Ethereum Struggles Below $3,000 as Long-Term Holders Cash Out

Ethereum is struggling to reclaim momentum after a sharp 6% drop in the last 24 hours pushed the altcoin king back from the critical $3,000 barrier. The level has acted as both psychological and technical resistance, and the latest rejection comes at a time when some of Ethereum’s most influential holders are pulling back. Ethereum

Ethereum is struggling to reclaim momentum after a sharp 6% drop in the last 24 hours pushed the altcoin king back from the critical $3,000 barrier.

The level has acted as both psychological and technical resistance, and the latest rejection comes at a time when some of Ethereum’s most influential holders are pulling back.

Ethereum Holders’ Supply Drops

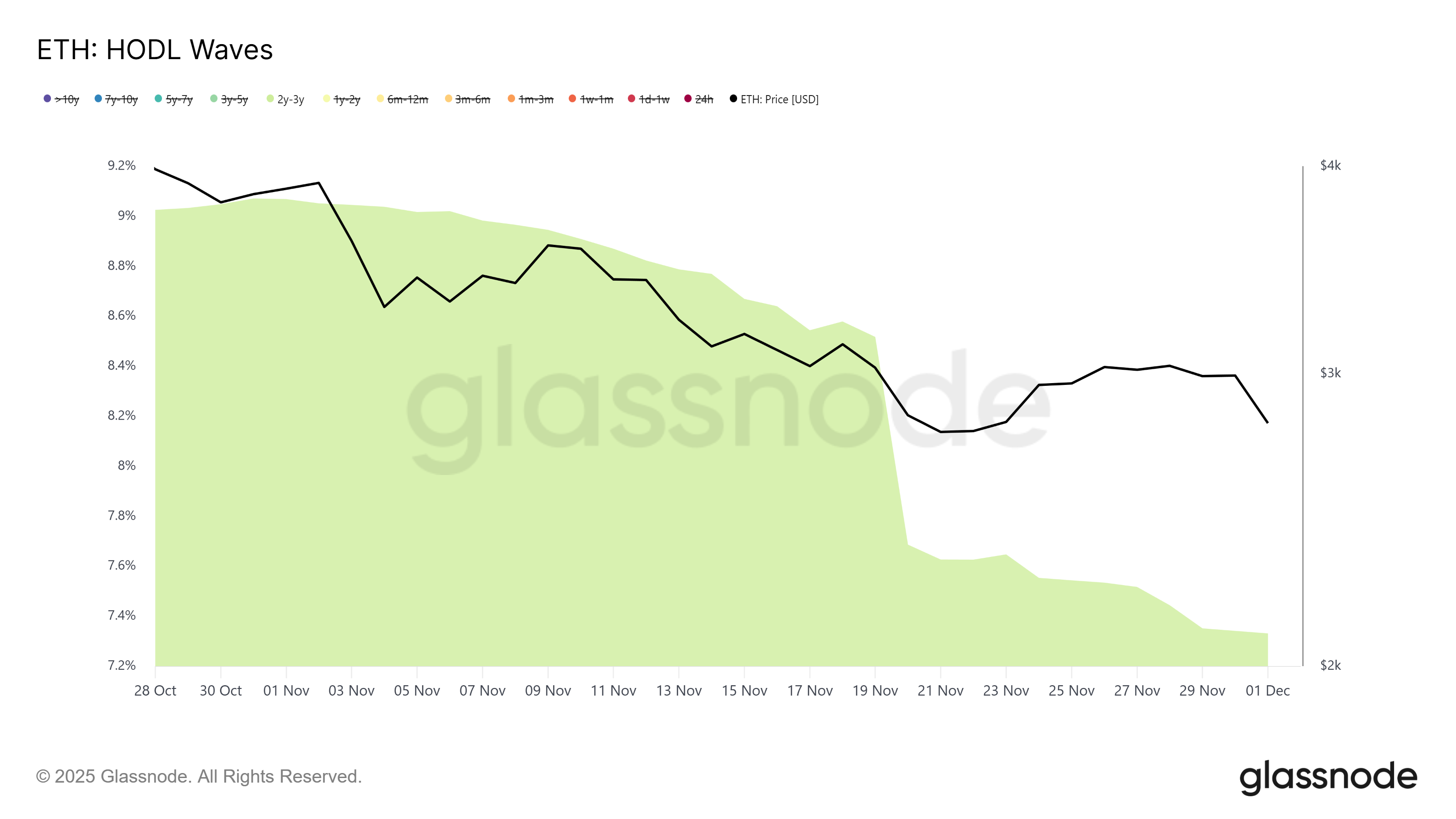

HODL Waves data shows that Ethereum’s long-term holders (LTHs) have been offloading their assets since early November. This selling pressure intensified around November 19, leading to a meaningful reduction in the supply controlled by the 2-to-3-year cohort. Their share of the circulating supply dropped from 8.51% to 7.33%, a clear sign that this group moved to offset losses and reduce risk exposure.

Given that LTHs tend to be the most stable participants in the Ethereum ecosystem, their selling has had a direct impact on price performance. More importantly, their positions have not recovered since the sell-off, creating a supply gap that new investors will need to fill if ETH is to regain upward momentum.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

Ethereum HODL Waves. Source:

Glassnode

Ethereum HODL Waves. Source:

Glassnode

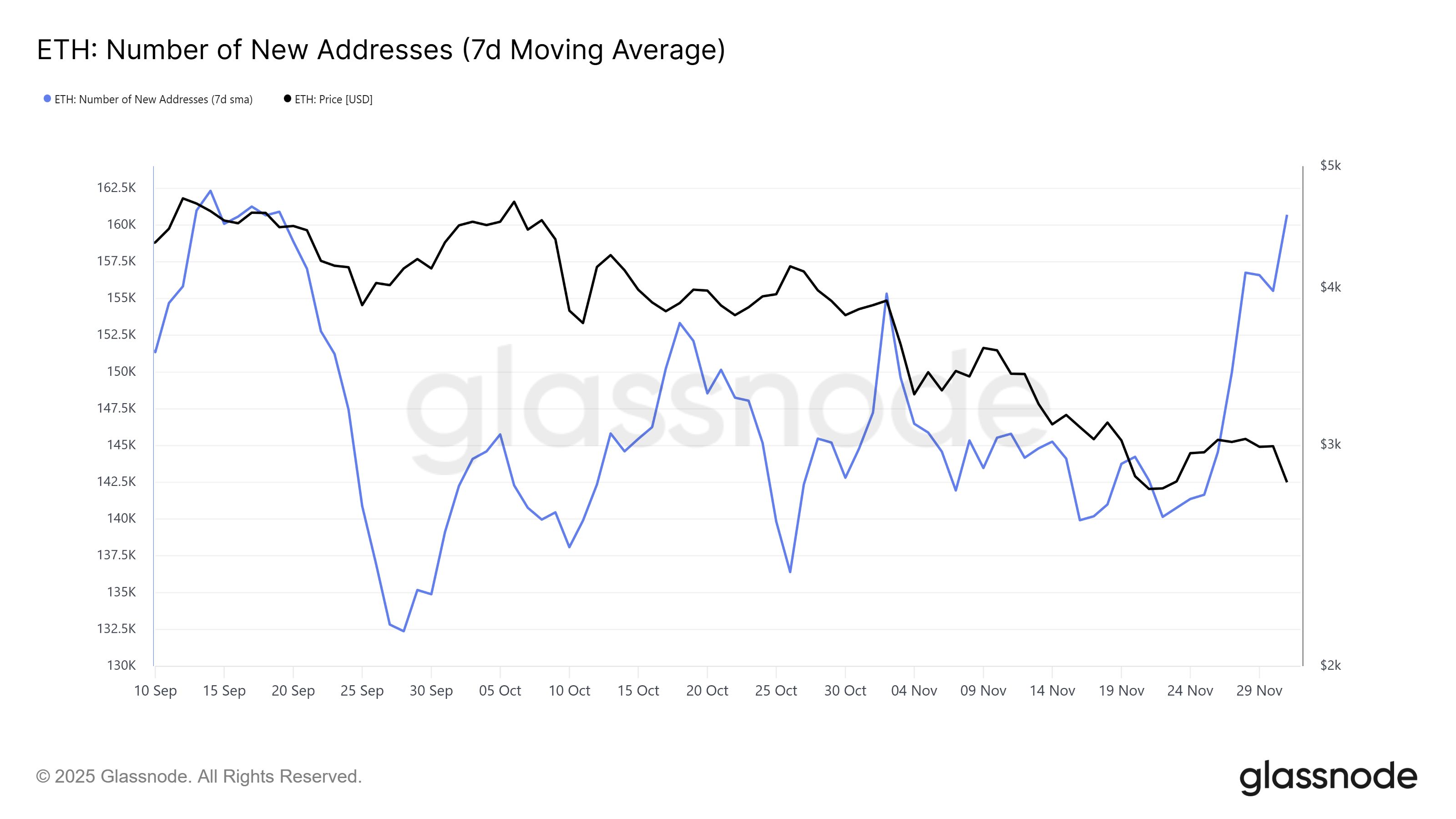

Fortunately, Ethereum is seeing encouraging signs of new demand. Over the past seven days, new addresses on the network have surged 13.4%, rising from 141,650 to 160,690. This marks the strongest weekly jump in more than two and a half months and signals fresh investor interest despite the recent correction.

New addresses often translate into new capital flowing into the market, which is critical for Ethereum as it attempts to stabilize above key support levels. However, sustaining this growth is essential. If the influx of new holders slows, the market may not be able to compensate for the missing LTH participation.

Ethereum New Addresses. Source:

Glassnode

Ethereum New Addresses. Source:

Glassnode

ETH Price Is Yet To Find A Direction

Ethereum is trading at $2,805 at the time of writing, reflecting a 6% daily decline. The asset is sitting just below the $2,814 resistance level after its latest failed attempt to break through $3,000.

Based on current sentiment and market structure, ETH could stabilize and attempt a rebound, but a strong recovery will require consistent investor support. In the near term, Ethereum will likely fluctuate between $2,814 and $3,000 as it searches for direction.

ETH Price Analysis. Source:

TradingView

ETH Price Analysis. Source:

TradingView

