Bitcoin Exchange Supply Nears 5-year Low After $2 Billion Buy This Week

Bitcoin continues to struggle beneath a month-long downtrend after failing once again to break above it. The crypto king is trading without clear support from macro financial markets, leaving its trajectory uncertain. However, investors appear increasingly active, and their accumulation could help stabilize price action if institutional capital joins in. Bitcoin Holders Are Stepping Up

Bitcoin continues to struggle beneath a month-long downtrend after failing once again to break above it. The crypto king is trading without clear support from macro financial markets, leaving its trajectory uncertain.

However, investors appear increasingly active, and their accumulation could help stabilize price action if institutional capital joins in.

Bitcoin Holders Are Stepping Up

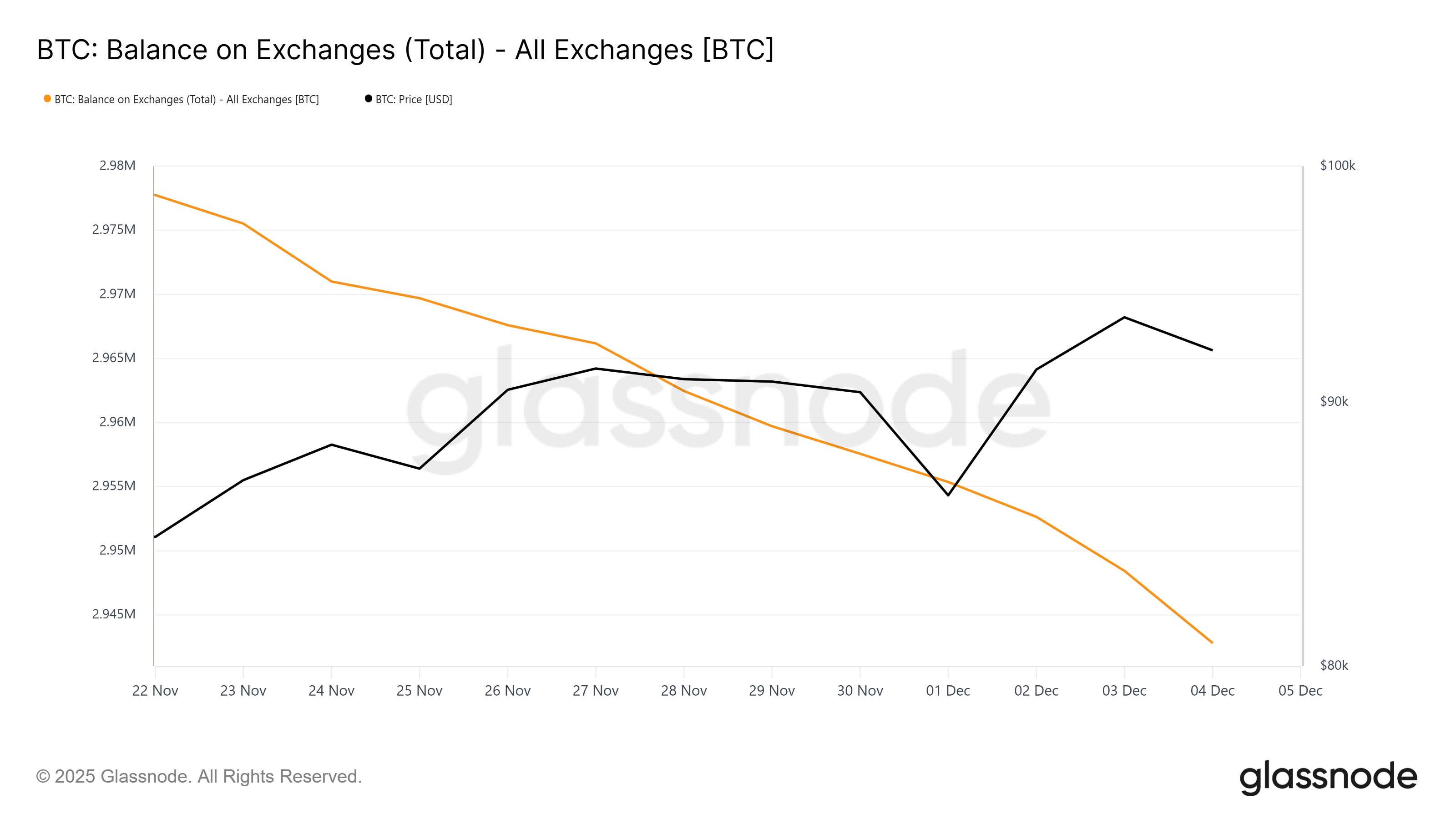

Exchange balances have seen a sharp decline over the past week, signaling renewed confidence among holders. More than 23,385 BTC have been withdrawn from trading platforms in seven days, representing over $2.15 billion in accumulated supply. This shift has pushed exchange reserves to their lowest level since January 2021, a period associated with strong bullish conviction.

Such pronounced outflows often reflect longer-term holding behavior, reinforcing optimism even during bearish conditions. With less available supply on exchanges, selling pressure eases, improving the likelihood of a potential recovery. This investor-driven accumulation could provide meaningful support for Bitcoin if broader market forces stabilize.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

Bitcoin Balance On Exchanges. Source:

Glassnode

Bitcoin Balance On Exchanges. Source:

Glassnode

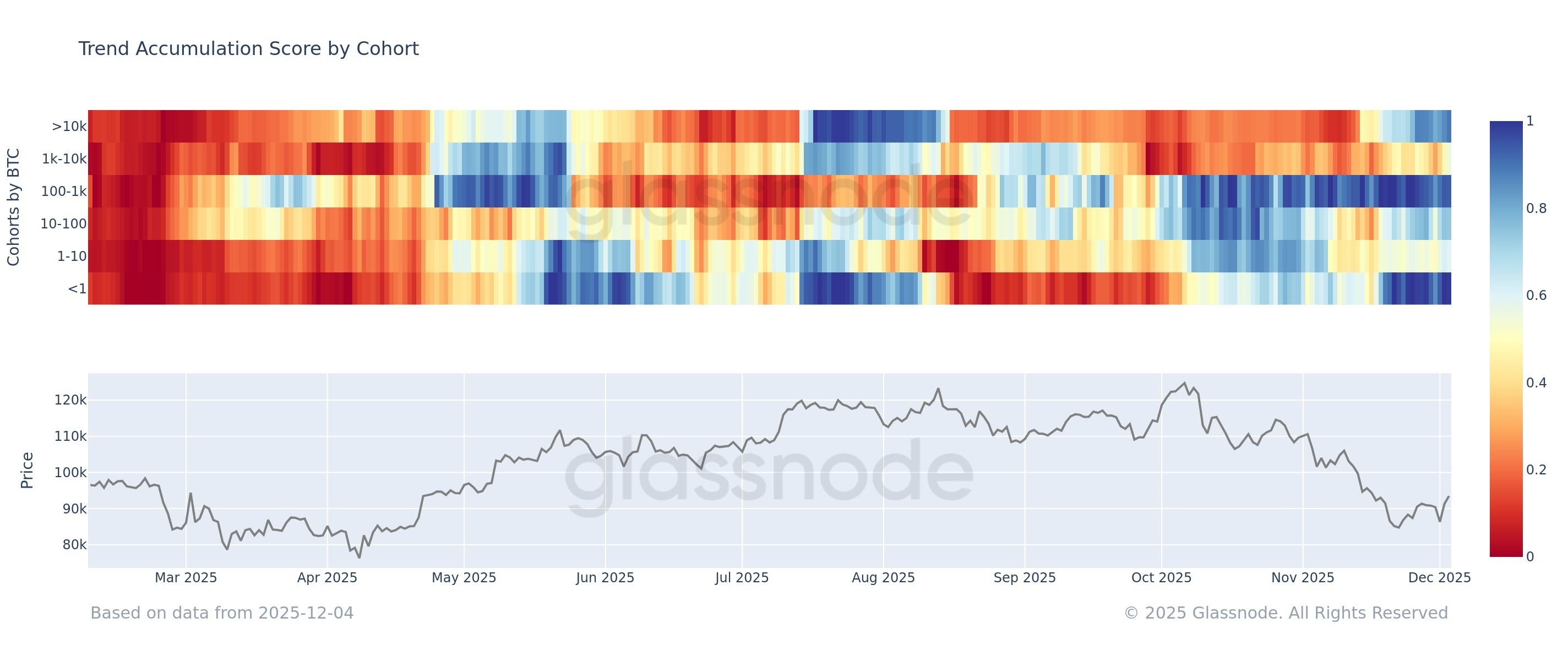

The Bitcoin Trend Accumulation Score is also signaling noteworthy activity. Distribution has eased considerably at current price levels, with smaller holders accumulating aggressively and larger cohorts accumulating at a moderate pace. This dynamic reflects growing retail confidence and reduced sell-side pressure across several wallet groups.

However, the absence of strong “smart money” participation remains a concern. Large institutional holders tend to influence price direction more significantly, and their hesitation could hinder Bitcoin’s ability to convert retail-driven accumulation into a sustained rally.

Bitcoin Trend Accumulation Score. Source:

Glassnode

Bitcoin Trend Accumulation Score. Source:

Glassnode

BTC Price Remains Stuck

Bitcoin is trading at $92,047, holding above the critical $91,521 support level while remaining trapped under the month-long downtrend. Recovering from this position requires a decisive breakout, which has yet to materialize despite recent attempts.

Invalidating the downtrend demands a flip of $95,000 into support. Given the ongoing accumulation and tightening of exchange supply, such a move remains possible. Additional support from institutional buyers would further strengthen Bitcoin’s path toward $100,000, restoring bullish momentum.

Bitcoin Price Analysis. Source:

TradingView

Bitcoin Price Analysis. Source:

TradingView

If large holders remain sidelined, Bitcoin may continue to struggle. A failure to sustain support could send BTC back below $89,800 and toward $86,822. This would reinforce bearish sentiment and delay recovery attempts.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The COAI Price Reduction: Impact on Technology and Green Energy Industries

