XRP Stuck Between $2.00 and $2.20 as Network Activity Hits 3-Month Low

XRP is once again trapped in tight consolidation, extending a rangebound pattern that has held the altcoin for several days. The altcoin is drawing renewed attention from traders, but this interest has not yet translated into meaningful market participation or price expansion. XRP Investors Pull Back The number of active addresses on the XRP Ledger

XRP is once again trapped in tight consolidation, extending a rangebound pattern that has held the altcoin for several days.

The altcoin is drawing renewed attention from traders, but this interest has not yet translated into meaningful market participation or price expansion.

XRP Investors Pull Back

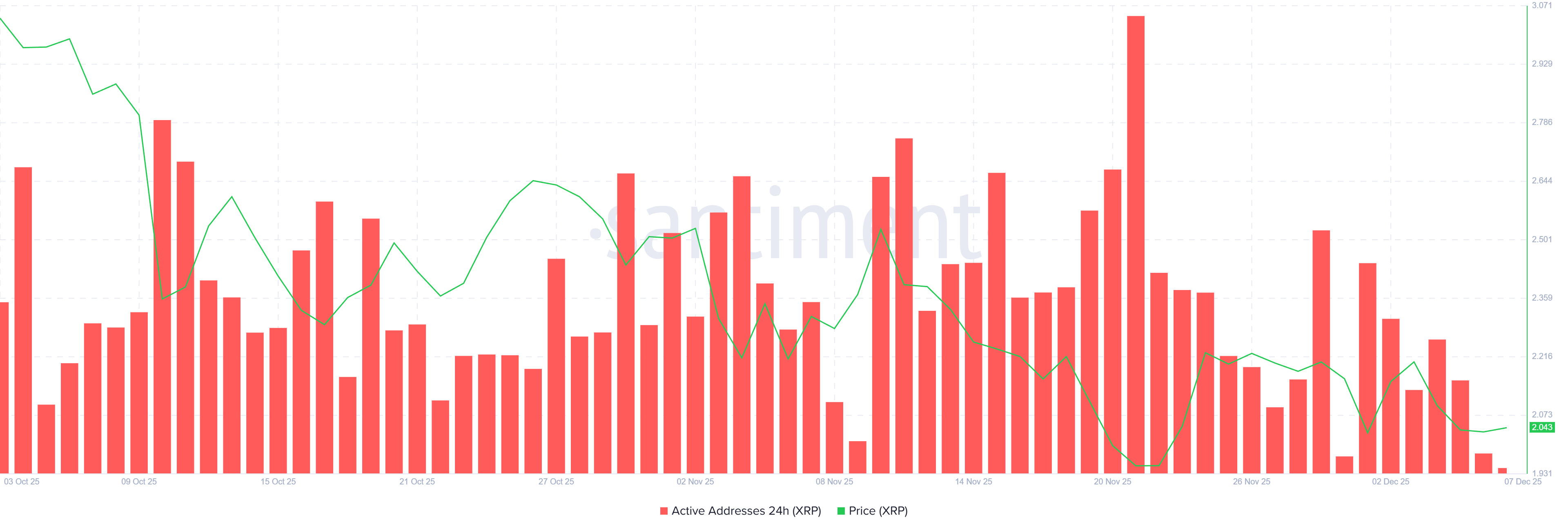

The number of active addresses on the XRP Ledger has dropped sharply, falling to 35,931 — the lowest level in more than three months. This decline highlights waning investor engagement as users pull back from transacting on the network. The lack of consistent activity reinforces the perception that XRP is struggling to generate momentum.

This retraced participation weakens the foundation needed for a sustainable recovery. When network activity falls this low, price rallies often lose strength quickly. This is making it difficult for XRP to build the demand required to break out of its established range.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

XRP Active Addresses. Source:

XRP Active Addresses. Source:

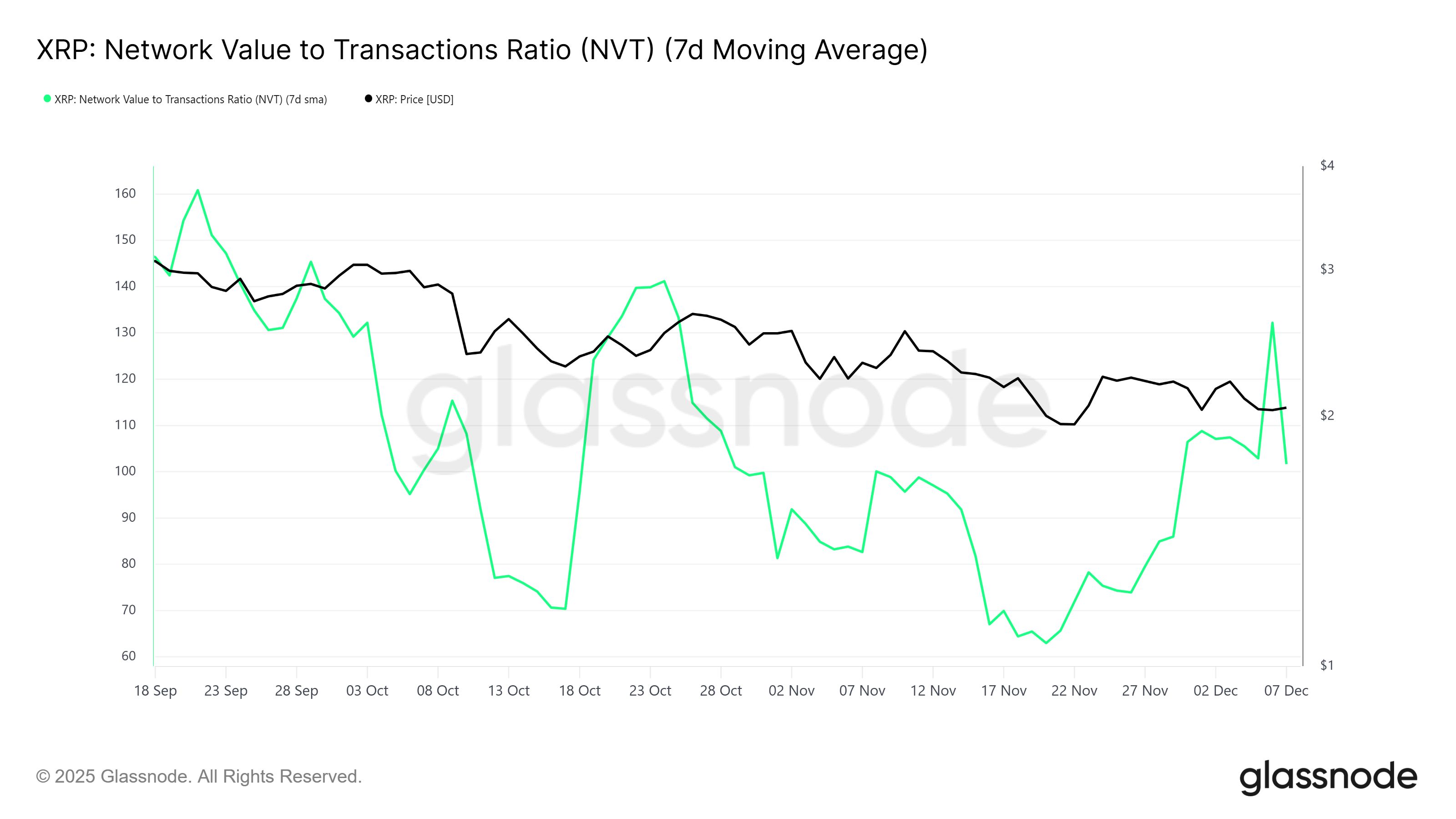

The NVT ratio is flashing another warning sign as it surges to a two-week high. A rising NVT typically suggests that an asset is overvalued relative to its transaction volume. In XRP’s case, subdued on-chain activity and elevated valuation pressure form a bearish combination that complicates recovery prospects.

This imbalance indicates that investors may be pricing in optimism that the network’s current fundamentals do not support. Until transaction activity increases, XRP will likely remain vulnerable to correction despite brief speculative rallies.

XRP NVT Ratio. Source:

XRP NVT Ratio. Source:

