They already knew the TGA Game of the Year in advance, earning tens of thousands of dollars.

Violating history, yet persisting.

Today, the highly anticipated TGA (The Game Awards) ceremony in the gaming world finally came to a close.

Let's rewind to 3 hours before the end of the ceremony. At this point, the "Best Independent Game" had just been awarded to the popular title "Light & Shadow: Expedition 33," which actually caused many fans to start worrying: historically, no game has ever won both the "Best Independent Game" and the "Game of the Year (GOTY)" awards at TGA.

As the front-runner for GOTY, "Light & Shadow" now faced the burden of breaking the curse since the inception of TGA, creating an unprecedented moment in the gaming world.

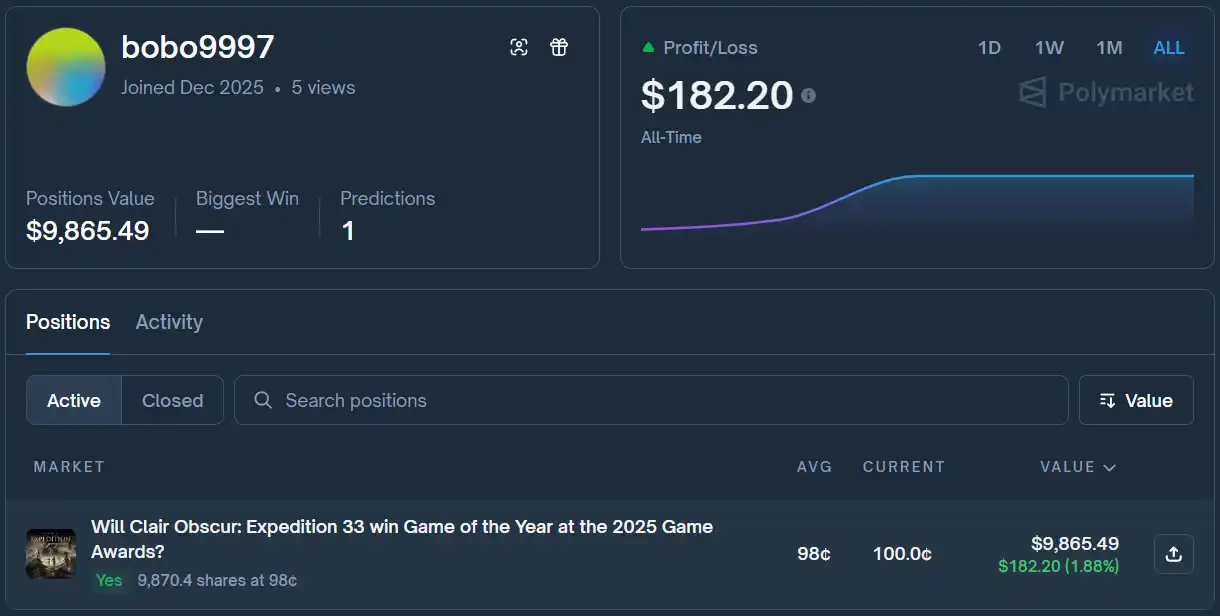

Just as everyone was anxious, a mysterious individual registered an account on a seemingly unrelated "prediction market" platform and deposited ten thousand dollars. He found the topic on the platform regarding "Will Light & Shadow win the 2025 GOTY?" and placed his entire ten thousand dollar deposit on "Yes."

At that moment, the price representing the probability of the topic being "Yes" was $0.98 per share, which meant that even if "Light & Shadow" did make history by winning both awards, his ten thousand dollar bet would only yield less than two hundred dollars in profit. However, if "Light & Shadow" failed to break the TGA curse, the probability of this topic would instantly drop to 0, resulting in his just-deposited ten thousand dollars being wiped out.

How fervent a fan of "Light & Shadow" must one be to take such a reckless risk? How does the prediction market attract gamers from around the world to speculate in advance on the frontrunners for awards?

The "Pre-Determined" Script

As early as October 30, a month and a half before the ceremony, the prediction market Polymarket launched the topic of "2025 Game of the Year." The odds of "Light & Shadow" winning were firmly above 80% from the start, while the probabilities of other highly anticipated AAA titles winning were suppressed below 10%. Since such one-sided situations usually only occur in events where the outcome is already certain, many traders sensed a peculiar atmosphere: this wasn't just optimism, this was certainty.

Among these traders who held a "certain" attitude, a few had extremely similar strategies. DieselDiesel, trumpnogo, and kasae all bet on "'Light & Shadow' winning TGA 2025 GOTY" when the probability was around 85%, and they bet amounts that were tens or even hundreds of times larger than their usual bets. This highly concentrated and abnormal betting behavior exposed them to significant risks: if "Light & Shadow" ultimately did not win, they would not only lose all their past profits but also face enormous losses.

