Investors are clearly showing strong risk appetite across the board.

To start, memecoins are driving much of this momentum. Top-cap memecoins are posting double-digit weekly gains.

At first glance, this raises an obvious question: Are investors simply chasing speculation?

However, when we shift focus to Ethereum [ETH], that narrative begins to weaken. On-chain metrics instead point to a supply shock forming, highlighted by BitMine’s staking of 771k ETH over the past two weeks.

In short, capital is rotating into conviction-driven assets rather than pure “hype” trades. Notably, this rotation is starting to show up in price.

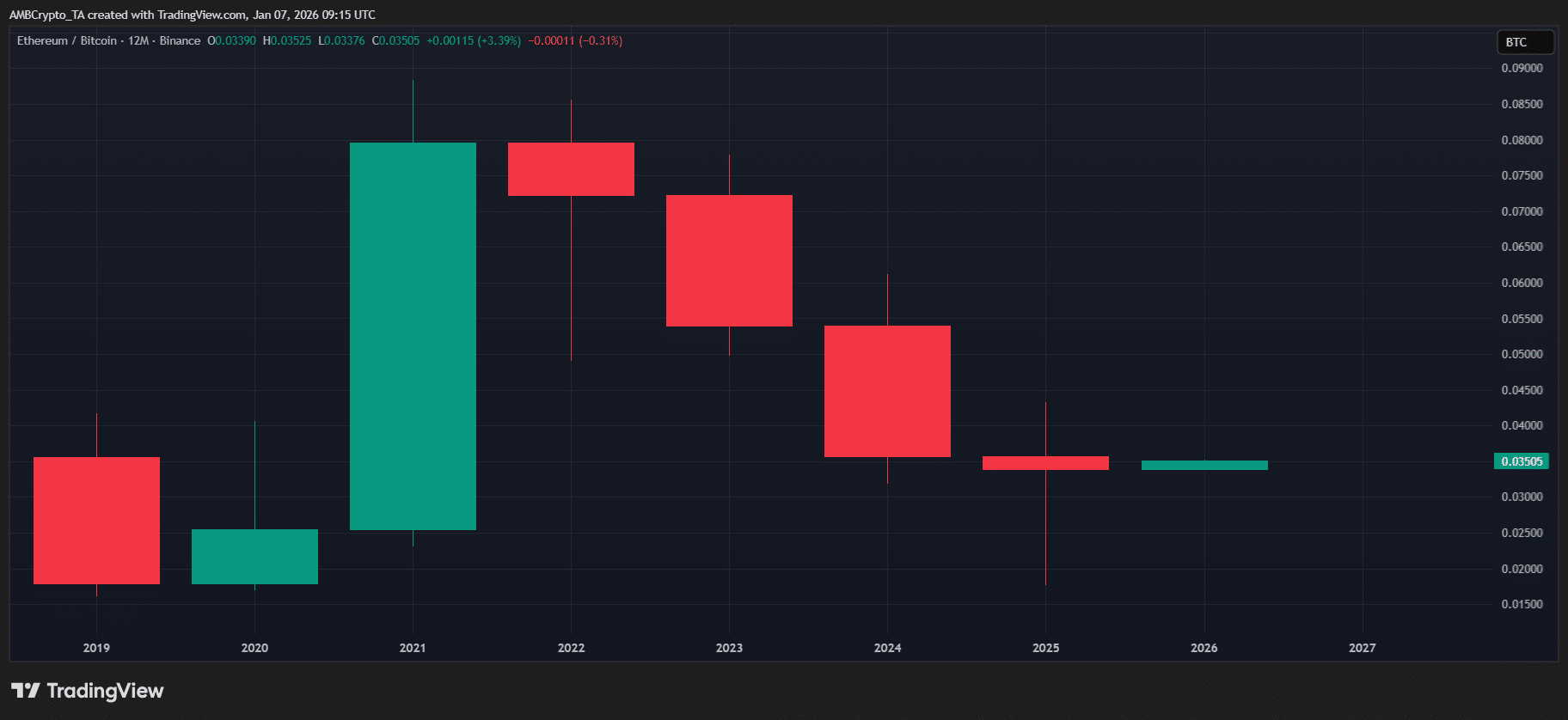

Because ETH has outperformed BTC by 2×, logging a 9.3% move in just one week into 2026.

