Luminar secures a $22 million offer for its lidar division

High-Resolution LiDAR Data from Luminar

Image: Visualization of Luminar’s LiDAR data as a detailed point cloud. | Image Credits: Luminar

Luminar’s LiDAR Division Faces Sale Amid Bankruptcy

Luminar has agreed to sell its lidar division to Quantum Computing Inc. for $22 million, unless a superior bid is received by 5:00 p.m. CT on Monday.

The company, which entered Chapter 11 bankruptcy in December, previously revealed plans to offload its semiconductor arm to Quantum Computing Inc. for $110 million. Both transactions await approval from a bankruptcy judge in the Southern District of Texas before they can proceed.

Founder’s Involvement and Legal Developments

Austin Russell, Luminar’s founder and former CEO, has shown interest in acquiring the lidar assets and had attempted to purchase the entire company last October, prior to the bankruptcy filing. Currently, Luminar is seeking to serve Russell with a subpoena for information on his mobile device as part of an ongoing review into potential legal claims arising from a board-led ethics investigation that prompted his resignation in May. The number of competing bids expected by the Monday deadline remains unclear.

Stalking Horse Bid and Bankruptcy Process

Quantum Computing Inc. has been named the “stalking horse bidder,” setting a minimum price for the assets and discouraging undervalued offers. Luminar aims to expedite the bankruptcy proceedings, with its primary creditors—mainly financial institutions that have lent money in recent years—providing funding for the process.

From Billion-Dollar Valuation to Asset Sale

Even if a higher bid emerges, the current offer marks a dramatic decline from Luminar’s peak valuation of approximately $11 billion in 2021. That lofty market cap was driven by expectations that Luminar’s lidar sensors would be widely adopted by major automakers, such as Volvo, which at one time intended to purchase over a million units before ultimately backing out in 2025. Other partnerships, including those with Mercedes-Benz and Polestar, also unraveled.

Quantum Computing Inc.: A Company’s Evolution

Quantum Computing Inc. began in 2001 as Ticketcart, a business focused on ink-jet cartridge sales, according to filings with the Securities and Exchange Commission. The company later acquired a beverage business in 2007, underwent its own restructuring a decade later, and shifted its focus to optical technology for the emerging quantum computing sector. In 2025, the company raised over $700 million through share sales, but its revenue for the first nine months of the previous year was only $384,000.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana DEX Jupiter Unveils JupUSD, Returning Native Treasury Yield to Users

ChatGPT suddenly announces ads, $8 subscription plan can't avoid them

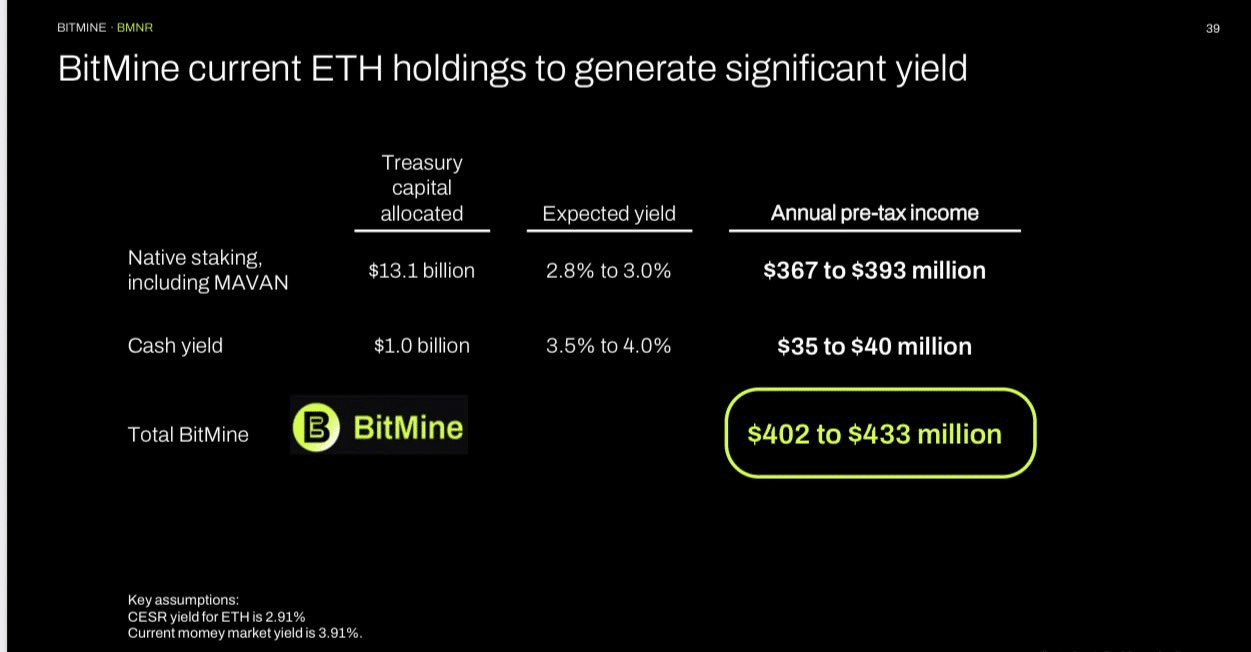

From $3.5K to $12K? Here’s why BMNR’s Ethereum forecast makes sense