Bitcoin has long been treated as a hedge against traditional market cycles, but this week exposed a new and unsettling dynamic: BTC is now moving in tight correlation with the AI-driven tech sector. When weakness hit AI-related equities, Bitcoin reacted almost instantly, slipping alongside them, a signal that risk appetite across markets is becoming dangerously intertwined. This shift has pushed many investors to reevaluate where stability truly exists during periods of uncertainty.

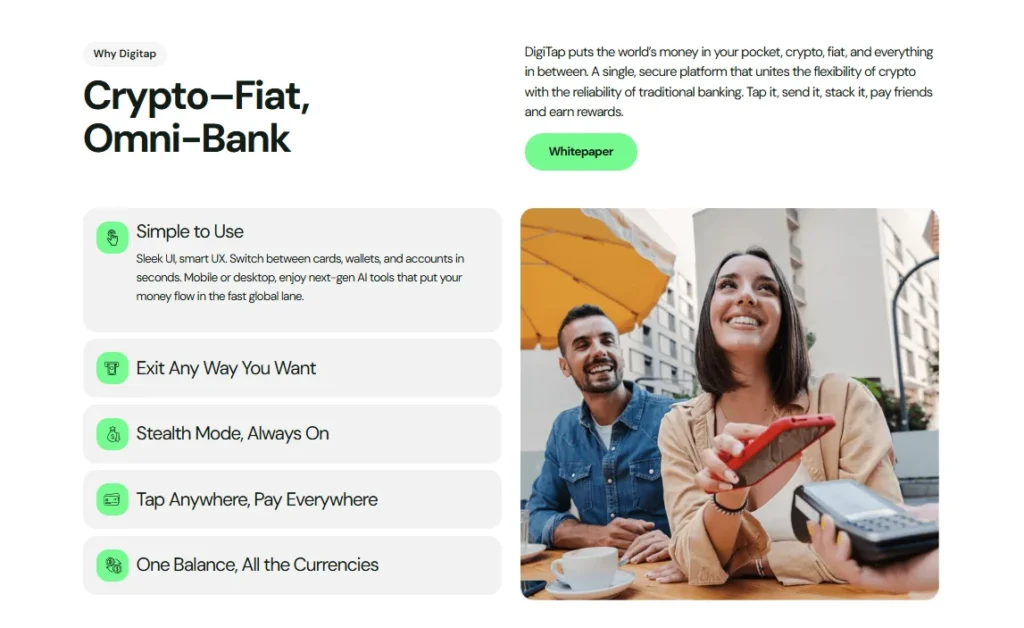

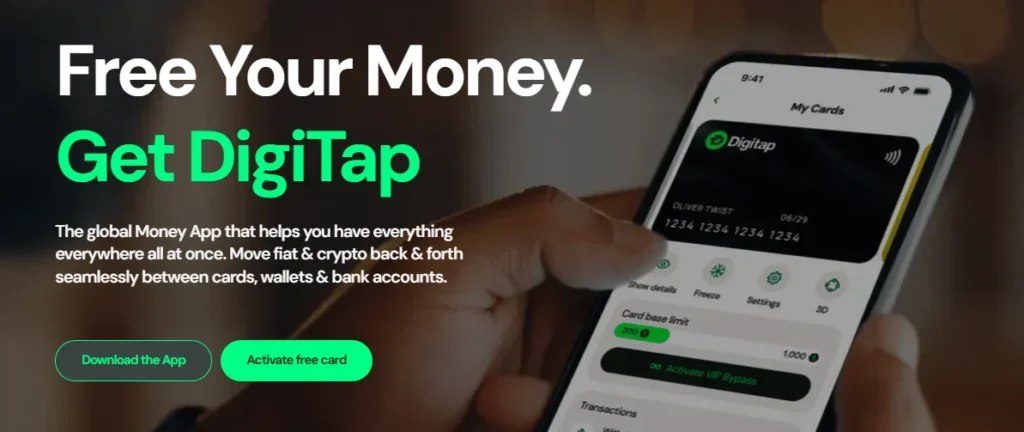

As macro narratives collide, a new class of alternative opportunities is taking shape. Digitap ($TAP), a live global money app with a privacy-optional Visa card and multi-currency banking tools, is gaining attention as a more grounded hedge for December, especially for users seeking a crypto opportunity backed by real product utility rather than speculative market behavior.

AI Market Jitters Send Shockwaves Into Bitcoin: A Correlation No One Wanted

For years, Bitcoin was viewed as a separate asset class, insulated from equity cycles. That narrative is now being challenged. When a wave of selling hit AI-linked stocks after several tech names reported weaker-than-expected guidance, Bitcoin suddenly faltered as well, breaking below key short-term support.

According to recent market analysis, the correlation between Bitcoin and major tech benchmarks has tightened significantly. The Nasdaq-100 Volatility Index (VXN) surged more than 12% in a single session as AI sentiment weakened, highlighting how fragile risk appetite became across multiple asset classes.

This rising volatility created a ripple effect, pulling Bitcoin lower and reinforcing a new reality: BTC may behave more like a high-beta tech asset during AI-driven uncertainty than a neutral macro hedge. Investors are now asking a serious question: If the AI bubble pops, what happens to Bitcoin?

Why Investors Are Rotating Toward Utility-Based Projects?

The fear surrounding Bitcoin’s alignment with tech-sector volatility has sparked a noticeable shift in capital flow. Instead of chasing assets that move with daily market headlines, investors are starting to seek platforms built on functionality and steady, structured progress.

One of the clearest signs of this transition came from new user behavior data showing that demand for privacy-first financial tools is accelerating globally. A recent report from the International Association of Privacy Professionals (IAPP) shows that 78% of consumers feel they have “lost control” over how financial platforms collect or share their information, fueling adoption of no-KYC alternatives.The combination of unpredictable market swings and increasing user privacy concerns is paving the way for solutions like Digitap, platforms that users can actually engage with now, not years from now.

Digitap’s Real Banking Stack Offers Stability in a Volatile Environment

Digitap distinguishes itself from speculative projects by operating as a live financial platform rather than a future promise. The app already unifies crypto and fiat in a single dashboard, allowing users to manage balances, convert funds, and spend globally without relying on multiple services.

At the core of its offering is a no-KYC virtual Visa card that enables instant crypto spending at any Visa-accepted merchant, including Apple Pay and Google Pay, making it especially useful in regions with limited or restrictive banking access. Digitap also supports multi-currency fiat and crypto accounts with instant conversion, alongside licensed partners for global transfers.

This infrastructure is reinforced by deflationary tokenomics, where 50% of app profits are used for $TAP buy-backs and partial burns, directly linking token supply to platform activity. Together, these features position $TAP as a strong choice for those prioritizing real utility and private financial access over speculation.

Digitap’s 12 Days of Christmas Drop Adds Tailwind to Its December Traction

Digitap is amplifying year-end adoption through its 12 Days of Christmas Holiday Drop, a festive 12-day event where new offers unlock every 12 hours. Users can unwrap 24 time-limited rewards, including Premium/Pro upgrades, seasonal $TAP bonuses, and exclusive holiday perks.

The campaign has increased activity across the platform, creating strong user engagement as interest continues to build.