Research Report|In-Depth Analysis and Market Cap of Fogo (FOGO)

Bitget2026/01/13 06:19

By:Bitget

I. Project Overview

Fogo is a high-performance Layer 1 blockchain focused on real-world asset (RWA) tokenization, decentralized physical infrastructure networks (DePIN), and institutional-grade applications. It aims to break through existing blockchain limitations in speed, cost, and compatibility. By optimizing network latency and validator performance, Fogo reduces block time to under 40 milliseconds.

The project adopts the Solana Virtual Machine (SVM) execution environment, fully compatible with Solana programs and ecosystem tooling, and integrates the Firedancer validator client to significantly enhance system throughput through parallel processing and zero-copy data streams.

Its unique Validator Zones mechanism partitions validators by geography and optimizes their layout along the path of the sun’s movement, effectively reducing on-chain latency. The consensus design combines Tower BFT with the Proof of History (PoH) clock to ensure efficient finality.

Fogo implements the Sessions standard, granting users controllable temporary permissions to enable gasless, seamless Web3 interactions.

The total supply of the $FOGO token is 1 billion. Allocation includes Community 15.25% (6% airdrop, 9.25% incentives), Ecosystem Development 35%, Team & Foundation and Validator Incentives, among others. Inflation is fixed at 2%, with rewards distributed to validators and delegators via a points mechanism. The token supports governance, incentives, revenue sharing, and deflationary burns.

Fogo emphasizes a community-first approach, replacing presales with airdrops to strengthen community distribution and a sustainable deflationary model. Regionalization and standardized performance further improve high-frequency settlement capabilities.

Mainnet is scheduled to launch on January 13, 2026. The airdrop snapshot has been completed, and the testnet phase has demonstrated exceptional speed.

II. Project Highlights

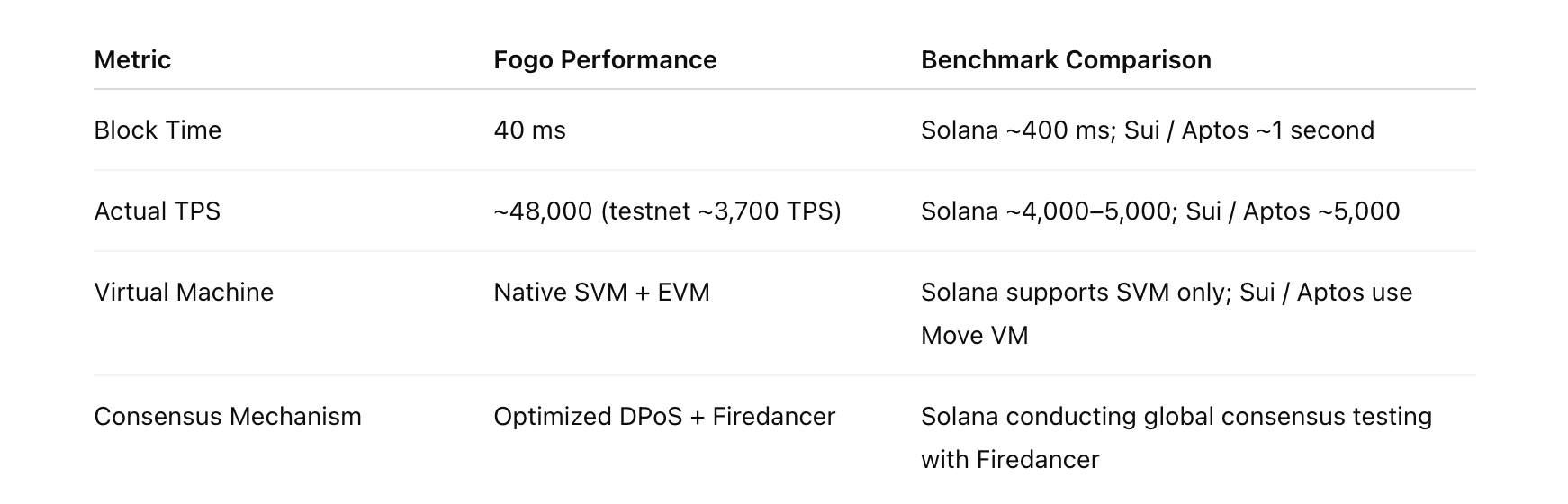

Institutional-grade “Lightning Chain” experience: Positioned as a high-performance Layer 1, Fogo bridges the speed of centralized exchanges with the fairness and composability of DeFi, targeting professional traders and institutions. Its tech stack achieves ~40ms block confirmation and sub-second finality, delivering a smooth experience for high-frequency trading and asset settlement. According to Chainspect’s December 2025 rankings, Fogo ranks first in transaction speed, surpassing Solana, Sui, Aptos, and other major high-performance chains.

