating the bearish outlook.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The COAI Price Reduction: Impact on Technology and Green Energy Industries

- COAI's 88% price drop in Nov 2025 exposed governance failures and regulatory ambiguity, triggering investor reassessment of AI-linked assets. - U.S. clean energy investment fell 36% due to Trump-era policy shifts, while global clean energy attracted $3.3 trillion in 2025 despite AI sector turmoil. - Investors migrated to stable AI stocks (Microsoft/Nvidia) and non-AI renewables, prioritizing transparency over speculative crypto projects like COAI. - The crisis accelerated capital reallocation toward ethi

Timeless Strategies for Investing in Today's Market

- R.W. McNeel and Warren Buffett share timeless value investing principles emphasizing emotional discipline, long-term vision, and intrinsic value. - Both stress faith in the U.S. economy, with Buffett's Berkshire Hathaway exemplifying this through long-term investments in American icons like Apple and Coca-Cola . - Retained earnings and margin of safety strategies, demonstrated by Apple's reinvestment and Berkshire's share buybacks, highlight compounding's role in mitigating market volatility. - Modern be

Investing for Tomorrow: Preparing the Workforce and Advancing Tech Education in the Digital Age

- AI, cybersecurity, and data analytics are reshaping industries, driving 29% growth in cybersecurity roles and 56% wage premiums for AI skills. - Educational institutions like CCBC and Cengage Work are bridging skill gaps through AI-powered training and industry partnerships. - Government-industry collaborations aim to train 500 AI researchers by 2025, emphasizing workforce readiness as a shared responsibility. - ROI metrics for tech education now include operational efficiency gains and strategic alignme

FARTCOIN Trades at $0.347 as 9.6% Daily Gain Meets Strong $0.38–$0.40 Resistance