Why Shares of Northrop Grumman (NOC) Are Rising Today

Recent Developments

Northrop Grumman (NYSE:NOC), a leader in security and aerospace, saw its stock price climb 3.9% during afternoon trading after President Trump advocated for a substantial boost to the U.S. defense budget.

This surge followed a volatile period for defense stocks. The previous day, shares had dropped sharply when Trump suggested blocking dividends and share buybacks for defense firms. However, his subsequent proposal to raise military spending by over 50% to $1.5 trillion reignited investor interest in the sector. Adding to the momentum, Northrop Grumman secured a $94.3 million contract from the U.S. Navy to develop a new solid rocket motor for extended-range missiles, along with a separate award from the U.S. Marine Corps for a tactical aircraft initiative.

After the initial rally, Northrop Grumman shares settled at $595.72, marking a 3.2% gain from the previous close.

Market Perspective

Historically, Northrop Grumman’s stock has shown limited volatility, with only four instances of price swings exceeding 5% over the past year. This recent movement suggests that investors view the news as significant, though it may not fundamentally alter the market’s outlook on the company.

The most notable fluctuation in the last year occurred nine months ago, when shares plunged 14.6% following disappointing first-quarter 2025 results. Revenue fell short of expectations, and profits missed Wall Street forecasts.

A major factor was a $477 million loss in the company’s B-21 bomber program, driven by increased production costs and higher material prices, which severely impacted margins. Revenue also declined by 7% year-over-year, primarily due to sharp drops in the space and aircraft divisions as legacy programs ended and new projects ramped up slowly. Despite some growth in areas like Mission and Defense Systems, overall earnings per share dropped considerably.

Looking forward, Northrop Grumman maintained its full-year sales and cash flow projections but reduced its profit outlook by over 10%. The company also expressed caution regarding trade tariffs. Meanwhile, competitor Raytheon reported weak results and issued a lackluster forecast, fueling concerns about the defense industry’s resilience amid rising trade tensions.

Stock Performance and Investment Insights

Since the start of the year, Northrop Grumman’s stock has risen 1.7%. At $595.72 per share, it is trading near its 52-week high of $637.95, reached in October 2025. An investor who purchased $1,000 worth of Northrop Grumman shares five years ago would now have an investment valued at $2,066.

Many major companies—such as Microsoft, Alphabet, Coca-Cola, and Monster Beverage—began as lesser-known growth stories that capitalized on major trends. We’ve identified a new opportunity: a profitable AI semiconductor company that has yet to catch Wall Street’s full attention.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

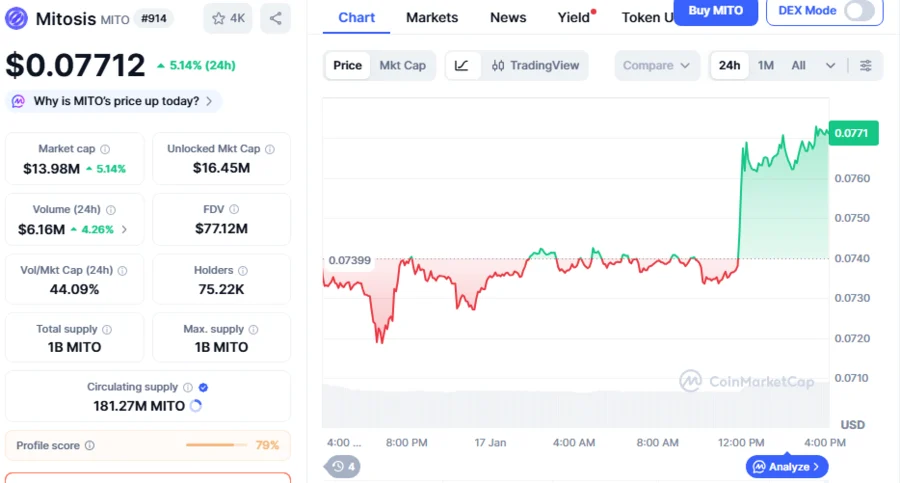

Mitosis Price Flashes a Massive Breakout Hope; Cup-And-Handle Pattern Signals MITO Targeting 50% Rally To $0.115305 Level

Recent financial moves by Trump spark renewed worries about possible conflicts of interest

Why Quant (QNT) Price Is Rising Today: Can It Hit $100 This Weekend?

XRP Price Prediction January 2026: Onchain Signals Elevating XRP Rally Odds