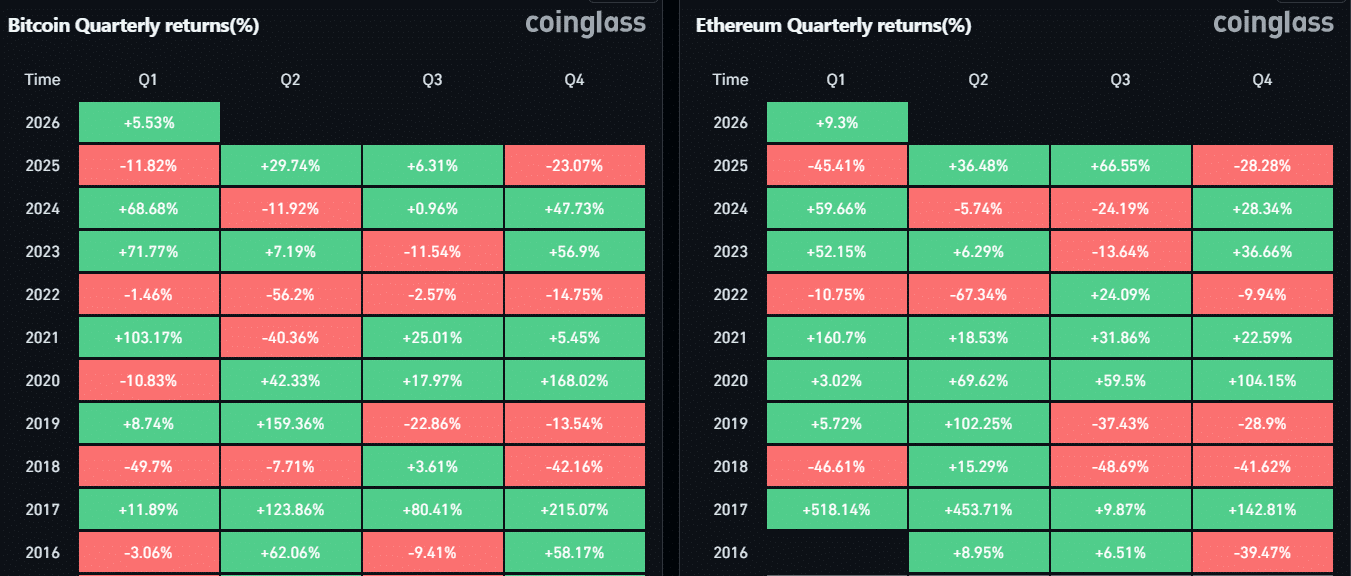

On a quarterly view, this sets up a clear divergence.

For context, since 2022, Bitcoin [BTC] has consistently outperformed ETH in Q1, posting stronger rallies and shallower pullbacks. However, with an Ethereum supply shock building, does this cycle finally break the trend?

From Q1 loss to early lead – Ethereum vs Bitcoin in 2026

Ethereum’s 2026 roadmap is clearly developer-focused.

From RWA tokenizations to DeFi, the network is expanding its institutional footprint and boosting L1 competitiveness. Looking at 2025, it laid a solid base for scaling adoption and attracting more institutional activity in 2026.

Notably, the impact is now showing on-chain as well.

Ethereum supply is getting locked. As of press time, 1.32 million ETH was waiting to stake, while only 3k is queued to exit. In fact, entry exceeds exit for the first time in six months.

In this context, ETH/BTC posting a near 4% rally so far isn’t a fluke.

Instead, it could mark the start of a bigger move. With a tightening supply, solid fundamentals, and a growing L1 footprint, long-term conviction in Ethereum is showing, with investors clearly committing for the cycle.

That sets up a strong 2026 divergence.

ETH’s 2× larger move than BTC so far is just the start, and if momentum holds, this cycle could finally flip the script, with ETH delivering higher ROI than BTC by the end of Q1 2026.

Final Thoughts

- On-chain metrics show 1.32 million ETH queued to stake vs. just 3k exiting, signaling strong capital rotation into Ethereum over hype trades.

- ETH has outperformed BTC 2× YTD. If momentum holds, this cycle could break historical patterns with ETH delivering higher ROI than BTC by the end of Q1.