Top 3 Technology Stocks That May Deliver Your Highest Returns This Month

Top Oversold Technology Stocks: Opportunities for Value Investors

Stocks in the information technology sector that are currently oversold may offer attractive entry points for investors seeking undervalued opportunities.

The Relative Strength Index (RSI) is a momentum-based tool that evaluates a stock’s performance by comparing gains on up days to losses on down days. When the RSI drops below 30, it often signals that a stock is oversold and could be poised for a short-term rebound. This threshold is widely recognized by market analysts, including those at Benzinga Pro.

Below is a roundup of notable technology companies with RSI readings at or near the oversold level of 30.

Apple Inc (NASDAQ: AAPL)

- According to Goldman Sachs, Apple’s App Store net revenue growth slowed to 5.7% year-over-year in December, down from 6.1% in November. Spending patterns varied across Apple’s key markets. Analyst Michael Ng continues to rate Apple as a Buy, maintaining a $320 price target. Over the last month, Apple’s share price declined by roughly 6%, reaching a 52-week low of $169.21.

- RSI: 25.5

- Recent Price Movement: Apple shares slipped 0.8% to close at $260.35 on Wednesday.

- Edge Stock Ratings: Momentum score of 91.92 and Value score of 93.51.

Hewlett Packard Enterprise Co (NYSE: HPE)

- On December 4, Hewlett Packard Enterprise released mixed results for its fourth quarter and provided first-quarter earnings and sales forecasts that fell short of expectations. CFO Marie Myers highlighted record gross profit, strong non-GAAP operating profit, and free cash flow that surpassed projections. The stock dropped about 6% over the past week and hit a 52-week low of $11.96.

- RSI: 28

- Recent Price Movement: Hewlett Packard Enterprise shares declined 5.7% to close at $22.43 on Wednesday.

- Trend Analysis: Benzinga Pro’s charting tools have identified this downward trend in HPE shares.

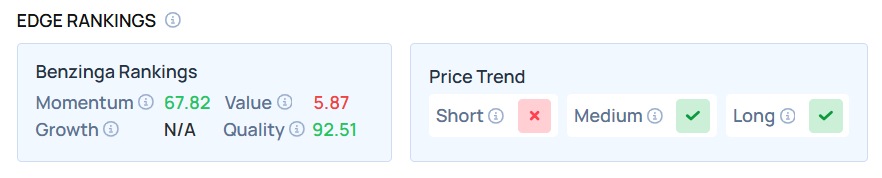

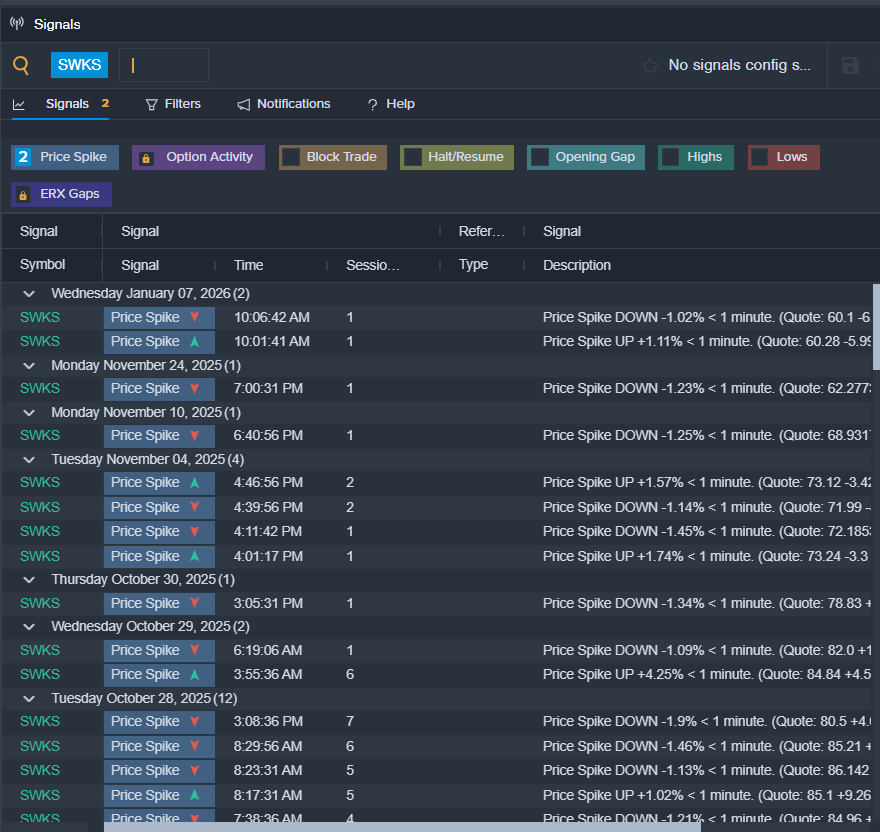

Skyworks Solutions Inc (NASDAQ: SWKS)

- On November 11, Mizuho analyst Vijay Rakesh upgraded Skyworks Solutions from Underperform to Neutral and increased the price target from $65 to $73. The stock has fallen approximately 14% over the past month, reaching a 52-week low of $47.93.

- RSI: 22.2

- Recent Price Movement: Skyworks Solutions shares dropped 9.7% to close at $59.82 on Wednesday.

- Breakout Alert: Benzinga Pro’s signals feature flagged a potential breakout in SWKS shares.

Interested in how other technology stocks compare?

Further Reading

Image credit: Shutterstock

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Large bitcoin investors have accumulated more coins than at any time since the FTX crash in 2022

Trump throws UK automakers into turmoil once again

Cryptocurrency Market Stirs Enthusiasm as Bitcoin Holds Strong

DOJ No-Sell on Samourai Bitcoin, Advisor Says – Kriptoworld.com