Gensler calls out crypto hype—again: Bitcoin aside, ‘it’s a risk asset’

Former SEC Chair Gary Gensler isn’t letting crypto enthusiasts off the hook anytime soon.

- Gary Gensler doubles down on skepticism, calling most cryptocurrencies (beyond Bitcoin and USD-backed stablecoins) speculative assets lacking fundamental value.

- Investor caution is key, as Gensler warns that political narratives and ETF hype don’t reduce the underlying volatility or risk.

- Regulation vs. innovation: Gensler maintains that protecting investors and fostering crypto innovation can coexist, despite ongoing sector mistrust.

In a recent Bloomberg interview , he reminded the market that most digital tokens remain speculative, volatile, and poorly understood by retail investors—even as the Trump administration and politicians increasingly talk up the sector.

“Look, I think it’s a risk asset,” Gensler said . “And the American public and the worldwide public have been fascinated with cryptocurrencies, but it’s a highly speculative, volatile asset.”

He reiterated a long-standing refrain: outside of Bitcoin and dollar-backed stablecoins, most tokens lack real value drivers like cash flows, dividends, or intrinsic utility. In other words, don’t mistake flashy headlines or political narratives for a sound investment.

Gensler’s tone echoes warnings he issued throughout his SEC tenure, when he flagged thousands of tokens as risky and spotlighted frauds, including the collapse of Sam Bankman-Fried’s empire.

Even as Bitcoin ETFs gain traction, Gensler pointed out the irony: markets are gravitating toward “centralized” structures—like ETFs—despite crypto’s decentralized promise. He frames this as a natural evolution akin to gold and silver investing: investors want accessibility, regulation, and some reassurance.

Through it all, Gensler maintains that regulation and innovation aren’t enemies. Protecting investors, he argues, is a prerequisite for the sector’s long-term survival.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

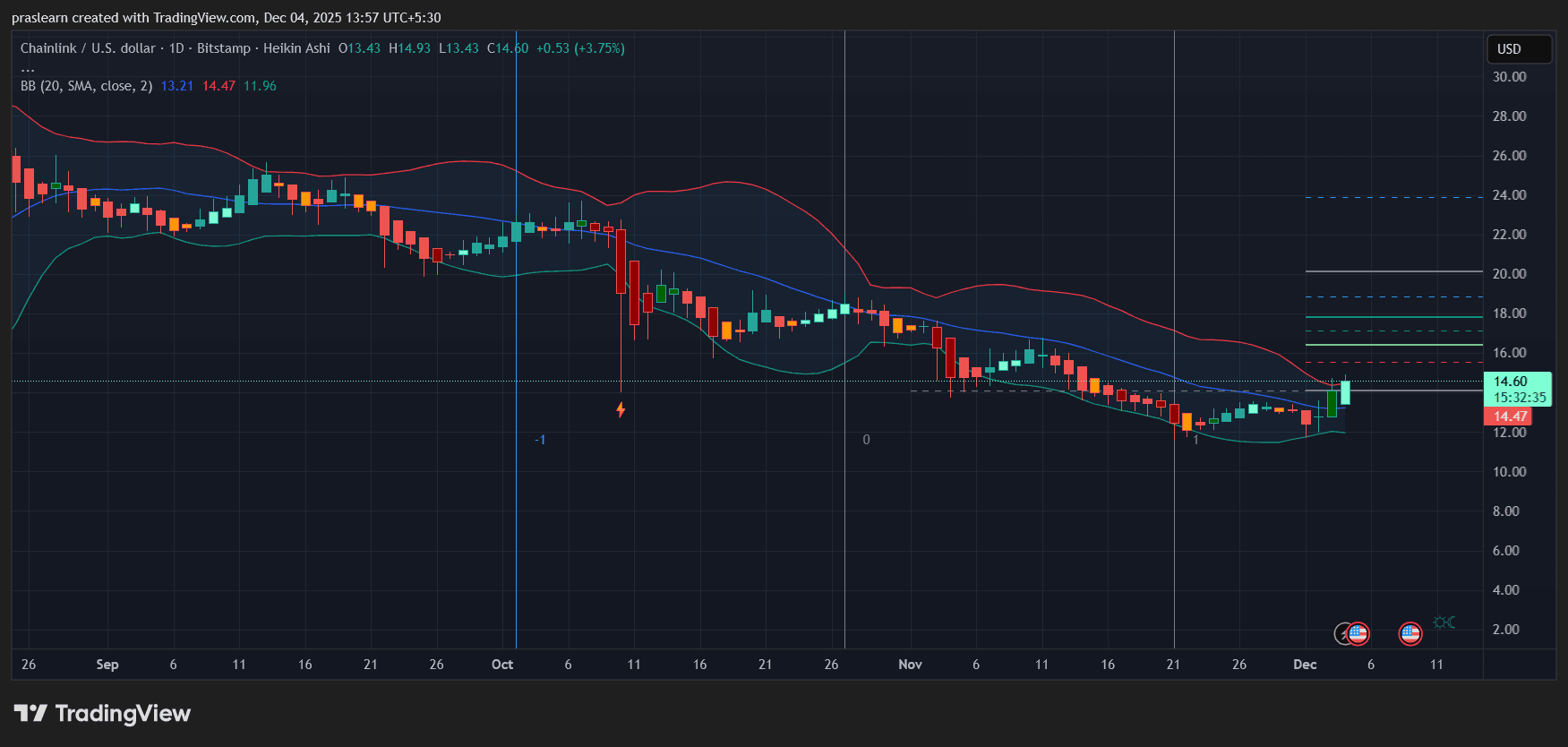

Will Chainlink Price Reach $50?

Top 3 Reasons Why Bitcoin Price Should Go Up Next

Fusaka Just Changed Ethereum’s Speed Limit

The Influence of Vitalik Buterin's Support for ZKsync on the Uptake of Layer-2 Solutions

- Vitalik Buterin's 2025 endorsement of ZKsync boosted its ZK token price by 50%, driving institutional adoption and market validation. - ZKsync's Atlas upgrade achieved 30,000 TPS with Ethereum compatibility, raising TVL to $3.3B through enterprise partnerships and GPU-optimized proofs. - Unlike StarkNet's niche scalability or Loopring's trading focus, ZKsync balances Ethereum compatibility, developer accessibility, and enterprise-grade performance. - Deflationary tokenomics and Deutsche Bank partnerships