SVM compatibility and physical-layer innovation: Fogo is fully compatible with the Solana Virtual Machine (SVM), enabling seamless migration from the Solana ecosystem. At the base layer, it uses the Frankendancer client and a proprietary tile architecture that maps functional components to dedicated CPU cores. Combined with zero-copy data streams and kernel-bypass networking, this design substantially improves execution throughput and determinism, eliminating validator performance bottlenecks at the physical layer.

Reinvented interaction experience: The Fogo Sessions standard introduces Web2-level UX to Web3 applications by allowing a single signature to authorize time-bound, scope-limited permissions. This truly enables gasless, frictionless interactions, addressing signature fatigue and wallet compatibility issues, and establishing a new paradigm for DeFi, gaming, and mobile-first applications.

III. Market Cap Outlook

Funding and valuation benchmarks

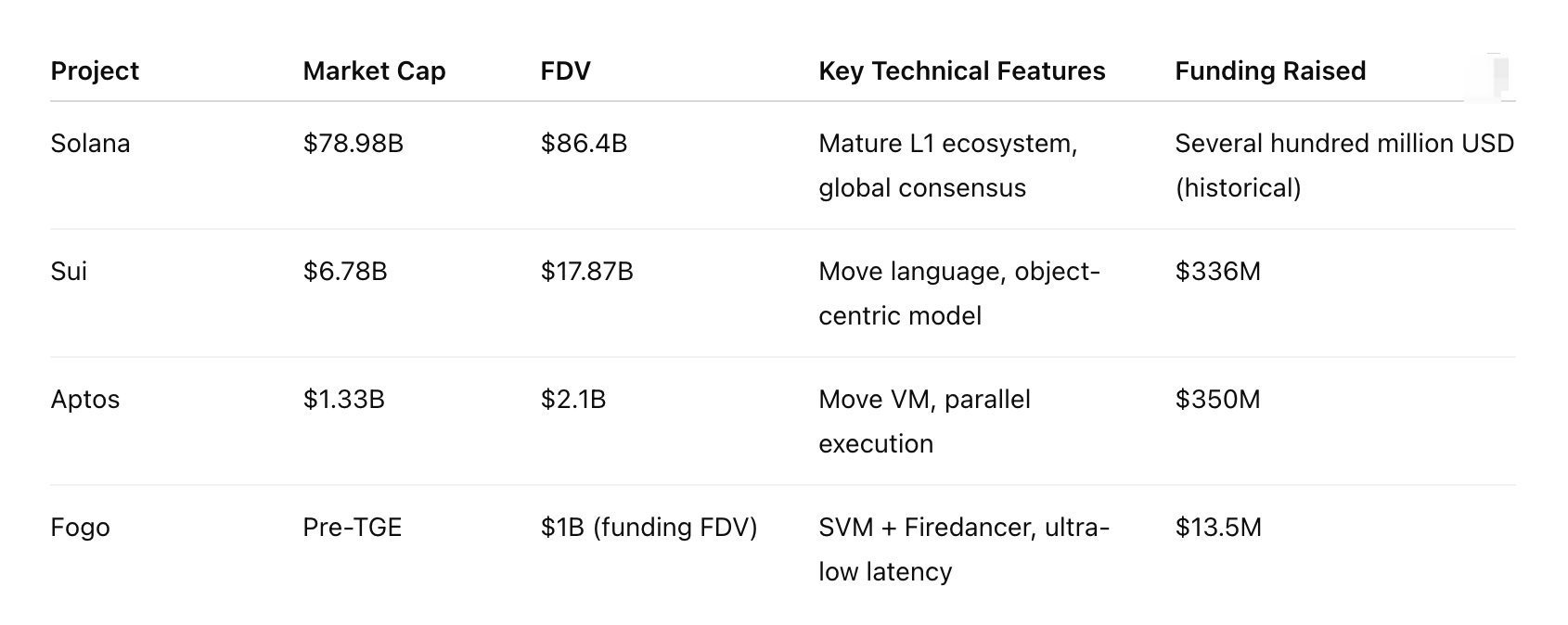

Fogo raised a total of USD 13.5 million across two rounds, priced at a USD 100 million FDV (fully diluted valuation):

-Seed Round (January 2025): USD 5.5 million, led by Distributed Global (USD 5.0m) and CMS Holdings (USD 0.5m)

-Echo Public Sale (January 24, 2025): USD 8.0 million, with Echonomist (Cobie-led USD 6.0m), CMS Holdings 4 Ventures (USD 1.0m), Big Brain Collective (Larry Cermak-led USD 0.5m), Patrons (Kain Warwick-led USD 0.5m), and over 3,000 angel investors

Market views on $FOGO’s post-TGE valuation diverge:

-Bearish view: FDV may struggle to exceed USD 700 million due to 39% of tokens unlocked at TGE, only six native protocols, a crowded SVM landscape, and declining mindshare.

-Bullish view: Based on comparable SVM L1 projects such as Eclipse and Soon (USD 340–443 million FDV on TGE day), Fogo’s technical edge (speed/latency), early engagement (points/NFTs/games), and exchange backing support a conservative FDV estimate of USD 200–500 million, implying a market cap of ~USD 80–200 million at 39% circulation.

