Bitwise CIO says bitcoin will break 4-year cycle and set new all-time highs in 2026

It's that time of year again when industry analysts set their outlook for the year ahead. Bitwise Chief Investment Officer Matt Hougan is no exception, teasing what he described as three of the most important themes from the crypto asset manager's forthcoming 10 predictions for 2026, including bitcoin all-time highs, lower volatility, and falling correlations.

Bitcoin has traditionally followed a pattern of three strong years followed by a sharp pullback, implying 2026 should be bearish. With bitcoin down more than 30% from its Oct. 6 peak of around $126,000 and most altcoins faring worse, that's a view widely held by current market participants.

However, Hougan does not see that outcome materializing this time around. In a note to clients late Monday, he argued that bitcoin is likely to defy its historical four-year market cycle and reach new all-time highs in 2026, as structural changes reshape the asset's behavior, though he stopped short of offering a specific price target for the peak.

The forces that once drove the cycle are now significantly weaker, he said, pointing to the diminishing impact of successive bitcoin halvings, expectations for falling interest rates in 2026 compared to the rises in 2018 and 2022, and a reduction in leverage-driven blowups following record liquidations in October and improving regulation.

More importantly, Hougan said, institutional adoption will accelerate in 2026 as platforms such as Morgan Stanley, Wells Fargo, and Merrill Lynch begin allocating, while Wall Street and fintech firms increasingly adopt digital assets following the pro-crypto regulatory shift under the Trump administration.

Volatility and correlations to decline

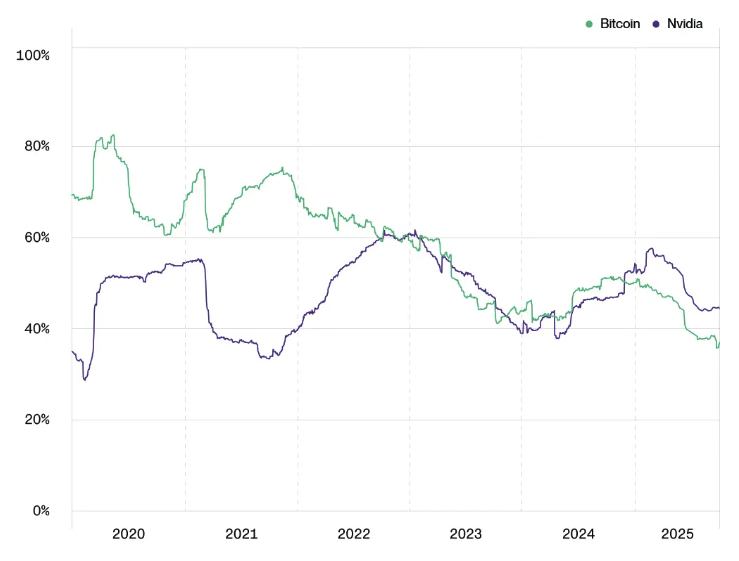

Hougan also said bitcoin's volatility has been steadily declining and is likely to remain lower in 2026. Despite concerns from some investors that bitcoin is simply too volatile compared to more traditional assets, he noted that bitcoin was less volatile than Nvidia stock throughout 2025. Hougan said the trend reflects a broad derisking of the asset and a more diversified investor base driven by traditional investment vehicles such as exchange-traded funds, with Bitwise expecting that dynamic to continue next year.

Bitcoin vs. Nvidia 1-year rolling annualized volatility. Image: Bitwise.

In addition, Hougan said bitcoin's correlation with equities should fall in 2026. While bitcoin is often described as highly correlated with the stock market, he noted that rolling correlation data shows it has rarely exceeded levels considered statistically meaningful. Bitwise expects crypto-specific drivers, including regulatory progress and institutional inflows, to support digital assets even if equities face pressure from valuation concerns and slower economic growth.

Taken together, Hougan said the outlook points to "strong returns, less volatility, and lower correlations" — a trifecta he described as particularly attractive for portfolio construction. If those conditions play out, he expects tens of billions of dollars in new institutional investment to enter the market.

Hindsight 2025

Looking back, Bitwise's 2025 predictions were directionally correct on institutional and regulatory momentum but too aggressive on price and scale. Bitcoin, Ethereum, and Solana did set new all-time highs during the year, validating Bitwise's broad bullish thesis, but none came close to the specific targets of $200,000, $7,000, and $750, respectively. U.S. Bitcoin ETF inflows are also unlikely to surpass 2024 levels, against Bitwise's expectations.

However, several of the firm's high-conviction market-structure calls did land, including Coinbase joining the S&P 500, Strategy entering the Nasdaq-100, and the U.S. Department of Labor backing away from its 2022 anti-crypto 401(k) guidance, while U.S. stablecoin legislation was also passed as expected.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Uniswap Fork Protocol Stable Swap Integrated Into Stable, Brings Uniswap V2 and V3 Functionality

Best Crypto To Buy in 2026? Could EV2 Outpace BTC, ETH, XRP & ADA Over the Next Bull Cycle?

SEC Chair Paul Atkins Warns That Overregulation Could Turn Crypto Networks Into Powerful Surveillance Tools

Stable Swap has been integrated into Stable, combining features from both Uniswap V2 and V3 versions.