MakerDAO’s MKR Soars 28% in a Week as Token Buyback Scheme Goes Live

The lending platform is on track to remove some $7 million of MKR governance tokens from the market in the next month, according to blockchain data.

Maker (), the governance token of $5.3 billion decentralized finance () lender MakerDAO, surged to near a one-year high price Friday following the introduction of a token buyback program.

MKR briefly rose above $1,200 early Friday for the first time since last August, then pared some of its gains to change hands at around $1,148. The token is up 28% over the past week, significantly outperforming the 4.6% decline of the , which tracks the broader crypto market’s performance.

The price action occurred as the lending protocol activated a token buyback scheme on Wednesday, removing MKR supply from the market. The so-called Smart Burn Engine periodically allocates excess DAI stablecoins from Maker’s surplus buffer to purchase MKR from a UniSwap pool, a explains.

The program was earlier this month, and it went live Wednesday once the surplus buffer exceeded $50 million.

In the last 24 hours, the protocol bought back some $230,000 worth of MKR, according to by Etherscan. At this pace, the protocol is on track to purchase about $7 million in tokens in the next month.

The token’s total market capitalization is about $1 billion, so the buyback would reduce 0.7% of the supply per month at curren t prices.

is one of the largest and oldest DeFi lending protocols, and also issues the $4.6 billion stablecoin. It is led by a decentralized autonomous organization (), in which MKR holders vote on governance proposals.

The protocol has been DAI’s reserve assets in traditional investment products such as bank loans and government bonds to earn revenue from yields. MakerDAO also is undergoing a that includes upgrading the DAI and MKR tokens, and breaking up its structure into smaller, autonomous organizations called SubDAOs that could issue their own tokens.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

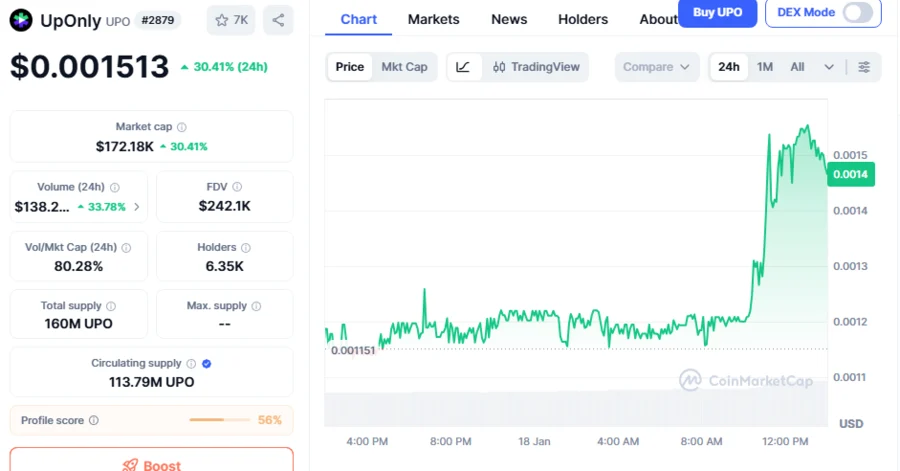

UPO Climbs Above $0.001500, Sets to Explode Amid Incoming Mega Pump, Whale Accumulation: Analyst

Ethereum staking just hit a $118B record at 30% of all coins, but one whale might be skewing the signal

Bullish Analyst Tom Lee Says, ‘Ethereum Will Outperform Bitcoin,’ Explains His Expectations