- COAI's 88% price drop in Nov 2025 exposed governance failures and regulatory ambiguity, triggering investor reassessment of AI-linked assets. - U.S. clean energy investment fell 36% due to Trump-era policy shifts, while global clean energy attracted $3.3 trillion in 2025 despite AI sector turmoil. - Investors migrated to stable AI stocks (Microsoft/Nvidia) and non-AI renewables, prioritizing transparency over speculative crypto projects like COAI. - The crisis accelerated capital reallocation toward ethi

Timeless Strategies for Investing in Today's Market

- R.W. McNeel and Warren Buffett share timeless value investing principles emphasizing emotional discipline, long-term vision, and intrinsic value. - Both stress faith in the U.S. economy, with Buffett's Berkshire Hathaway exemplifying this through long-term investments in American icons like Apple and Coca-Cola . - Retained earnings and margin of safety strategies, demonstrated by Apple's reinvestment and Berkshire's share buybacks, highlight compounding's role in mitigating market volatility. - Modern be

Investing for Tomorrow: Preparing the Workforce and Advancing Tech Education in the Digital Age

- AI, cybersecurity, and data analytics are reshaping industries, driving 29% growth in cybersecurity roles and 56% wage premiums for AI skills. - Educational institutions like CCBC and Cengage Work are bridging skill gaps through AI-powered training and industry partnerships. - Government-industry collaborations aim to train 500 AI researchers by 2025, emphasizing workforce readiness as a shared responsibility. - ROI metrics for tech education now include operational efficiency gains and strategic alignme

FARTCOIN Trades at $0.347 as 9.6% Daily Gain Meets Strong $0.38–$0.40 Resistance