Bank of New York Mellon Expected To Announce Increased Q4 Profits; Top Analysts Update Projections Prior To Earnings Announcement

Bank of New York Mellon Set to Announce Q4 Earnings

Bank of New York Mellon Corporation (NYSE: BK) is scheduled to unveil its fourth-quarter financial results before the market opens on Tuesday, January 13, 2025.

Market analysts are forecasting that the New York-based financial institution will post earnings of $1.98 per share for the quarter, an increase from $1.72 per share reported during the same period last year. Revenue is anticipated to reach $5.14 billion, up from $4.85 billion a year ago, according to data.

On December 8, the bank revealed a partnership with Google Cloud, aiming to enhance its Eliza AI platform through the integration of Gemini Enterprise.

Shares of Bank of New York Mellon closed at $120.45 on Wednesday, reflecting a 0.7% decline.

For those interested in the latest analyst opinions, Benzinga offers an Analyst Stock Ratings page, where you can filter ratings by ticker, company, analyst, and more.

Recent Analyst Ratings for BK

Below are some of the most recent ratings from Benzinga’s top analysts:

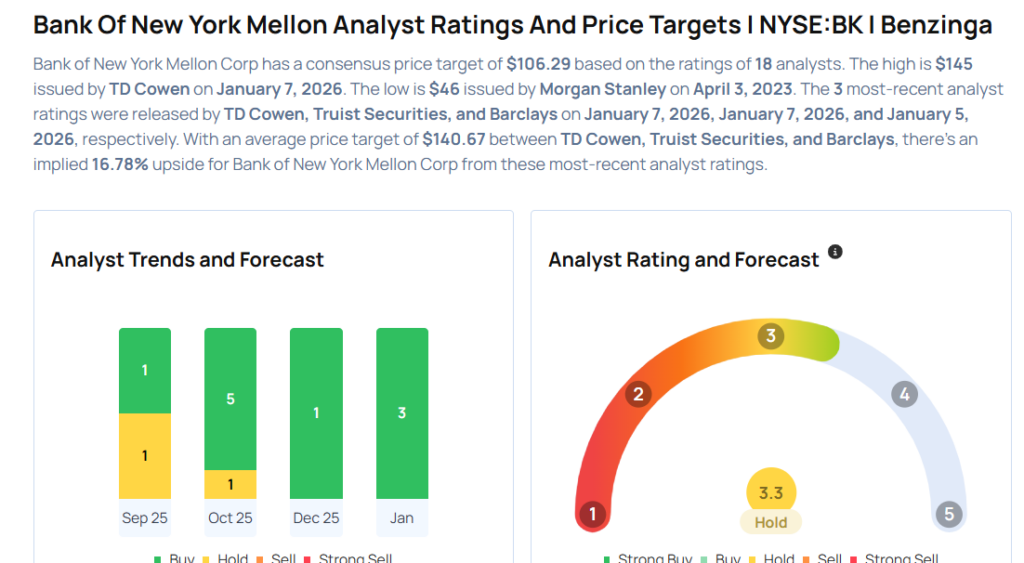

- Steven Alexopoulos of TD Cowen reaffirmed a Buy rating and increased the price target from $133 to $145 on January 7, 2026. His accuracy rate is 69%.

- David Smith at Truist Securities upgraded the stock from Hold to Buy and raised the price target from $119 to $134 on January 7, 2026, with a 79% accuracy rate.

- Jason Goldberg from Barclays maintained an Overweight rating and lifted the price target from $120 to $143 on January 5, 2026. His accuracy stands at 61%.

- Betsy Graseck of Morgan Stanley kept an Overweight rating and moved the price target from $118 to $124 on December 17, 2025, with a 62% accuracy rate.

- Mike Mayo at Wells Fargo maintained an Equal-Weight rating and increased the target from $100 to $109 on October 17, 2025. His accuracy rate is 73%.

Thinking about investing in BK? Here’s a snapshot of current analyst sentiment:

Further Reading

- Top 2 Materials Stocks That May Implode In January

Image credit: Shutterstock

BK Stock Overview

Name: Bank of New York Mellon Corp

Last Price: $120.90

Change: +0.71%

Market News and Data provided by Benzinga APIs

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bessent: Supreme Court reversal of tariffs is improbable, as they are a key element of Trump’s economic agenda

US Strategic Bitcoin Reserve Stalls Amid Interagency Legal Complications

Large bitcoin investors have accumulated more coins than at any time since the FTX crash in 2022

Trump throws UK automakers into turmoil once again