Top Wall Street Analysts Adjust Acuity Projections Prior to First Quarter Earnings

Acuity Inc. Set to Announce Q1 Earnings

Acuity Inc. (NYSE: AYI) is scheduled to unveil its first-quarter financial results before the market opens on Thursday, January 8, 2025.

Market analysts are forecasting that the Atlanta-based company will post earnings of $4.59 per share for the quarter, an increase from $3.97 per share reported in the same period last year. Revenue is projected to reach $1.14 billion, up from $951.6 million a year ago, according to Benzinga Pro data.

In its previous earnings release on October 1, Acuity reported a 17.1% year-over-year rise in fourth-quarter net sales, totaling $1.21 billion. However, this figure fell slightly short of the consensus estimate of $1.23 billion.

On Monday, Acuity shares closed at $376.69, marking a 0.9% increase for the day.

For those interested in the latest analyst perspectives, Benzinga offers a comprehensive Analyst Stock Ratings page, where users can filter by ticker, company, analyst firm, rating changes, and more.

Recent Analyst Ratings for Acuity Inc.

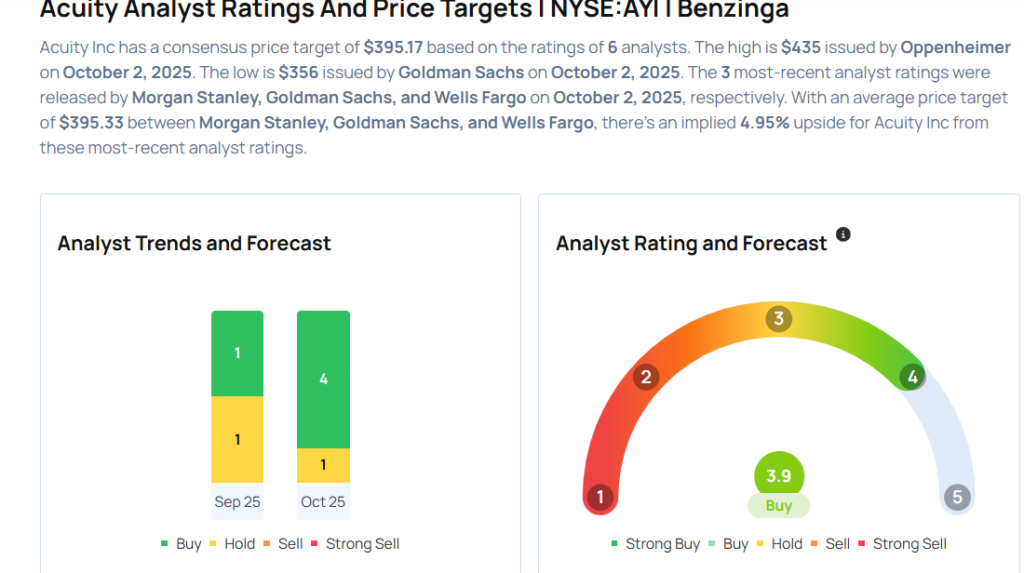

- Christopher Snyder of Morgan Stanley reaffirmed an Overweight rating and lifted the price target from $365 to $425 on October 2, 2025. Snyder’s accuracy rate stands at 66%.

- Brian Lee from Goldman Sachs maintained a Neutral stance, raising the price target from $312 to $356 on October 2, 2025. Lee has a 60% accuracy rate.

- Joseph O'Dea at Wells Fargo kept an Overweight rating and increased the price target from $380 to $405 on October 2, 2025. O'Dea’s accuracy rate is 68%.

- Christopher Glynn of Oppenheimer continued with an Outperform rating and boosted the price target from $380 to $435 on October 2, 2025. Glynn’s accuracy rate is 81%.

- Timothy Wojs from Baird maintained a Neutral rating and raised the price target from $335 to $360 on September 25, 2025. Wojs has a 55% accuracy rate.

Thinking about investing in AYI? Here’s what the experts are saying:

Further Reading

- How to Generate $500 Monthly from Jefferies Financial Stock Before Q4 Earnings

Image credit: Shutterstock

Market news and data provided by Benzinga APIs

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum : Buterin reveals major upcoming reforms

Samsung set to hand out record bonuses as AI boom translates into profits

Bitcoin Gains Traction As ETF Demand Surges

Bank of England raises concerns as hedge fund positions in gilts reach £100 billion