Examining the Latest Short Interest in Viking Therapeutics Inc

Viking Therapeutics Inc: Recent Trends in Short Interest

Viking Therapeutics Inc (NYSE: VKTX) has experienced a 4.51% increase in short interest as a percentage of its float since the previous update. Latest exchange data shows that 24.03 million shares are currently sold short, representing 25.48% of the company’s available shares for trading. At the current trading volume, it would take investors an average of 8.78 days to cover all short positions.

Understanding Short Interest

Short interest refers to the total number of shares that have been sold short but have not yet been repurchased or closed. Short selling involves selling shares that the trader does not own, anticipating a decline in the stock’s price. If the price falls, the trader profits; if it rises, losses occur.

Monitoring short interest is valuable because it reflects the market’s outlook on a stock. A rise in short interest often indicates growing pessimism among investors, while a decline suggests increasing optimism.

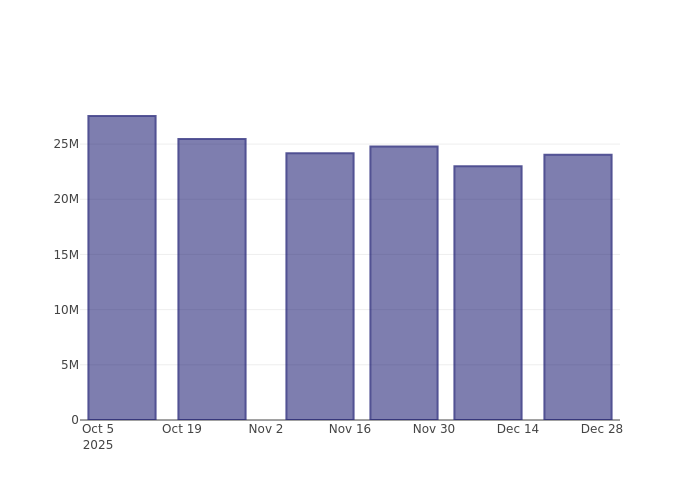

Short Interest Over the Past Three Months

The chart above illustrates that the proportion of Viking Therapeutics Inc shares sold short has increased since the last report. While this does not guarantee a near-term drop in share price, it does highlight that more traders are betting against the stock.

How Viking Therapeutics Inc Compares to Its Peers

Analysts and investors often compare companies to similar businesses—known as peers—based on factors like industry, size, age, and financial structure. Peer groups can be identified through company filings such as the 10-K or proxy statements, or by conducting independent research.

According to Benzinga Pro, the average short interest as a percentage of float among Viking Therapeutics Inc’s peers is 12.82%. This means Viking Therapeutics Inc currently has a higher level of short interest than most comparable companies.

Interestingly, a rise in short interest can sometimes be a bullish indicator for a stock. Learn how to potentially benefit from this trend in this Benzinga Money article.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Where Meta's ambitions for the metaverse fell short

ETH Stalls & Pepe Dips, Zero Knowledge Proof’s Stage 2 Coin Burns Could be the Start of a 7000x Explosion!

Targeting $900B Remittances Could Drive The Best Crypto To Buy 2026

Crypto Enthusiasts Witness HYPE Coin’s Rebound as Key Resistance Breaks Loom