Date: Thu, Dec 11, 2025 | 05:50 AM GMT

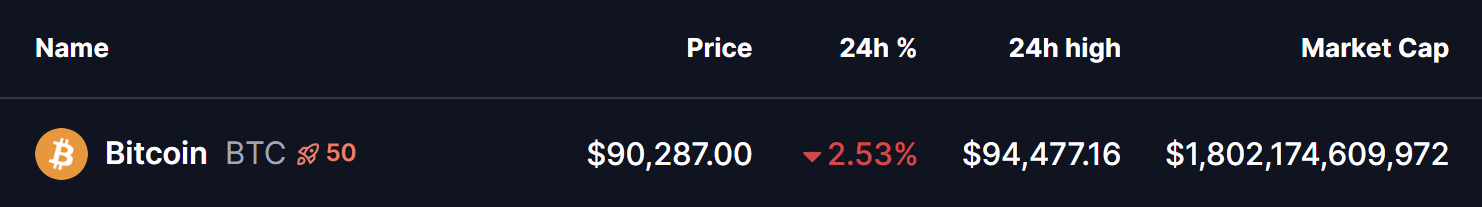

The broader cryptocurrency market is seeing a wave of retracement following the FED bounce that pushed Bitcoin (BTC) to a local high of $94,477. Since then, BTC has cooled down by more than 2.5%, slipping into the $90K zone. But beneath this short-term weakness, the chart is telling a different story — one that may favor a potential rebound if buyers defend a key level.

Source: Coinmarketcap

Source: Coinmarketcap

Ascending Triangle Pattern in Play?

On the 4H chart, BTC is currently shaping a classic ascending triangle, a pattern generally associated with bullish continuation phases. Price action has been steadily forming higher lows while repeatedly testing the horizontal resistance near $94,500.

This morning’s drop pulled BTC toward $89,405, touching the rising trendline that has been acting as a reliable support base throughout late November and early December. This level is critical. A successful rebound from here would confirm that buyers are still protecting the structure, keeping bullish momentum alive.

Bitcoin (BTC) 4H Chart/Coinsprobe (Source: Tradingview)

Bitcoin (BTC) 4H Chart/Coinsprobe (Source: Tradingview)

What the Chart Signals Next

If BTC continues to respect the ascending trendline around the $89K–$90K range, the likelihood of another move toward $94,500 grows significantly. This region remains the major ceiling — and now the 250-period moving average around $95,463 adds an additional layer of resistance.

A decisive breakout above both the horizontal resistance and the 250 MA would complete the ascending triangle, potentially triggering the next leg higher.

Based on the measured move projection of the triangle, the breakout target comes in at approximately $108,000, aligning with the dotted extension zone highlighted on the chart. This represents close to 19% upside from current price levels.

For now, all eyes remain on the rising trendline. As long as BTC holds this support and continues printing higher lows, the broader setup favors bullish continuation over deeper downside.