News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

If Trump returns to the White House, could Bitcoin reach new highs

Bernstein analysts highlighted in their latest report that the US presidential election is likely to shape the future of the cryptocurrency world!

Jin10·2024/09/10 06:49

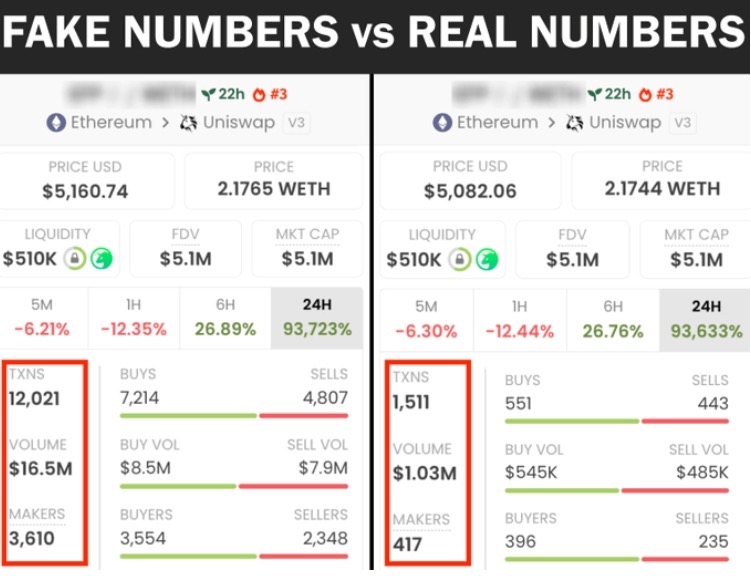

Without understanding this, you will lose all your money in cryptocurrency: Unveiling token manipulation on Dexscreener

BTC_Chopsticks·2024/09/09 10:32

Will the interest rate cut in September be 25 basis points or 50 How is the after-market

TVBee·2024/09/09 03:23

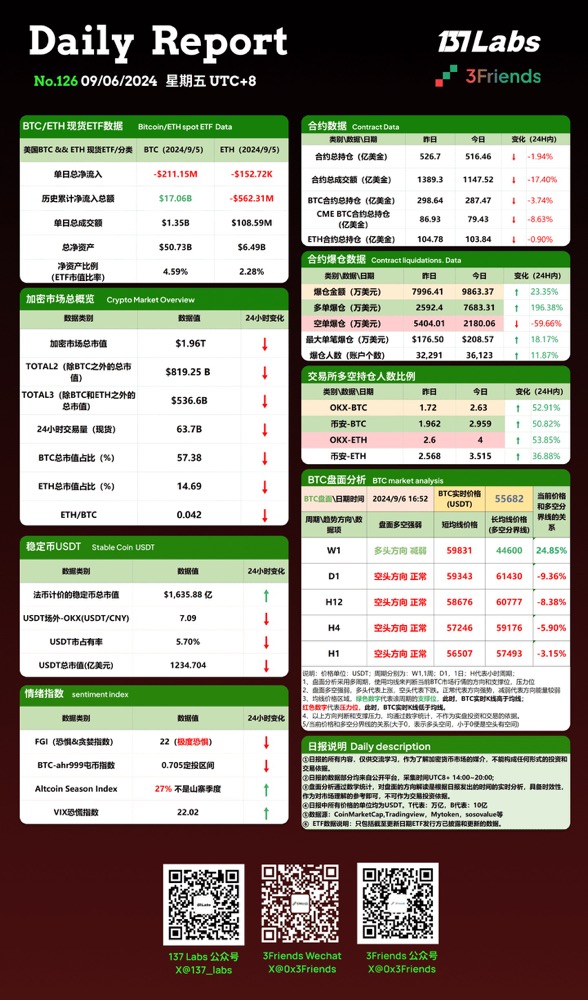

Daily BTC Market Briefing | Explore the Future of Crypto and Seize Market Opportunities

3Friends·2024/09/06 10:37

US job vacancies hit a three-year low in July as Bitcoin and US stocks rose

Bitget·2024/09/04 15:52

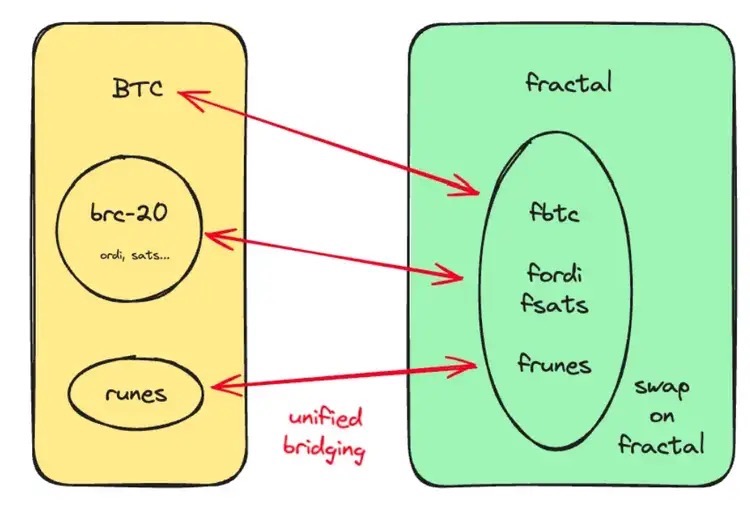

Can fractal Bitcoin overcome the computational power limitations of the Bitcoin chain

TechFlame·2024/09/04 10:12

Understand the intention behind Polygon $MATIC rebranding to $POL in an article

137 Lab·2024/09/04 06:13

Flash

04:34

White House Crypto Committee Head Says Passing Crypto Framework Bill Is Only a Matter of TimePatrick Witt, head of the White House Crypto Committee, stated on the X platform that the latest draft of the crypto market structure bill released by the U.S. Senate Agriculture Committee is a high-quality bipartisan achievement, with over 80% similarity to the House CLARITY Act text. The draft has received support from the majority of Democrats on the Agriculture Committee and nearly 40% support among House Democrats. Patrick Witt emphasized that, under the regulatory environment shaped by Trump and crypto advocates, the passage of crypto market structure legislation is only a matter of time. If the current window is missed, the future may face a stricter regulatory framework.

04:34

A trader shorted silver with a unrealized loss of over $2 million, with a liquidation price of $112.79.BlockBeats News, January 23rd, according to HyperInsight monitoring, a trader (0x61cee) went short with 20x leverage on 226,100 xyz:SILVER (pegged to the silver price), with an average entry price of $89.72, currently unrealized loss of $2.026 million, and a liquidation price of $112.79.

04:32

glassnode: Bitcoin Fails to Break Through, Market Awaits Catalyst for Trend ReversalBlockBeats News, January 23, glassnode released its weekly report stating that Bitcoin remains in a state of low participation, with price movements driven more by a lack of pressure than by active trading willingness. On-chain data continues to reflect an oversupply and fragile structural support, and although spot capital flows have improved, they have yet to translate into sustained accumulation. Institutional and corporate demand remains cautious, treasury company capital flows are stabilizing, and trading activity is concentrated in sporadic transactions. Derivatives participation remains sluggish, futures trading volume is shrinking, and leverage usage is relatively moderate, further exacerbating the illiquid market environment, making prices increasingly sensitive to minor position changes. Overall, the market seems to be quietly building a bottom, but this consolidation is not due to excessive participation or enthusiasm, but rather because investor confidence has paused, with everyone waiting for the next clear catalyst to reignite broader market participation and momentum.

News