PayPal, issuer of PYUSD, applies for Utah industrial bank license

Payments company PayPal (PYPL) applied for a Utah industrial bank license, it said Monday, with the goal of creating a lending arm called PayPal Bank.

The company, which also operates the PYUSD stablecoin through a partnership with Paxos, said in a press release it intends to "provide business lending solutions" to small businesses and interest-bearing savings accounts to other customers. It also intends to work with credit card networks.

PayPal also applied for deposit insurance through the Federal Deposit Insurance Corporation.

In a statement, PayPal CEO and President Alex Chriss said, "securing capital remains a significant hurdle for small businesses striving to grow and scale."

"Establishing PayPal Bank will strengthen our business and improve our efficiency, enabling us to better support small business growth and economic opportunities across the U.S.," he said.

Utah industrial banks are subject to "the same regulatory and supervisory oversight as commerical banks," but their activities "are not as restricted," according to the Utah Department of Financial Institutions website, with these types of institutions not beholden to the Bank Holding Company Act which regulates federal banks and prevents monopolization.

While PayPal's statement on Monday did not touch on its crypto-specific activities, PayPal has recently grown its foray into crypto, adding wallet-to-wallet crypto transfer functionality earlier this year and allowing its users to create personalized links for sending or requesting funds via crypto.

It's also launched a Pay with Crypto feature for merchant services, acting as an intermediary to let merchants accept cryptocurrencies as payment.

Monday's application comes on the heels of the U.S. Office of the Comptroller of the Currency, a federal bank regulator, granting five different crypto firms initial trust charters, including stablecoin issuers Circle and Paxos, Ripple, BitGo and Fidelity Digital Assets.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Why China’s Recent Mining Crackdown Triggered Bitcoin’s Latest Sell-Off

Animoca Partners with GROW to Connect Crypto and Traditional Finance

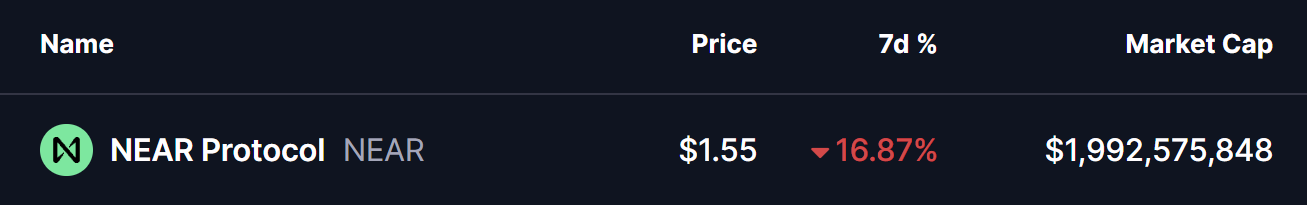

Near Protocol (NEAR) Flashes Potential Bullish Reversal Setup – Will It Bounce Back?

Solana Price Prediction: Grayscale Predicts New Bitcoin ATH, DeepSnitch AI’s Snowball to $900K Fuels the 100x Narrative