Looking at the Latest Short Interest Trends for Regeneron Pharmaceuticals Inc

Regeneron Pharmaceuticals Inc: Recent Short Interest Trends

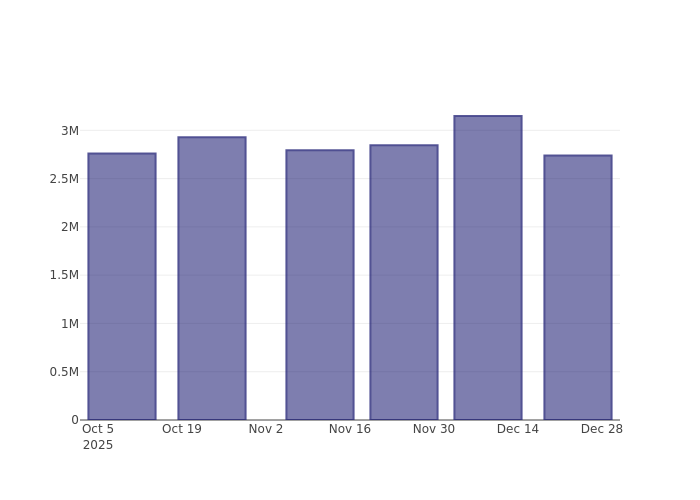

Regeneron Pharmaceuticals Inc (NYSE: REGN) has experienced a 12.97% decrease in short interest as a percentage of its float since the previous report. Latest exchange data shows that there are currently 2.74 million shares sold short, representing 2.75% of the total shares available for public trading. At the current trading volume, it would take an average of 2.81 days for traders to cover all short positions.

Understanding Short Interest

Short interest refers to the total number of shares that have been sold short but have not yet been repurchased or closed. In short selling, investors sell shares they do not own, anticipating a decline in the stock price. If the price falls, short sellers can buy back the shares at a lower price and profit; if the price rises, they incur losses.

Monitoring short interest is valuable because it reflects investor sentiment toward a stock. A rising short interest often indicates growing pessimism among investors, while a decline can suggest increasing optimism.

Short Interest Over the Past Three Months

The chart above illustrates that Regeneron Pharmaceuticals Inc has seen a reduction in the percentage of shares sold short since the last report. While this does not guarantee an imminent price increase, it does indicate that fewer shares are being targeted by short sellers.

Comparing Regeneron's Short Interest to Its Industry Peers

Analysts and investors often compare a company’s performance to similar firms, known as peers, which share characteristics such as industry, size, and financial structure. Peer groups can be identified through company filings or independent analysis.

According to Benzinga Pro, the average short interest as a percentage of float among Regeneron’s peer group is 7.46%. This means Regeneron’s short interest is lower than that of most comparable companies.

Interestingly, a rise in short interest can sometimes be a bullish sign for a stock.

Regeneron Pharmaceuticals Inc Stock Snapshot

- Ticker: REGN

- Company Name: Regeneron Pharmaceuticals Inc

- Current Price: $774.88

- Change: +1.53%

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Lumen’s 46% jump in 2025 carries into 2026 on AI bets

‘No Motivation to Hold’: Software Shares Plunge Amid Concerns Over Latest AI Technology

'A widening range of opportunities': Wall Street anticipates stock market growth extending past the tech sector

Where Meta's ambitions for the metaverse fell short