Is British American Tobacco PLC Experiencing an Increase or Decline in Market Backing?

British American Tobacco PLC: Recent Short Interest Trends

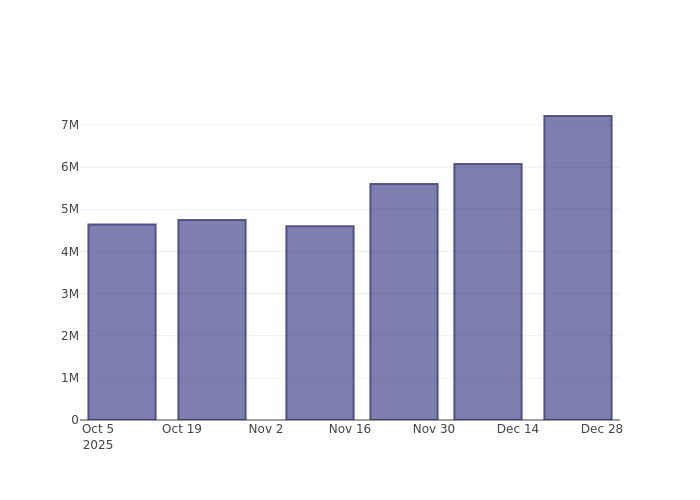

British American Tobacco PLC (NYSE: BTI) has experienced an 18.92% increase in short interest relative to its float since the previous report. Current data from the exchange indicates that there are now 7.21 million shares sold short, representing 0.44% of the total shares available for trading. At the present trading volume, it would take an average of 1.86 days for traders to cover all short positions.

Understanding Short Interest

Short interest refers to the total number of shares that have been sold short and remain open. Short selling occurs when an investor sells shares they do not own, anticipating a decline in the stock's price. If the price drops, the trader profits; if it rises, they incur a loss.

Monitoring short interest is valuable because it reflects investor sentiment toward a stock. A rise in short interest often suggests growing pessimism among investors, while a decline may indicate increasing optimism.

Short Interest Over the Past Three Months

The chart above illustrates that the proportion of British American Tobacco PLC shares sold short has increased since the last reporting period. While this does not guarantee an imminent decline in the stock's price, it is important for traders to note the uptick in short selling activity.

How Does British American Tobacco PLC Compare to Its Peers?

Analysts and investors often use peer comparisons to evaluate a company's performance. Peers are typically companies with similar industry profiles, sizes, ages, and financial structures. You can identify a company's peer group by reviewing its 10-K filings, proxy statements, or conducting your own analysis.

According to Benzinga Pro, the average short interest as a percentage of float among British American Tobacco PLC’s peers is 3.92%. This means British American Tobacco PLC currently has a lower short interest than most companies in its peer group.

This article was produced using Benzinga's automated content platform and reviewed by editorial staff.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bessent: Supreme Court reversal of tariffs is improbable, as they are a key element of Trump’s economic agenda

US Strategic Bitcoin Reserve Stalls Amid Interagency Legal Complications

Large bitcoin investors have accumulated more coins than at any time since the FTX crash in 2022

Trump throws UK automakers into turmoil once again