Bitget UEX Daily|Trump's Statements on Multiple Policies; State of the Union Scheduled for February 24; Anthropic's Financing Doubles Valuation ( (26/01/08)

I. Hot News

Federal Reserve Dynamics

U.S. Economic Data Release Schedule Adjusted

- The Commerce Department has updated the release timetable for key indicators in 2025, with the initial Q4 and full-year GDP figures set for February 20.

- Key Points: October and November personal income and expenditure data will be released on January 22; December report and GDP final values will be scheduled separately to ensure data accuracy.

- Market Impact: This adjustment helps investors plan ahead, but data delays may heighten short-term market uncertainty, especially during sensitive periods for inflation and consumption indicators.

International Commodities

Venezuelan Oil Sales Led by the U.S.

- U.S. Energy Secretary announces indefinite control over Venezuelan oil sales, with revenues deposited into U.S.-controlled accounts to benefit both countries.

- Key Points: Short-term goals include stabilizing production through supply of diluents; future plans aim to attract U.S. oil company investments; Trump states that oil revenues will prioritize purchases of U.S.-made products.

- Market Impact: This move could moderately increase global crude supply and ease geopolitical tensions, but it depends on investment scale and may suppress short-term oil price volatility.

Goldman Sachs Warns of Intensified Silver Price Volatility

- Goldman Sachs anticipates continued sharp fluctuations in silver prices due to tight London inventories and capital flows.

- Key Points: Inflows from private investors amplify volatility; markets are prone to "squeeze" events causing rapid rises and falls; U.S. tariff risks remain low.

- Market Impact: Risk-averse investors should proceed with caution; short-term silver investments need to monitor inventory dynamics, potentially exacerbating uncertainty in the precious metals sector.

Macroeconomic Policies

Trump Boosts 2027 Military Budget to $1.5 Trillion

- Trump decides to increase the 2027 defense budget by 50% to build a "dream army," funded by tariff revenues.

- Key Points: Agreed upon through negotiations with Congress; emphasizes current global turmoil; does not affect other budgets.

- Market Impact: Positive for defense contractor stocks, but may amplify fiscal deficit concerns and push up long-term inflation expectations.

Trump Bans Institutional Investors from Adding Single-Family Homes

- Trump announces an immediate ban on large institutions purchasing more single-family homes and calls for legislation to preserve the "American Dream."

- Key Points: Addresses inflation-driven housing burdens; details on housing affordability proposals to be discussed in Davos speech.

- Market Impact: Could curb institutionalization of real estate, boosting individual homebuying markets, but may disrupt short-term liquidity in the real estate sector.

Trump's State of the Union Set for February 24

- House Speaker invites Trump to deliver the State of the Union on February 24, focusing on economic and legislative agendas.

- Key Points: Timed ahead of midterm elections; will discuss Venezuelan actions and broader foreign policies.

- Market Impact: The speech may release policy signals to boost investor confidence, but economic concerns could trigger market volatility.

Canadian Prime Minister Carney to Visit China Next Week

- Canadian Prime Minister's Office announces Carney's visit to China from January 13 to 17, discussing trade, energy, and other topics.

- Key Points: First prime ministerial visit since 2017; involves agriculture and international security.

- Market Impact: May ease trade frictions among China, the U.S., and Canada, benefiting related commodities, but geopolitical impacts require monitoring follow-up developments.

II. Market Review

- Gold: Slightly down, closing at $4,454/oz, ending recent gains and appearing to enter a correction phase.

- Silver: Slightly up, closing at $77.33/oz, with significantly amplified volatility influenced by tight inventories.

- Crude Oil: Slightly up, closing at $56.34/barrel, as the Venezuelan agreement triggers changes in supply expectations.

- US Dollar Index: Essentially flat, closing at 98.49 points, supported by economic data expectations and geopolitical policies.

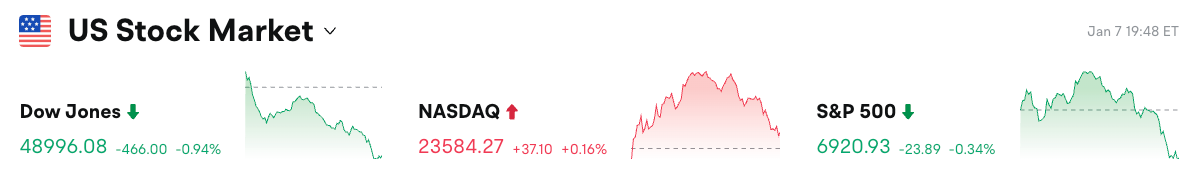

U.S. Stock Index Performance

- Dow Jones: Down 0.94%, closing at 48,996.08 points, retreating from record highs and under pressure for two consecutive days.

- S&P 500: Down 0.34%, closing at 6,920.93 points, dragged by banking stocks.

- Nasdaq: Up 0.16%, closing at 23,584.27 points, with a slight rebound driven by divergence in the tech sector.

Tech Giants Dynamics

- Google: Up over 2%, market cap at $3.88 trillion, benefiting from AI chips and Gemini 3 release, surpassing Apple for the first time since 2019.

- Microsoft: Up over 1%, sustained momentum from AI strategy.

- NVIDIA: Up over 1%, strong chip demand.

- Amazon: Slight increase, supported by cloud services.

- Meta: Down over 1%, intensified competition in social platforms.

- Apple: Slight decline, growth expectations impacted by delayed Siri upgrade, market cap drops to $3.84 trillion.

- Tesla: Slight decline, fluctuations in the EV market. Overall, tech giants' gains and losses stem from divergences in AI competition, with leaders like Google favored, while Apple's delayed upgrades weigh on performance.

