News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Is Visa Inc. (V) The Best Financial Services Company?

Finviz·2026/02/26 02:15

From Breakdown To Bottoming? Ethereum Tests Key High-Timeframe Support

Newsbtc·2026/02/26 02:15

VICI Properties (VICI) Q4 Earnings: Taking a Look at Key Metrics Versus Estimates

Finviz·2026/02/26 02:03

WTW appoints Han Wei Fong as new Country Leader for Singapore

Finviz·2026/02/26 02:03

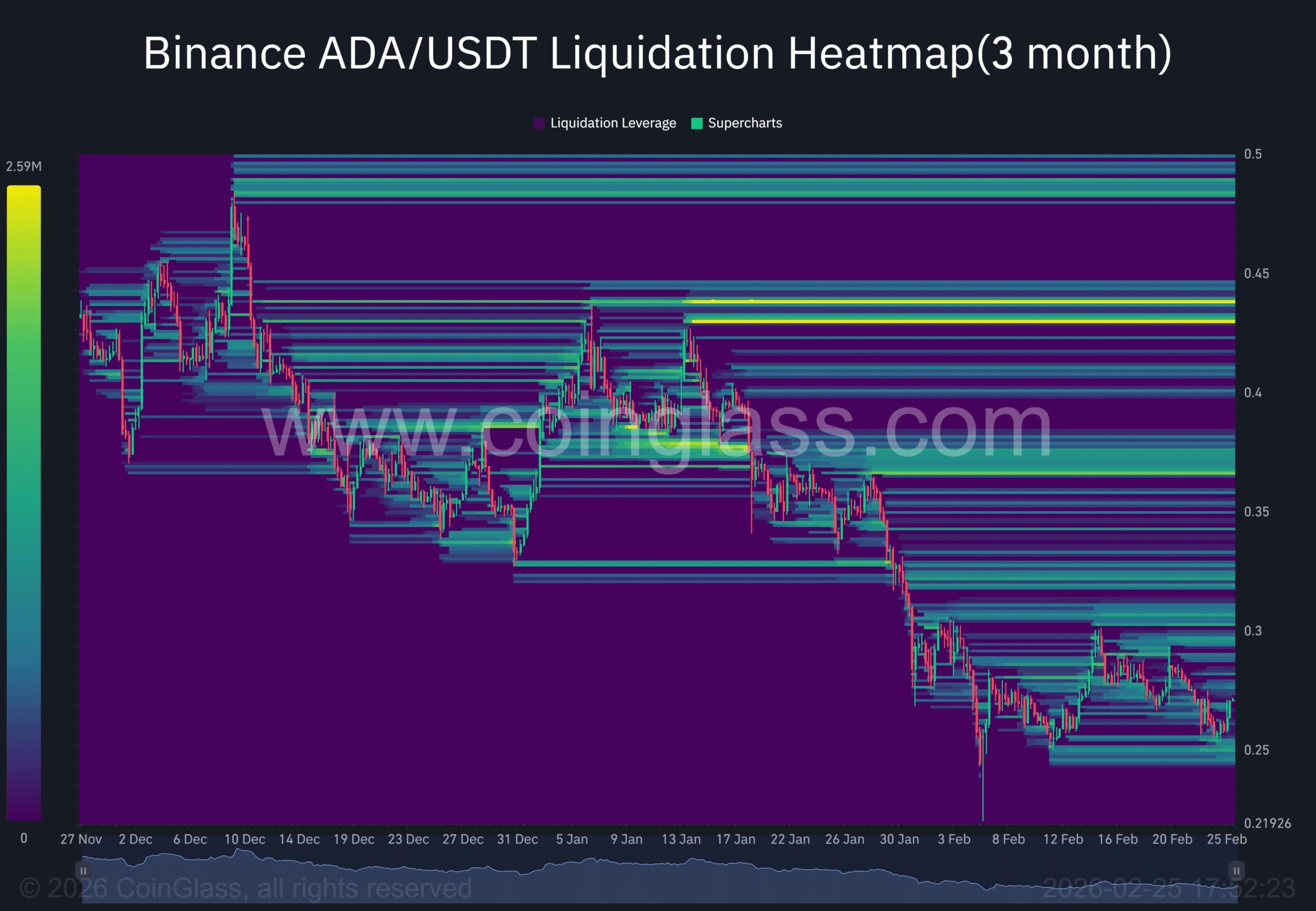

Here’s how Cardano whales may be shaping ADA’s price action

AMBCrypto·2026/02/26 02:03

The Dalilah Law may trigger a significant surge in trucking rates

101 finance·2026/02/26 02:00

Westlake Rises 5.09% Amid Bearish Technical Signals

101 finance·2026/02/26 01:57

Bitcoin’s Rapid Recovery Fuels Optimism but Uncertainty Lingers in Crypto Markets

Cointurk·2026/02/26 01:54

「Crypto Buddy」 Finally Sees Profit, Adds to Ethereum Long Position Again This Morning

BlockBeats·2026/02/26 01:48

Flash

06:59

Goldman Sachs: Oil prices have already priced in a $5-6 per barrel Iran risk premium, expected to fall to $60 in Q4Goldman Sachs stated in a report on February 25 that oil prices already include a risk premium of $5 to $6 per barrel due to the possibility of a U.S. attack on Iran. Analysts, including Yulia Grisby, pointed out that this premium, combined with declining inventories at major global pricing centers, has kept Brent crude prices just above the $70 level. The report shows that Iran's crude oil loadings have risen to their highest level since 2018, and offshore Iranian crude inventories for sale have reached a record high. Global visible inventories decreased by an average of 500,000 barrels per day last week, with a daily average decline of 300,000 barrels so far this month. Meanwhile, Russian oil production is also under pressure from Ukrainian attacks. Goldman Sachs also mentioned that several new projects in Saudi Arabia, Brazil, Nigeria, Uganda, and the United States will come online this year, including the Jafurah oil and gas field in Saudi Arabia, which started production in December last year, and the Zuluf oil field, which will begin production this year. The bank reiterated its forecast: Brent crude prices will fall to $60 per barrel in the fourth quarter of this year.

06:52

Address 0x2BD's holdings have increased to 25,434.5 ETH, with a total value of approximately $52.45 million.According to monitoring by Onchain Lens, address 0x2BD exchanged 240.44 BTC (approximately $15.7 million) for 8,152 ETH via ThorChain yesterday at an exchange rate of 0.02945. Today, the ETH was deposited into Aave as collateral, and approximately $36 million USDT was borrowed in a loop, which was then used to purchase 17,283 ETH at a price of $2,083. Currently, this address holds 25,434.5 ETH, with a total value of approximately $52.45 million.

06:51

A whale address swapped 240.44 BTC for Ethereum via ThorChain, then used Aave lending to purchase more Ethereum.ChainCatcher News, according to monitoring by Onchain Lens, a whale address exchanged 240.44 bitcoin (approximately $15.7 million) for 8,152 ethereum, with an exchange rate of 0.02945.