News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

MOODENG ETH (MOODENGETH): The Meme Coin with a Heart for Charity and Security

What is MOODENG ETH (MOODENGETH)? MOODENG ETH (MOODENGETH) is a meme coin that is inspired by a real, small, and adorable pygmy hippo in Thailand named Moodeng, who has captured the hearts of many. Like other meme coins, MOODENG ETH started as a lighthearted project, but it has grown to mean much m

Bitget Academy·2024/10/14 09:23

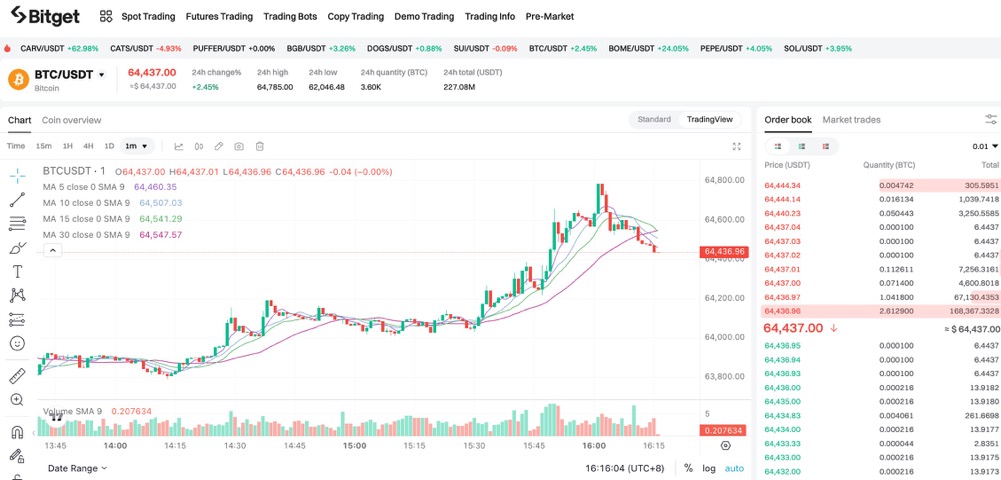

Daily BTC Market Briefing | Explore the Future of Crypto and Seize Market Opportunities

3Friends·2024/10/14 08:24

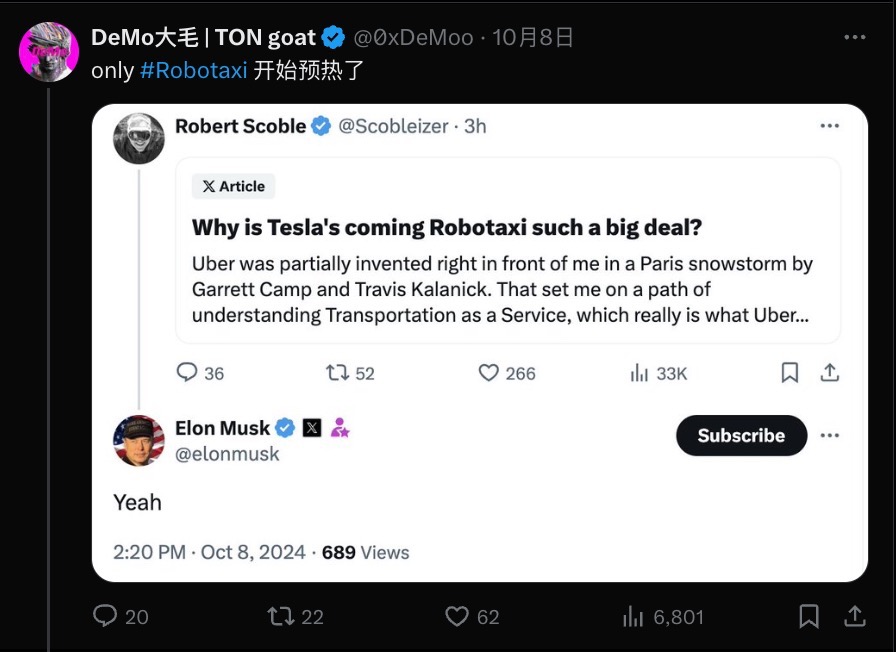

Today's Must-Read | Twitter Highlighted Perspectives

Renata·2024/10/12 07:12

Today's Must-Read | Twitter Highlighted Perspectives

Renata·2024/10/09 09:22

What do we need to know about EigenLayer ($EIGEN) 137SPS027

137 Labs·2024/10/09 08:21

Daily BTC Market Briefing | Explore the Future of Crypto and Seize Market Opportunities

3Friends·2024/10/09 06:09

Flash

12:09

Alchemy Pay obtains MTL license in Nebraska, expanding its compliance coverage to 14 states in the USAccording to Odaily, crypto payment company Alchemy Pay has officially obtained the Money Transmitter License (MTL) in the state of Nebraska, USA, marking further progress in its compliance process. With this, the company now holds relevant business licenses in 14 states across the US, including Arkansas, Iowa, Minnesota, New Hampshire, New Mexico, Oklahoma, Oregon, Wyoming, Arizona, South Carolina, Kansas, West Virginia, and South Dakota. (PRNewswire)

11:51

Data: In 2025, stablecoins on Ethereum are expected to generate approximately $5 billion in revenue, with the supply increasing by about $50 billion.BlockBeats News, January 25, Token Terminal released data showing that in 2025, stablecoin issuers will earn approximately $5 billion in revenue by deploying stablecoins on Ethereum. Throughout 2025, the supply of stablecoins on Ethereum will increase by about $50 billion, with the total scale exceeding $180 billion by the fourth quarter. Issuers' revenues will also grow accordingly, reaching around $1.4 billion in quarterly income in the fourth quarter. Part of the revenue comes from the yield generated by reserve assets backing the stablecoin supply, and Ethereum has always been the largest supply carrier for most major stablecoin issuers.

11:49

Sanae Takashi's tough stance causes a short squeeze on yen traders. due to Japanese Prime Minister Sanae Takaichi issuing a warning about abnormal exchange rate fluctuations, traders will be on high at the beginning of this week to guard against Japanese government intervention aimed at stopping the recent decline of the yen — this action may even receive rare assistance from the United States. Michael Brown, Senior Research Strategist at Pepperstone Group, stated: "Exchange rate checks are usually the last warning before intervention actions are taken. The Takaichi administration's tolerance for foreign exchange speculation appears to be much lower than that of its predecessor." Reports about exchange rate checks may deter the market from further shorting the yen, thereby squeezing yen short positions that have reached their largest increase in more than a decade. In the last few trading hours of last week, the yen experienced sharp fluctuations, reversing from a downward trend toward 2024 lows, surging 1.75% against the dollar to 155.63 at one point, marking the largest single-day gain since August last year. Nick, Chief Analyst at AT Global Markets, pointed out that if the United States participates in the potential exchange rate check, its impact would not be limited to the yen but could also affect global markets.

News