The latest announcement surrounding the new PYTH Network Reserve has has shed some lights on the crashing PYTH Network price as the project now claims to shift toward a sustainable, revenue-backed value model. With PYTH Network price today hovering near $0.064, the market now weighs whether this structurally reinforced mechanism can catalyze renewed upside momentum similar to past Chainlink reserve-driven 80% rally witnessed in August this year.

The launch of the PYTH Network Reserve marks a substantial shift in how network value is reinforced. Based on the information from X post, under the new mechanism, the ecosystem revenue flows directly into the PYTH DAO treasury, which then conducts systematic monthly open-market purchases of PYTH.

Essentially, this structure aims to convert all real customer revenue into long-term value support for the PYTH Network crypto, which is indeed a significant benefit to PYTH holders.

Importantly, the reserve is going to purchase, per the data, about one-third of the treasury every month. A somewhat different reserve was announced by Chainlink this August. Perhaps the vibe is different here regarding the model, but the idea is to receive similar treatment to the LINK price.

During that period, the Chainlink price surged nearly 80% within 19 days, creating a notable benchmark for market observers assessing how PYTH Network price chart movements may respond to this development.

They informed the public that the PYTH Network Reserve is supported by four core ecosystem revenue streams. Pyth Pro, which surpassed $1 million in annualized revenue in its first month, and Pyth Core, which has been generating recurring on-chain revenue across over 100 chains.

Likewise, they have Entropy, which is also gaining traction in the gaming field, prediction markets, and even L1 integrations. And, Express Relay, that’s solely designed for the purpose of providing low-latency blockspace and competitive execution.

PYTH said, these products collectively form the network’s economic engine. This is aligning adoption with treasury growth and, ultimately, with potential buying strength on the open market.

Their post also had information about their institutional demand, which remains a central storyline for any deep-diver investor.

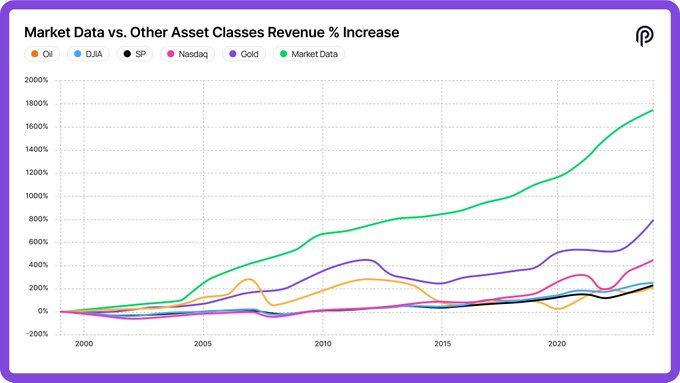

They announced that institutions are spending over $50 billion annually on market data, and the PYTH network believes capturing even 1% of that market would reach around $500 million in ARR, and they are pretty confident that they could significantly expand the PYTH Network Reserve.

Moreover, Pyth Pro’s adoption by major financial institutions and active DeFi protocols positions PYTH as one of the fastest-growing data services in recent cycles.

- Also Read :

- Whale Loads Up on $612M in BTC, ETH & SOL Longs—Is a Broader Crypto Market Rally Coming?

- ,

While the narrative is relatively strong, but for now, the onchain activity tells a different story, which appears to be in problem state. Data from visualizing Solscan shows that DeFi activity has steadily declined since mid-September. Daily activity values have fallen from around $2 million range to around $68,000, with active traders sliding from around 1,170 to just 259 by December 12th.

This deterioration highlights why the PYTH Reserve may be well-timed, as the ecosystem appears to need a catalyst capable of reenergizing participation.

Although early excitement resembles the lead-up to the Chainlink reserve rally, whether PYTH Network price USD reacts similarly remains dependent on investor reception and sustained demand.

With PYTH Network price today trading near $0.064, an 80% rally similar to Chainlink’s move, for instance, could theoretically push it toward $0.12 by year-end.

Additionally, the PYTH Network price forecast suggests that if momentum extends into early 2026, some analysts predict that the target will shift to a price near $0.22. For now, the market will focus on how the PYTH Network Reserve influences supply dynamics and sentiment in the weeks ahead.