Sector Movements Observation

Rare Earth Concepts Up Over 4%

- Representative Stocks: CRML up over 16%, UAMY up over 12%.

- Driving Factors: Geopolitical supply chain concerns boost demand, highlighting strategic value of rare earth resources.

Space Concepts Down Over 2%

- Representative Stocks: ASTS down over 12%, SIDU down over 6%.

- Driving Factors: Capital rotation out of high-valuation sectors, short-term technical corrections.

Storage Concepts Stocks Down Over 1%

- Representative Stocks: Western Digital down nearly 9%, Seagate Technology down nearly 7%.

- Driving Factors: Profit-taking after prior surges, intensified supply chain pressures.

SaaS Concepts Up Over 1%

- Representative Stocks: CRWD up over 4%, NOW up over 1%.

- Driving Factors: Accelerated enterprise digital transformation, strong demand for cloud services.

Defense and Military After-Hours Rebound Over 3%

- Representative Stocks: Lockheed Martin up over 6%, Raytheon Technologies up over 3%.

- Driving Factors: Trump's military budget increase expectations uplift industry prospects.

III. In-Depth Stock Analysis

1. Google - Market Cap Surpasses Apple for First Time in Seven Years

Event Overview: Google's stock rose over 2%, pushing its market cap to $3.88 trillion, exceeding Apple's $3.84 trillion. This reversal stems from Google's strong AI positioning, including the seventh-generation Tensor processor Ironwood and positive reviews for the Gemini 3 model, while Apple's Siri upgrade is delayed, prompting Wall Street to lower its 2026 growth expectations. Market Interpretation: Institutional views diverge; Raymond James downgrades Apple, highlighting AI absence risks; Goldman Sachs and others see Google as a potential NVIDIA alternative, positioning it as the new tech stock leader. Investment Insights: AI strategy leaders offer greater appeal; consider Google's long-term growth, but watch for valuation bubbles.

2. Intel - 18A Process AI Chips Enter Mass Production

Event Overview: Intel unveiled AI PC chip series based on 18A process at CES, with stock up over 6%. The chips feature innovative architecture, signaling the company's manufacturing revival, aimed at reclaiming share from AMD and proving foundry competitiveness. CEO emphasizes fulfilling 2025 commitments, with 2026 as an industry turning point. Market Interpretation: Analysts say this revives Intel's tech image; Morgan Stanley bullish on foundry prospects but warns of intense competition and needs to monitor market penetration. Investment Insights: Chip cycle recovery is favorable; moderate allocation to Intel to capture AI hardware demand.

3. Eli Lilly - Acquires Ventyx Biosciences

Event Overview: Eli Lilly acquires Ventyx Biosciences for $14 per share in all-cash deal, with stock up over 4% and the latter surging 36%. Ventyx's pipeline includes multiple small-molecule drugs for chronic inflammation oral therapies, strengthening Lilly's advantages in inflammatory diseases. Market Interpretation: Institutions view it as strategic reinforcement; Barclays says it will enhance Lilly's pipeline diversity but requires assessing integration risks. Investment Insights: Active pharma M&A period; Lilly's growth potential strengthened, suitable for long-term holding.

4. GameStop - CEO Incentive Plan Announced

Event Overview: GameStop approves long-term stock option awards for CEO Ryan Cohen, covering 171.5 million shares at $20.66 exercise price, with stock up over 3%. Awards in nine tranches, vesting only upon market cap and EBITDA targets; full amount requires market cap exceeding $100 billion, with no guaranteed compensation. Market Interpretation: Analysts see the incentive as aggressive; UBS notes it could drive transformation but high thresholds add uncertainty. Investment Insights: High-risk, high-reward; suitable for aggressive investors tracking performance milestones.

5. Raytheon Technologies - Trump Criticizes Defense Response

Event Overview: Trump calls Raytheon the least responsive to the Defense Department, urging more upfront investments and halting buybacks, with stock down over 2%. Comments arise from defense budget negotiations, emphasizing contractors' need for more active responses. Market Interpretation: Goldman Sachs and others believe short-term pressure is limited, with overall military budget increases beneficial, but policy execution needs monitoring. Investment Insights: Defense sector outlook positive, but avoid stocks targeted by policy risks.

IV. Today's Market Calendar

| 07:30 | United States | Challenger Job Cuts Report | ⭐⭐⭐ |

| 08:30 | United States | International Trade in Goods and Services | ⭐⭐⭐⭐ |

| 08:30 | United States | Productivity and Costs | ⭐⭐⭐⭐ |

| 10:00 | United States | Wholesale Trade Sales and Inventories | ⭐⭐⭐ |

Important Events Preview

- Canadian Prime Minister's Visit to China: January 13-17 - Focus on trade and energy issues, potentially impacting North American supply chains.

- CES Exhibition Continues: All Day - Tech product launches, focusing on AI and chip dynamics.

Bitget Research Institute Views:

Over the past 24 hours, U.S. stocks touched new highs before a slight pullback, with the Dow and S&P under pressure but Nasdaq slightly up, which can be viewed as a healthy adjustment; precious metals retreated mainly due to profit-locking and inventory squeeze risks, but long-term Fed easing provides price support. Crude oil slightly declined influenced by the Venezuelan agreement, with overall market optimism but heightened volatility, recommending diversified allocation.

Disclaimer: The above content is compiled by AI search and manually verified for publication only, not as any investment advice.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

US Strategic Bitcoin Reserve Stalls Amid Interagency Legal Complications

Large bitcoin investors have accumulated more coins than at any time since the FTX crash in 2022

Trump throws UK automakers into turmoil once again

Cryptocurrency Market Stirs Enthusiasm as Bitcoin Holds Strong