What's Influencing Investor Sentiment Toward Unusual Machines Inc?

Rising Short Interest in Unusual Machines Inc (NYSE: UMAC)

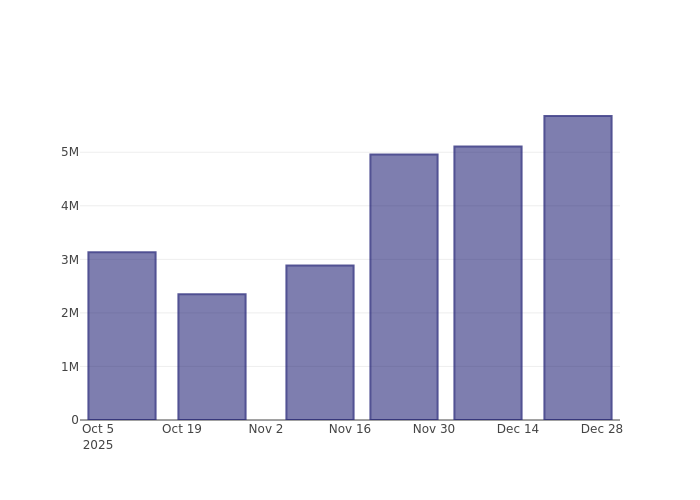

Unusual Machines Inc has experienced an 11.1% increase in short interest as a percentage of its float since the previous update. Recent exchange data reveals that 5.68 million shares are currently sold short, representing 16.42% of the company’s available shares for trading. At the current trading volume, it would take traders an average of 3.05 days to cover all short positions.

Understanding Short Interest

Short interest refers to the total number of shares that have been borrowed and sold but not yet repurchased or closed. Short selling is a strategy where investors sell shares they do not own, anticipating a decline in the stock’s price. If the price drops, the trader profits; if it rises, they incur a loss.

Tracking short interest is valuable because it reflects the market’s outlook on a stock. A rising short interest often indicates growing pessimism among investors, while a decline can suggest increasing optimism.

Short Interest Trends for Unusual Machines Inc

The chart above illustrates that the proportion of Unusual Machines Inc shares sold short has increased since the last report. While this trend does not guarantee a near-term decline in share price, it is important for traders to note the heightened level of short selling activity.

Comparing Short Interest with Industry Peers

Analysts and investors often compare a company’s short interest to that of similar firms to assess its market standing. Peer companies are typically those with comparable industry focus, size, age, and financial structure. You can identify a company’s peers by reviewing its 10-K filings, proxy statements, or conducting your own analysis.

According to Benzinga Pro, the average short interest as a percentage of float among Unusual Machines Inc’s peers is 8.22%. This means Unusual Machines Inc has a higher short interest than most companies in its peer group.

Is Rising Short Interest Always Bearish?

Interestingly, a surge in short interest can sometimes be a bullish indicator.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Large bitcoin investors have accumulated more coins than at any time since the FTX crash in 2022

Trump throws UK automakers into turmoil once again

Cryptocurrency Market Stirs Enthusiasm as Bitcoin Holds Strong

DOJ No-Sell on Samourai Bitcoin, Advisor Says – Kriptoworld.com