Paramount files lawsuit against Warner Bros, initiates indirect battle to derail Netflix agreement

Paramount Skydance Intensifies Bid for Warner Bros Discovery

Paramount Skydance has significantly raised the stakes in its pursuit of Warner Bros Discovery (WBD), announcing plans to nominate new board members, challenge the proposed merger with Netflix, and initiate legal proceedings to demand greater transparency regarding the deal.

This escalation comes after months of disputes among major U.S. media corporations over the future of one of Hollywood’s leading companies. Shareholders are now faced with a choice between Paramount’s fully funded cash offer and Netflix’s more intricate merger proposal.

In a recent statement, Paramount explained, “After WBD declined to discuss our $30 per share cash proposal to acquire the company, we have repeatedly been asked what our next steps will be.”

Paramount maintains that WBD’s unwillingness to negotiate has left the ultimate decision in the hands of shareholders.

The company intends to propose changes to WBD’s bylaws, requiring shareholder approval for any separation of the Global Networks division. This move is designed to ensure that investors have the final say on which offer best serves their interests.

Additionally, Paramount plans to put forward a slate of director candidates at WBD’s 2026 annual meeting and, if necessary, campaign against the approval of the Netflix merger.

Related Articles

These developments have broader implications for both politics and editorial direction. Gaining control of WBD’s Global Networks would give Paramount influence over CNN, raising concerns about the channel’s editorial independence and the potential for increased shareholder involvement in political reporting.

Such worries have grown following recent changes in media governance, such as the appointment of conservative commentator Bari Weiss to lead CBS, a network owned by Paramount.

The Ellison family, who control Paramount Skydance and are known for their public support of President Trump, could further shape news coverage priorities if their bid succeeds.

At the heart of the dispute is the question of value. Paramount argues that its $30-per-share cash offer is clearly superior to Netflix’s proposal, which involves a mix of cash, Netflix stock, and a planned spin-off of WBD’s Global Networks. Paramount claims this alternative introduces risk and ultimately offers less value to shareholders.

To address these concerns, Paramount has filed a lawsuit in Delaware Chancery Court, seeking to force WBD to reveal details about how it valued the Netflix deal, the Global Networks spin-off, and any related debt transfers. Paramount insists that shareholders need this information to make an informed choice.

“WBD investors require full disclosure to properly evaluate our proposal, and Delaware law has consistently upheld the necessity of providing such information to shareholders,” Paramount stated.

This battle also underscores the ongoing competition between traditional studios and streaming platforms. While Netflix has long aimed to consolidate content creation and distribution, Paramount is seeking to expand its scale to remain competitive in the rapidly evolving streaming industry.

Warner Bros Discovery, which owns HBO, CNN, and Warner Bros Studios, is at the center of this contest, valued for its extensive library, popular franchises, and international presence.

Despite the escalating conflict, Paramount has expressed a preference for reaching a negotiated agreement and criticized WBD’s board for not engaging in meaningful discussions before moving forward with what it considers a less favorable deal.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana DEX Jupiter Unveils JupUSD, Returning Native Treasury Yield to Users

ChatGPT suddenly announces ads, $8 subscription plan can't avoid them

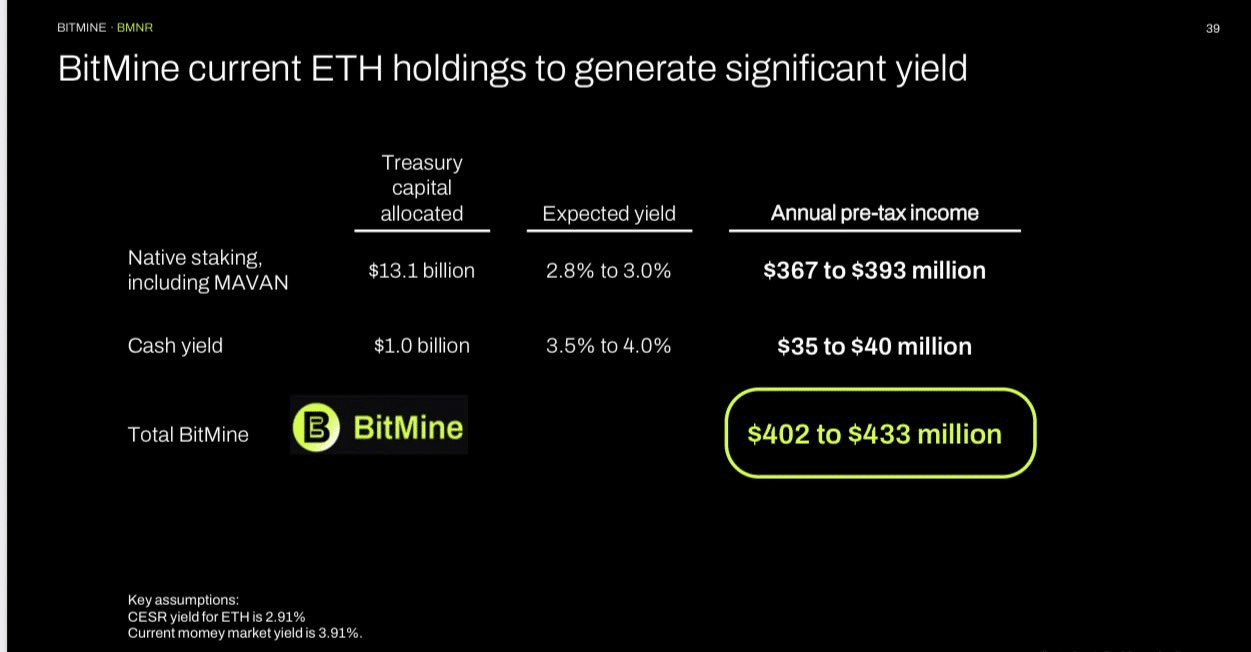

From $3.5K to $12K? Here’s why BMNR’s Ethereum forecast makes sense