Using Sui’s FDV/MC ratio of 2.63x and broader emerging L1 performance as reference, Fogo’s FDV could reach USD 500 million–1 billion within 6–12 months post-TGE if ecosystem development progresses smoothly.

IV. Token Economics

Initial total supply: 10 billion $FOGO. TGE circulation: 40.98% (primarily from Foundation Reserve, Community allocations, Launch Liability, and Burns). Allocation breakdown:

-Community Ownership: 18.25% total (9.25% locked, 9.00% unlocked). Notes: Echo, Sale, Airdrop (community incentives, airdrops, and sales)

-Launch Liability: 5.40% total (0.00% locked, 5.40% unlocked). Notes: DEXs and CEXs liquidity provision

-Foundation Reserve: 24.58% total (0.00% locked, 24.58% unlocked). Notes: future growth, staking

-Institutional Investors: 8.77% total (8.77% locked, 0.00% unlocked). No additional notes

-Core Contributors: 34.00% total (34.00% locked, 0.00% unlocked). No additional notes

-Advisors: 7.00% total (7.00% locked, 0.00% unlocked). No additional notes

-Burned: 2.00% total (0.00% locked, 2.00% unlocked). Notes: non-circulating, burnt on-chain

Token utilities

-Staking (independent rewards, lock-ups)

-Participation in high-quality liquidity pools and innovative financial products

-Protocol governance weighting and treasury allocation

-Pricing power for cross-chain communication and institutional applications

-Gas payments, liquidity mining participation, and partnership incentives

-Base medium of exchange and application enablement for the network

V. Team & Funding Background

Douglas Colkitt (Co-founder): Founder of Crocodile Labs and creator of the decentralized exchange Ambient Finance (formerly CrocSwap), with deep experience in on-chain market structure and high-performance trading systems.

Robert Sagurton (Co-founder): Former Global Head of Digital Asset Sales at Jump Crypto (5+ years). Previously held roles at R3, JPMorgan, State Street, and Morgan Stanley. His traditional finance and institutional market background supports institutional-grade product design and deployment.

The project completed two funding rounds in January 2025, raising a total of USD 13.5 million at a consistent valuation of USD 100 million FDV. Funds will primarily be used for team expansion, enhancement of core technical capabilities, and ecosystem incentives and development to accelerate network growth and developer adoption.

-Seed Round (January 2025): USD 5.5 million at USD 100 million FDV, led by Distributed Global with participation from CMS Holdings

-Echo Public Sale (January 24, 2025): USD 8.0 million at USD 100 million FDV, led by Echonomist (Cobie), with participation from CMS Holdings, 4 Ventures, Big Brain Collective (Larry Cermak), Patrons (Kain Warwick), and 3,000+ angel investors

VI. Potential Risks

Fundamental risks

-Unproven technology: Reliance on a “pure-form” Firedancer client and multi-local consensus has yet to undergo large-scale mainnet stress testing. The globally curated validator architecture may face regional latency and congestion challenges.

-Intense L1 competition: Direct competitors include Solana, which has a mature ecosystem and strong developer lock-in, as well as high-TPS chains such as Sui and Aptos with established market positions.

-Crowded SVM landscape: Eclipse, Soon, and other SVM L1s compete for attention, while only six native protocols indicate an early-stage ecosystem.

-Team controversy: On January 5, 2026, Twitter users alleged that co-founder Robert Sagurton was “isolated” due to an “exposé video” (@chooserich, etc.). Although unverified, this may impact short-term reputation.

Token sell-pressure risk

40.98% of tokens unlock at TGE, creating potential sell pressure in secondary markets.

VII. Official Links

Website:

https://www.fogo.io/ X:

https://x.com/fogo

Disclaimer: This report is generated by AI and does not constitute any investment advice.

0

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Earn new token airdrops

Lock your assets and earn 10%+ APR

Lock now!

You may also like

US Strategic Bitcoin Reserve Stalls Amid Interagency Legal Complications

BTCPeers•2026/01/18 20:00

Large bitcoin investors have accumulated more coins than at any time since the FTX crash in 2022

101 finance•2026/01/18 19:06

Trump throws UK automakers into turmoil once again

101 finance•2026/01/18 19:06

Cryptocurrency Market Stirs Enthusiasm as Bitcoin Holds Strong

Cointurk•2026/01/18 18:54

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$95,334.56

+0.08%

Ethereum

ETH

$3,344.92

+0.90%

Tether USDt

USDT

$0.9997

+0.00%

BNB

BNB

$949.38

-0.25%

XRP

XRP

$2.05

-0.99%

Solana

SOL

$142.19

-1.41%

USDC

USDC

$0.9998

+0.00%

TRON

TRX

$0.3188

+0.78%

Dogecoin

DOGE

$0.1370

-1.17%

Cardano

ADA

$0.3923

-1.88%

How to buy BTC

Bitget lists BTC – Buy or sell BTC quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now