Duolingo Benefits From BofA's Upbeat Outlook, Seeing It As More Than Just A Language Platform: Growth Metrics Surge

Duolingo Shares Climb on Strong Growth Metrics

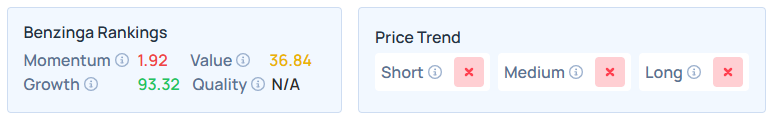

On Monday, shares of Duolingo, Inc. (NASDAQ: DUOL) jumped nearly 5%, coinciding with a notable improvement in its key performance indicators. The company’s Benzinga Edge Stock Rankings growth score soared to 93.32, positioning Duolingo among the leading U.S.-listed stocks for historical earnings and revenue growth.

See the latest DUOL stock price here.

Analyst Upgrade Boosts Optimism

Duolingo’s improved growth ranking follows a positive shift in analyst sentiment, as Bank of America Securities upgraded its rating from Neutral to Buy. The analysts believe that Wall Street is undervaluing Duolingo by viewing it solely as an educational service.

According to Bank of America, Duolingo’s real strength lies in its appeal as an entertainment platform. The app is seen as a competitor to casual mobile games, attracting users looking to fill brief moments throughout their day.

Bank of America also pointed out that Duolingo retains about 95% of its subscribers annually and has a payer-to-daily-active-user ratio of approximately 23%—figures that compare favorably with leading mobile gaming apps.

Related: Dollar General Gains Momentum Ahead of Ex-Dividend Date

Growth Score Reaches New Heights

Duolingo now ranks in the 93rd percentile for growth according to Benzinga’s proprietary system. This ranking is based on a composite measure of historical earnings and revenue growth over various timeframes, highlighting both sustained and recent progress.

Despite recent share price fluctuations—reflected in a low momentum score of 1.92 and downward trends across different timeframes—the company’s underlying financial growth remains strong.

For more performance insights, see Benzinga Edge Stock Rankings.

Future Prospects

Bank of America estimates that Duolingo could access a global market of 3 billion casual gamers. Although the firm slightly reduced its price target to $250, it maintains that Duolingo’s shares are attractively valued given the company’s long-term growth prospects, a view supported by its high quantitative rankings.

Over the past six months, DUOL shares have declined by 53.30%, and by 45.01% in the last month. However, the stock rose 4.91% on Monday to close at $185.15, and gained an additional 1.54% in Tuesday’s premarket trading.

Further Reading

- Masimo’s Quality Score Drops Despite Major Patent Victory Over Apple

Image credit: Shutterstock

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Markets Brace for Turbulent Times as US-EU Tensions Escalate

Ethereum may finally kill “trust me” wallets in 2026, and Vitalik says the fix is already shipping

KLA Corp. Shares Receive Highest Price Target Yet—Is Now the Time to Invest in KLAC?

Bessent: Supreme Court reversal of tariffs is improbable, as they are a key element of Trump’s economic agenda