If bullish momentum strengthens and fresh demand remains steady, Ethereum could finally break above the $3,000 barrier. A successful breach would pave the way for a move toward $3,131 and potentially $3,287. This would invalidating the short-term bearish thesis.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Revealing Hidden Value in Industrial Properties After Xerox in Webster, NY

- Webster , NY, revitalizes post-Xerox industrial zones through strategic rezoning and $9.8M FAST NY infrastructure grants. - Reimagine Webster plan transfers road control and designates Brownfield Opportunity Areas to unlock state funding for redevelopment. - Shovel-ready infrastructure and mixed-use zoning attract advanced manufacturers, slashing vacancy rates and boosting property values. - Policy-driven revitalization creates scalable investment opportunities in semiconductors , logistics, and clean en

The Rapid Rise of ZK Technology and What It Means for Cryptocurrency Investors

- ZK rollups (e.g., zkSync, StarkNet) solve blockchain scalability, enabling 15k-43k TPS with sub-second finality via GPU-optimized proofs and EVM compatibility. - Institutional adoption surges as Deutsche Bank , Sony , and Nike integrate ZK solutions for compliance, NFTs, and cross-chain operations, with 35+ financial firms adopting ZK by Q3 2025. - $1.28B ZK market grows at 22.1% CAGR through 2033, driven by DeFi, enterprise compliance, and Ethereum's Fusaka upgrade, which will optimize Layer 2 scalabili

Bitcoin-to-silver ratio hits lowest since October 2023 as silver prices surge

BlackRock's Bitcoin ETF options rank among top traded in market