Bitcoin (BTC)’s performance versus the U.S. equity market, particularly the S&P500, shows little change, as market digestion (consolidations) remains across the wider financial markets, according to the latest data reported today by market analyst Daan Crypto Trades.

Today, BTC dropped back to the $90k level after opening strong rally during the first week of 2026 as investors’ new year allocations renewed enthusiasm in the asset and the larger crypto markets. Likewise, the S&P500 market is only up 1% over the past week of the new year as overall market conditions remain cautious.

The comparison between BTC’s performance in relation to the S&P500 market is an important field of study for investors. This highlights how BTC behaves in connection to traditional financial markets, providing insights into diversification and risk management strategies for investment portfolio development.

Uncertain Macro Conditions Restrict BTC, S&P500 Performance

While US equities slumped today, Friday, January 9, Bitcoin’s slide continues as the S&P500 market’s heightened new year rebound took a noticeable downturn, reflecting the 2025 November-December correction momentum, an indicator of investor cautiousness in the larger financial markets. As per the data posted by the analyst, Bitcoin’s versus S&P 500 performance has shown little to no change over the past two months as volatility continued into the 2026’s January trading month.

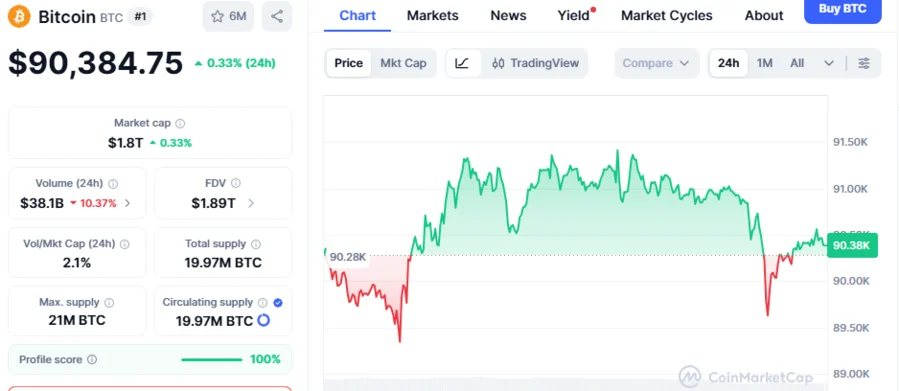

The S&P500 market, which currently hovers at $6,921.46, is up 0.53% today, continues trading in the $6,900-$6,800 level noticed in the December-November period last year. On the other hand, Bitcoin, which currently trades at $90,384, is up 0.2% in the past 24 hours, but declined from the high $94,762 level reached earlier this week. The digital asset is currently trading in the $90k-$86k range experienced in the past two months.

Both Bitcoin and equities are going through market corrections after recent gains as global investors try to gauge macro uncertainty threatened by the US-Venezuela tensions.

The current price of Bitcoin is $90,384.

The current price of Bitcoin is $90,384.

Why Bitcoin Price Is Likely to Further Drop

While yesterday (January 8), Bitcoin dropped below the $90k level, today it trades above the crucial psychological mark after falling from the $94,762 peak reached early this week on Tuesday, January 6. With the bearish reset, some analysts project that the flagship cryptocurrency could be heading towards a further fall, heightened by increased profit-taking activities among investors.

Yesterday, Keith Alan, the co-founder of the trading resources platform Material Indicators, disclosed that the weakening Bitcoin’s rebound momentum could send the token’s price back to the $76,000 level soon. The analyst based his analysis on the current formation of a macro death cross pattern on the BTC’s weekly trading chart, an indicator of potential pullback. Despite the fresh volatility, the analyst believes that the January trading range and market fundamentals remain intact.