As time passed and the odds of winning The Game Awards increased, they did not profit by selling any of their held shares. Even 3 hours after the award for "Best Indie Game" was announced, when they had already seen a significant unrealized gain, they remained unmoved as if they had foreseen the future, joining forces with the mysterious figure mentioned at the beginning of this article to stake their entire account balance for the ultimate marginal profit.

Award-winning Moment of History-Making and Insider Trading

Amidst doubt and uncertainty, The Game Awards (TGA) seemed to follow a script these traders had laid out over a month ago, dispelling the final suspense: the highly anticipated "The Light and The Shadow," having already won the "Best Indie Game" award, broke the historical curse to win the Best Game of the Year award.

While players on one side cheered and celebrated, the prediction market on the other side unraveled the final mystery: three traders who were convinced a month ago that "The Light and The Shadow" would win the award solidified their role as "seers," realizing substantial profits:

DieselDiesel profited $5,357 in this event, representing 176% of all their other trading profits;

trumpnogo profited $2,958 in this event, representing 62% of all their other trading profits;

kasae profited $1,658 in this event, representing 220% of all their other trading profits.

Meanwhile, the mysterious figure mentioned at the beginning (bobo9997) won $200 on a $10,000 bet that "The Light and The Shadow" would make history.

"Even Seers Need to Eat"

The most notable commonality among these four traders is that, while many players doubted whether "The Light and The Shadow" could break the historical curse, they were willing to "risk" nearly $100,000 in their positions to "bet" on this historic moment, yet the combined profit from this "gamble" was less than $2,000.

Let's assume for a moment that these "seers" were actually TGA ballot auditors. As insiders earning a $100,000 annual income, if they wanted to monetize the information in a traditional sense, they would have to sell the insider information to platforms such as the media, which would entail various potential fines, dismissal, or even imprisonment.

However, with the emergence of prediction markets, they were able to anonymously exchange the information gap for a sum equivalent to 1 to 3 months of their disposable income in cold, hard cash.

When we view it as if they were an insider who already knew the outcome in advance, everything becomes clear: In a situation where it was already 100% certain that "Light and Shadow" would be the GOTY, their "bet" at the last moment was simply exchanging one hour of waiting before the award for a seemingly high-risk yet actually unchanging $2,000 profit.

This type of seemingly high-risk but actually unchanging money-making "bet," was almost impossible to encounter before platforms like prediction markets appeared.

However, with the proliferation of Polymarket, how many people can resist converting information into cold, hard cash in an anonymous manner?

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin OG Whale Builds $611M Long Position Across ETH, BTC and SOL

Quick Take Summary is AI generated, newsroom reviewed. The whale "1011short" holds a massive directional long position exceeding $611 million across Ethereum, Bitcoin, and Solana. Ethereum makes up the core of the bet, with 150,466 ETH at 5x leverage and an additional $125 million in limit orders for scaling. The whale recently deposited $110 million in USDC into Hyperliquid to expand his BTC and aggressively leveraged SOL positions. The large, highly leveraged bet makes the address a real-time sentiment i

Ethereum Report Claims ETH Is Severely Mispriced

Quick Take Summary is AI generated, newsroom reviewed. The report claims Ethereum is mispriced because markets treat it like a company. It proposes valuing Ethereum as a public good similar to Internet protocols. A new model estimates Ethereum’s intrinsic value at $2–6 trillion. Current ETH market cap sits near $400 billion, far below the model’s estimate.References X ref

wXRP Solana Launch Opens Doors for Ripple and Solana Users

Quick Take Summary is AI generated, newsroom reviewed. wXRP is now available on the Solana blockchain. Users can trade XRP in Solana’s DeFi apps and NFT marketplaces. Solana offers faster transactions and lower fees for wXRP users. The launch connects Ripple and Solana communities, opening new trading opportunities.References JUST IN: Wrapped $XRP is coming to Solana blockchain.

AMINA Bank Becomes First in Europe to Go Live With Ripple Payments

Quick Take Summary is AI generated, newsroom reviewed. Regulated Swiss institution AMINA Bank became the first European bank to officially integrate Ripple Payments technology. The integration connects crypto-native clients to smoother, faster global fund movements using Ripple's licensed infrastructure. AMINA can now route transactions through both traditional fiat and Ripple's RLUSD stablecoin channels simultaneously. This partnership deepens Ripple's role in Europe's crypto banking sector, aligning with