First Mover Asia: Bitcoin Crosses $31K After Spot BTC ETF Issuers Begin Refiling

PLUS: The first half of 2023 has so far been very promising for the crypto majors.

Good morning. Here’s what’s happening:

Prices: The market is optimistic that re-filed bitcoin ETF applications have legs.

Insights: Crypto majors are up in a big way during the first half of 2023 as the market repairs the damage from last year's catastrophes.

Bitcoin Crosses $31K After Bitcoin ETF Issuers Begin Refiling

Happy Fourth of July.

While many parts of the U.S. are off for an extended long weekend, market action has been tame.

Bitcoin began the Tuesday business day in Asia past the $31,000 mark at $31,153 as the after a few prospective bitcoin ETF issuers re-filed their applications.

“Enthusiasm for bitcoin is growing, propelled by efforts to revive spot bitcoin ETF applications,” Rachel Lin, CEO and co-founder of SynFutures, told CoinDesk in a note. “Its commanding presence in the crypto market is increasingly evident, making up nearly half of the industry's $1.2 trillion market cap, the most dominant it's been in over two years.”

The (CMI) is up 18 points to 1,318.

Meanwhile, prices of NFTs seem to be becoming disconnected from the price of ether as .

The Bored Ape Yacht Club's NFT collection since October 2021 with a floor price dropping below 30 ETH ($58,700), an effective halving since April, reflecting a broader slump in the NFT market. But considering ether’s continued performance, there seems to be more confidence in the protocol than this use case.

Last year was a rough year for crypto, a saga that began with rising interest rates, and continued through the year with the crash of Do Kwon’s LUNA, Three Arrows Capital’s collapse, and finally, FTX.

Data from Messari shows that 2023 has fared much better.

During the first half of the year, crypto majors – meaning the 43 tokens with a market cap of over $1 billion – were up an average of 34%. In comparison, this same group of tokens declined an average of 56% for the same period last year.

So far this year, bitcoin is up 84.6% compared to a falloff of nearly 60% for the first half of 2022.

But of all the major assets, Bitcoin Cash (BCH) performed the best, up a whopping 203% so far this year. , technical improvements to the protocol and the introduction of a framework that would allow for the development of dApps has likely pushed up investor interest in the asset class.

Other stand-out performers for the period include liquid staking platform Lido DAO (LDO), which rallied in February on comments from U.S. Securities and Exchange Commission (SEC) chair Gary Gensler’s and then on the .

Solana is also up 93% during the first half of the year, raising prospects for the layer-1 protocol, whose total value soared at the height of the 2021 bull market but then plummeted with the rest of crypto during 2022’s dark days.

12:30 p.m. HKT/SGT(4:30 a.m. UTC):

In case you missed it, here is the most recent episode of on :

Architect CEO and former FTX US president Brett Harrison joined "First Mover" to discuss the recent flurry of spot bitcoin ETF applications in the U.S. and his outlook on the intersection of artificial intelligence with financial services. Plus, Coinbase Institutional head of research David Duong shared his crypto markets outlook for July. And, Superstate CEO Robert Leshner discussed plans to create a short-term government bond fund using the Ethereum blockchain as a secondary record-keeping tool.

The hedge fund that filed for bankruptcy last year has been roasted by victims and crypto-industry observers in the wake of its epic collapse, but one partner, Kyle Davies, says "karma" motivates the founders to give back.

Refiled application by Nasdaq to list a BlackRock bitcoin ETF follows a report last week that the SEC deemed earlier proposals "inadequate" since they didn't specify the name of the underlying market in so-called surveillance-sharing agreements.

Central bankers acknowledge that the nature of money evolves with technology, shifting definitions of money with it. But they’re not ready to let innovation occur organically as technology emerges. They want to maintain control.

The floor price of the Yuga Labs NFT collection fell to 27.4 ETH, or about $53,000, on Sunday evening before rebounding slightly.

