BTC Market Pulse: Week 3

Overview

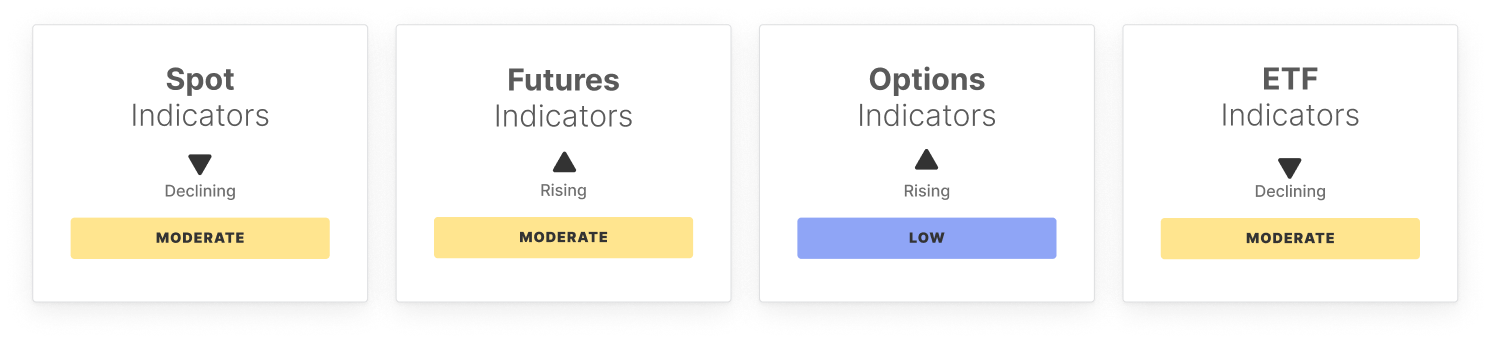

Spot market conditions remain fragile. Trading volume has rebounded modestly from cycle lows, pointing to early signs of liquidity rebuilding, however spot CVD has deteriorated, signalling rising sell-side dominance and a more defensive near-term posture. Derivatives positioning is mixed. Futures open interest has edged higher, reflecting a mild rebuild in speculative engagement, while long-side funding has risen sharply, signalling renewed willingness to pay for bullish exposure. In contrast, perpetual CVD has flipped deeply negative, highlighting elevated sell-side aggression across leveraged markets.

Options markets continue to price elevated uncertainty. Options open interest has risen materially, while the volatility spread has widened well beyond its statistical high band, signalling that implied volatility continues to materially outpace realised levels. The 25-delta skew has also trended higher, reflecting a growing bid for downside protection

US spot ETF netflows have reversed into heavy outflows beyond statistical extremes, signalling pronounced institutional de-risking. Despite this, ETF trading volume has risen, highlighting active re- positioning. ETF holder profitability remains elevated, maintaining an elevated profit-taking risk.

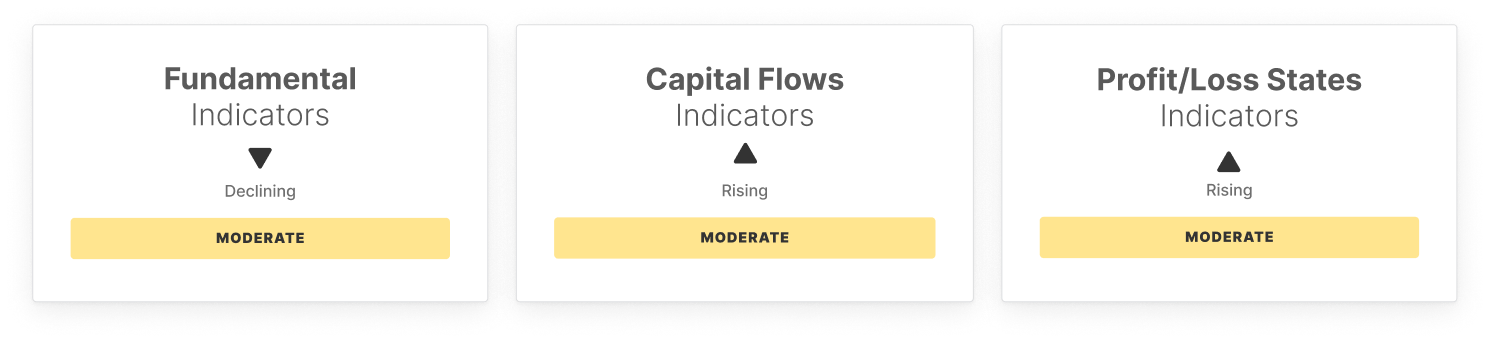

Active addresses have eased modestly, while transfer volume has surged, pointing to heightened capital reallocation. Network fees have drifted toward statistical lows, reflecting a quieter transactional backdrop. Capital flows show early signs of stabilisation, while the share of supply held by short-term participants remains elevated, reinforcing heightened speculative sensitivity.

Overall, the market remains in a fragile consolidation phase. While early signs of engagement rebuilding are emerging, elevated institutional de-risking, defensive options positioning, and persistent speculative sensitivity suggest that renewed spot-led demand remains necessary to re-establish a sustainable upside trend.

On-Chain Indicators

Don't miss it!

Smart market intelligence, straight to your inbox.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Jensen Huang predicts ‘God AI’ to come in the future

Is This Development Hindering the Upward Trend in the Cryptocurrency Market? Galaxy Digital Analyst Speaks Out

South Korea plans talks with US to exempt Samsung, SK Hynix from Trump’s 25% chip tariffs

Ethereum : Buterin reveals major upcoming reforms