LogX Tokenomics: $LOGX Token Introduction

Announcing $LOGX: The Native Token of LogX Network

The LogX Foundation is proud to unveil $LOGX, the native governance and gas fee token of LogX Network, marking a significant advancement in growing a fully community-driven protocol. The $LOGX governance token is set to play a pivotal role in empowering LogX users and contributors to impact decision-making processes and guide the future direction of the LogX ecosystem.

Why Now?

LogX V1 launched in August 2023. Since then, LogX has grown to become the most omnipresent perp DEX live across 17 EVM networks. LogX V1 has crossed a cumulative trading volume of $20+ billion. We thank the 1.2M+ users who have used the LogX Platform for trading derivatives.

Building on a solid foundation established over the past one year, our ambitions started evolving LogX into a suite of consumer use cases beyond the perp DEX. LogX Network, set out to unlock the next phase of growth, will bring exotic perps, leveraged prediction markets, and much more to the DeFi market.

$LOGX is the native governance and gas fee token of the LogX Network. With the launch of the upcoming LogX Network main-net, $LOGX will drive the future of the protocol.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Genius Terminal Hits Record $650M Single-Day Volume as EVM Chains Drive Surge

SUI Weathers Extended Shutdown with Minimal Price Impact

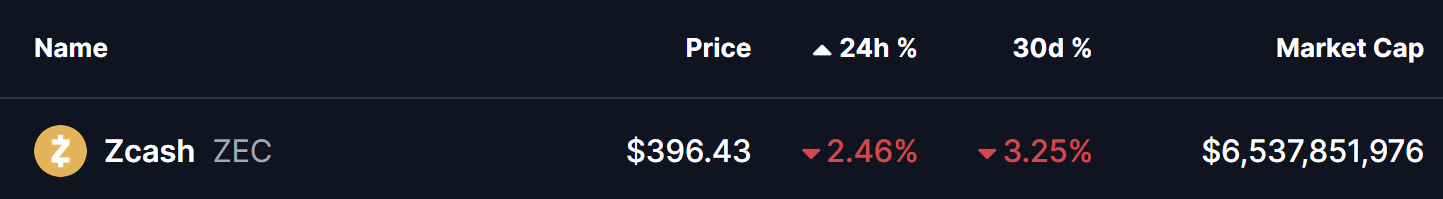

Is Zcash (ZEC) In Bears Control? This Emerging Bearish Pattern Formation Suggest So!