American Bitcoin Corp acquires 416 BTC, boosting holdings to 4,783 BTC

Key Takeaways

- American Bitcoin Corp acquired 416 BTC, raising its total holdings to 4,783 BTC.

- The acquisition announcement notes backing from Trump, highlighting growing support.

American Bitcoin Corp purchased 416 Bitcoin, bringing its total holdings to more than 4,783 Bitcoin, valued at over $440 million at current market prices, according to a Wednesday press release.

The company’s Satoshis Per Share metric rose more than 17% over the past month, as noted in the release. The team said the rapid reserve expansion demonstrates the strength of its accumulation model since listing on Nasdaq.

“In the three months since we listed on Nasdaq, we have built one of the largest and fastest growing Bitcoin accumulators, supported by a cost structure and margin profile that positions us for long-term value creation,” American Bitcoin’s co-founder Eric Trump stated. “We remain laser-focused on advancing our strategy and building on this momentum in the months ahead.”

ABTC shares closed up around 1.5% on Tuesday. The stock has been under pressure in recent weeks after its pre-merger private placement shares became eligible for public trading.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

TMGM Raises the Bar With Its Largest-Ever Global Competition Prize Pool of $671,500

TRUMP Price Rises Amid Doubled DeFi Activity: Can It Finally Recover?

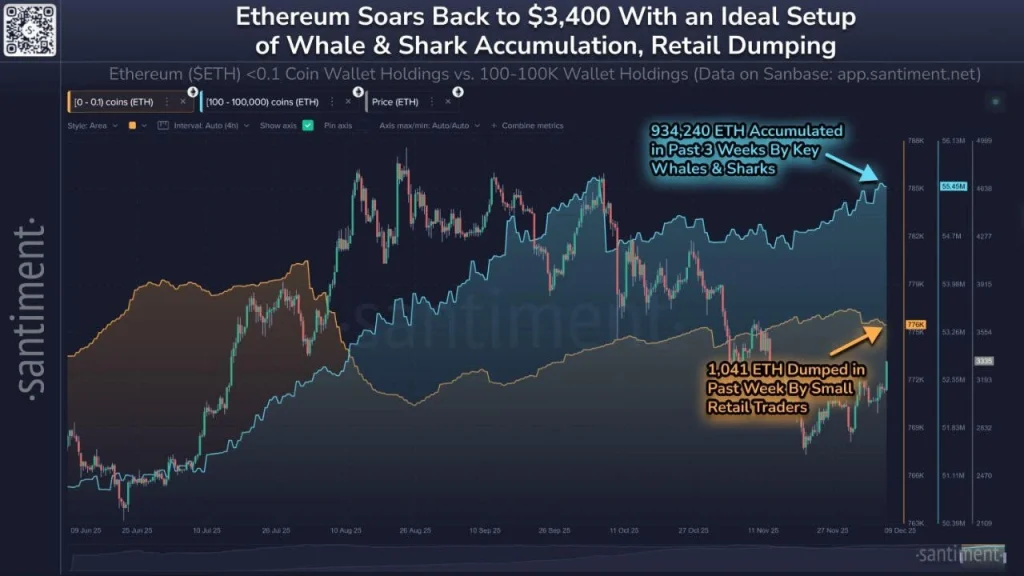

ETH Strengthens Against BTC Amid Its Renewed Whales Demand: Is Altseason Next?

Federal Reserve Strategies and the Rising Worth of Solana: How Changes in Monetary Policy Propel Institutions Toward High-Performance Blockchain Adoption

- Fed's 2025 rate cuts and QT halt injected $72.35B liquidity, coinciding with a 3.01% Solana price surge. - Institutional capital shifted toward Solana due to infrastructure upgrades and accommodative monetary policy. - Regulatory frameworks like MiCA and GENIUS Act boosted Solana's institutional appeal despite macroeconomic volatility. - Fed's policy normalization accelerated blockchain adoption, positioning Solana as a long-term investment amid uncertainty.