XRP Price Faces Sideways Movement

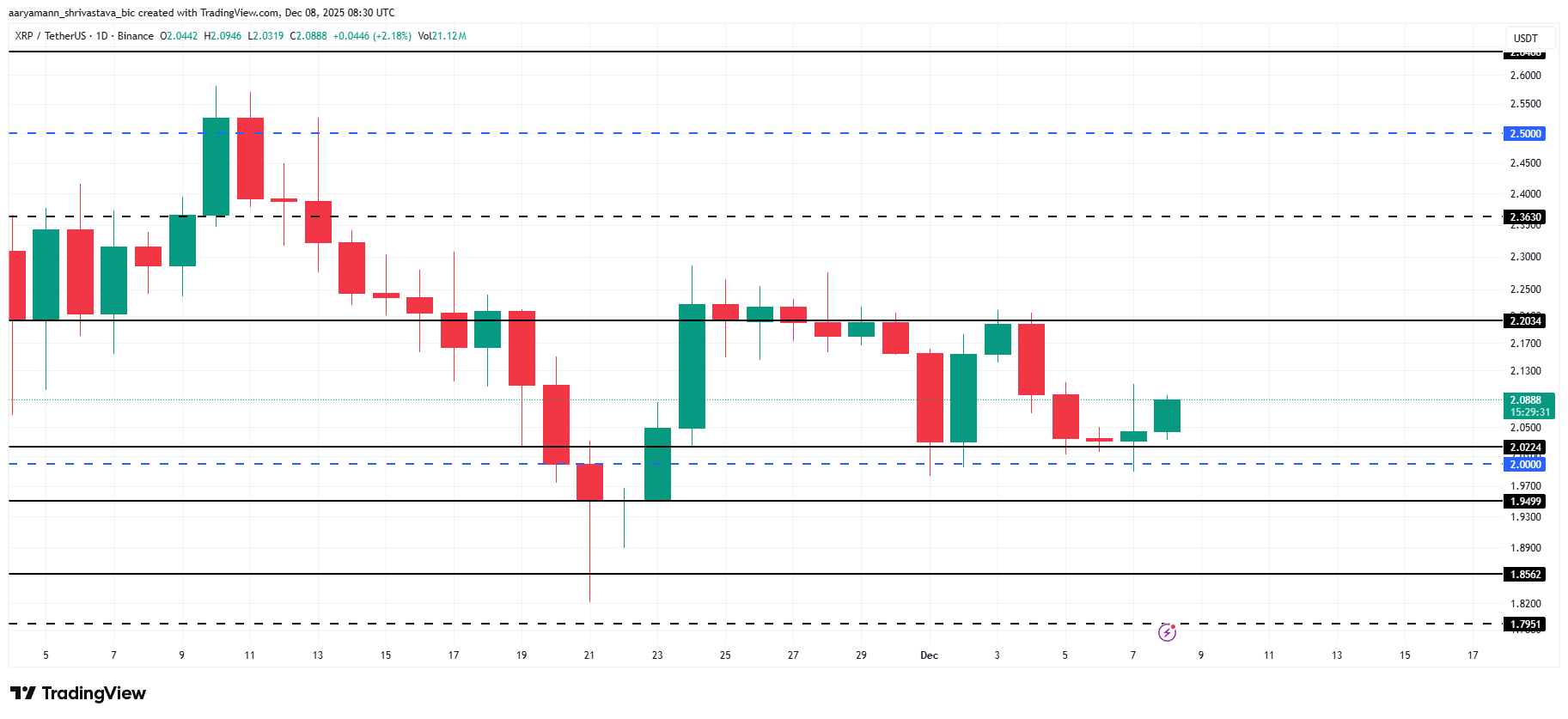

XRP is trading at $2.08 at the time of writing, maintaining a position above the $2.02 support. The altcoin has been stuck between $2.20 and $2.02 for several days. This reflects a lack of directional conviction.

The $2.00 zone remains a critical psychological and structural support. XRP may appear to bounce off $2.02 at times, but given current sentiment and macro signals, it will likely remain capped below $2.20 unless buyer interest strengthens.

XRP Price Analysis. Source:

XRP Price Analysis. Source:

If market conditions deteriorate further and XRP loses both $2.02 and $2.00, the bullish-neutral thesis would collapse. A breakdown could send the price below $1.94 and toward $1.85, exposing XRP to deeper losses.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New Prospects in STEM Learning and Career Advancement: Sustained Institutional Commitment to Academic Initiatives Fueling Tomorrow’s Innovation

- Global STEM education is accelerating as AI and engineering drive economic transformation, with 2025 government initiatives expanding AI-focused programs and workforce development. - U.S. universities report 114.4% growth in AI bachelor's enrollments, supported by corporate partnerships and $25M+ in tech industry investments for AI labs and teacher training. - EdTech's AI-powered platforms, valued at $5.3B in 2025, are projected to reach $98.1B by 2034, with startups like MagicSchool AI securing $45M in

ICP Caffeine AI: Leading the Way in AI-Powered Investment Prospects within the Web3 Landscape

- ICP Caffeine AI, developed by DFINITY Foundation, merges AI and blockchain to enable no-code app development via natural language prompts. - Its "chain-of-chains" architecture and Chain Fusion technology enhance scalability and cross-chain interoperability for AI-native applications. - With $237B TVL and partnerships with Microsoft/Google Cloud, ICP faces competition from TAO and RNDR but aims to rival AWS with on-chain AI solutions. - Institutional adoption in finance and energy, plus regulatory alignme

Internet Computer's Rapid Rise: Could This Signal a Significant Change in the Crypto Landscape?

- Internet Computer's ICP 2.0 upgrade and partnerships with Microsoft , Google, and SWIFT drove a 30% price surge in late 2025. - Caffeine AI and Chain Fusion innovations reduced AI costs and enabled cross-chain interoperability, enhancing decentralization. - Institutional adoption via hybrid infrastructure and reverse-gas model boosted ICP's credibility and deflationary appeal. - November 2025 price spike showed 35% address growth but 91% fewer token transfers, indicating speculative activity. - Analysts

The Importance of Higher Education in Equipping Tomorrow’s Workforce for AI-Powered Sectors: Prioritizing Investment in Educational Technology and Universities Emphasizing STEM

- Higher education institutions are investing in EdTech and STEM to address AI talent shortages. - Farmingdale State College's $75M center and AI Management program align with industry needs. - The AI EdTech market is projected to grow from $5.3B to $98.1B by 2034, driven by personalized learning. - Challenges include data privacy and educator training, but government policies support sustainable investment. - Strategic investments in STEM-focused universities prepare future talent and deliver economic gro