Edited by James Rubin.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Weekly Highlights Propel Cryptocurrency Trends

Google search traffic to news sites plunges by one-third globally

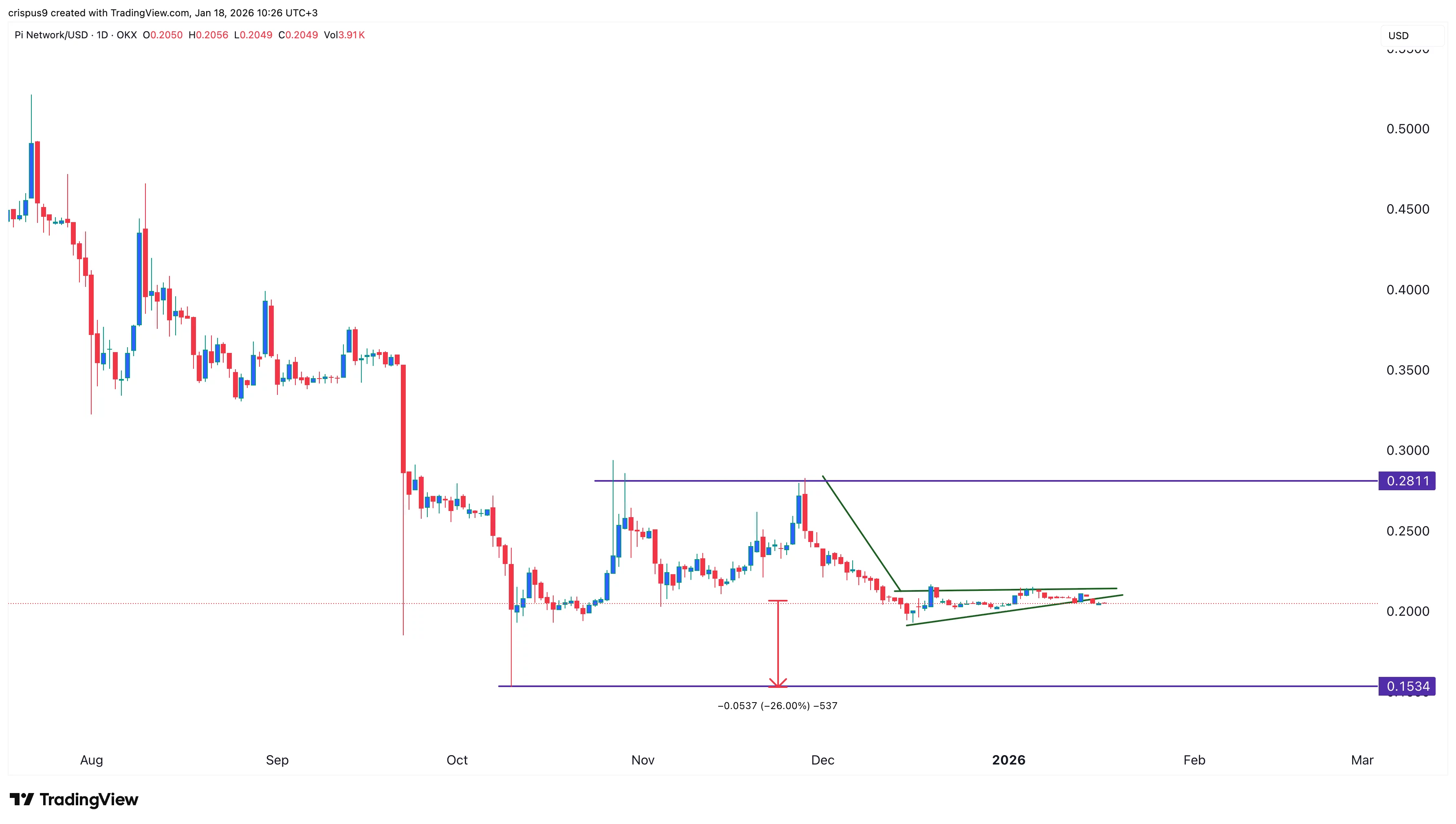

Pi Network price remains calm: will it rebound or crash?

Outrageous levels of student debt are putting immense pressure on the UK’s economy