Aster Resolves XPL Perp Glitch with Refunds as Growth Momentum Accelerates

Aster DEX swiftly refunded users after the XPL perpetual glitch, reinforcing trust while surpassing Hyperliquid in daily trading fees.

Aster DEX has completed compensation for users affected by abnormal price movements in its XPL perpetual trading pair.

The decentralized exchange rose as an inadvertent market rival against Hyperliquid, championed by Binance founder Changpeng Zhao, as the DEX runs on BNB Chain.

Aster Compensates Traders After Abnormal XPL Price Fluctuation Incident

Aster reassured the community that all impacted accounts have received direct USDT refunds, compensating users affected by anomalous XPL price movements.

“Compensation for the XPL perp incident has now been fully distributed. All affected users have received reimbursement directly in USDT to their accounts. We appreciate your patience and understanding throughout this process,” Aster stated.

Earlier this week, Aster detected unusual behavior in the XPL perpetual contract, prompting the exchange to suspend activity and pledge user protection.

We are aware of abnormal price movements on the XPL perpetual trading pair. Rest assured, all user funds are SAFU. We are conducting a full review and will compensate any affected users for losses.

— Aster (@Aster_DEX) September 25, 2025

Community reports suggest a misconfigured index caused the disruption. According to on-chain analyst Abhi, the index price had been hard-coded to $1, while the mark price was capped around $1.22.

When the cap was lifted without correcting the index, prices on Aster spiked to nearly $4, even as other exchanges held steady around $1.3.

The result was a sudden wick that briefly froze the trading chart before snapping back to more realistic levels.

XPL Price Performance. Source:

Abhi on X

XPL Price Performance. Source:

Abhi on X

Several traders were liquidated during this move, though Aster quickly pledged full reimbursement.

“The issue on the XPL perpetual trading pair has been fully resolved. All users liquidated during this period will have their liquidation losses calculated and reimbursed directly to their wallets in USDT within the upcoming hours,” Aster articulated.

While Aster has moved swiftly to restore confidence, the incident highlights the risks that still exist in decentralized derivatives trading. It shows that configuration errors can spiral into costly disruptions.

Nonetheless, the exchange’s rapid reimbursement has been well-received, with affected users reporting that their funds were restored within hours. However, some still decry losing their trading points.

“Why are my trading points down by over 100,000 points compared to yesterday? Can points still be deducted? What’s the reason?” one user lamented.

The incident reflects how even fast-growing exchanges remain vulnerable to operational glitches.

Aster Market Growth Outpaces Rivals

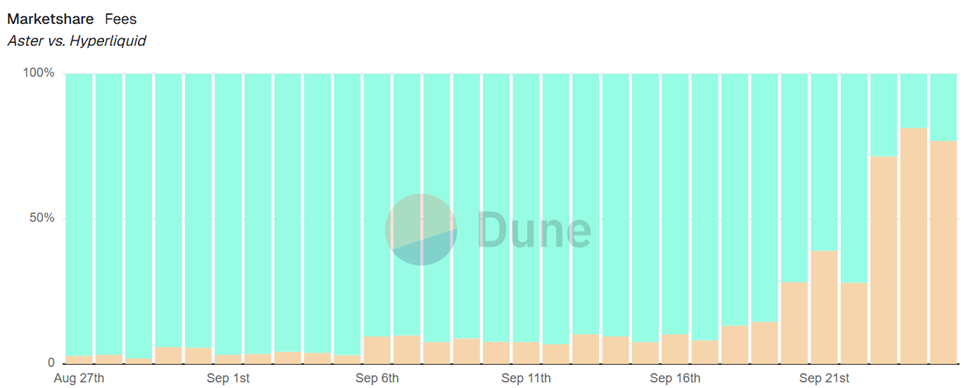

Despite the technical hiccup, Aster continues to post impressive growth figures. According to Dune Analytics, Aster generated $16.3 million in daily trading fees in the last 24 hours. This is more than three times Hyperliquid’s $4.9 million.

Aster vs Hyperliquid on Market Share Fees Metrics. Source:

Dune Analytics

Aster vs Hyperliquid on Market Share Fees Metrics. Source:

Dune Analytics

User adoption is also accelerating. Aster now reports more than 2.57 million total traders, with nearly 468,000 new accounts added in the past 24 hours alone.

Such growth suggests that demand for on-chain perpetuals remains strong, even in the face of occasional disruptions.

Adding to the momentum, whale activity in Aster’s native token has been drawing attention. Market analyst Mario Nawfal noted that one large holder recently accumulated 55 million ASTER tokens, worth roughly $115 million over two days.

THIS WHALE HAS BOUGHT 55M $ASTER ($115M) OVER THE PAST 2 DAYSWHAT DOES HE KNOW? pic.twitter.com/EDg0m8pHTr

— 0xMarioNawfal (@RoundtableSpace) September 26, 2025

That level of conviction has fueled speculation about insider confidence in the platform’s trajectory, even as the XPL incident briefly shook trader sentiment.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Buffett's Berkshire Invests in AI as Tradition Embraces a Technology-Focused Transformation

- Warren Buffett's Berkshire Hathaway acquired a $4.3B Alphabet stake, marking a shift from traditional value investing to AI-driven tech investments. - The move includes a 15% reduction in Apple holdings to 238.2M shares, while trimming Bank of America and exiting D.R. Horton positions. - As Buffett prepares to step down, his handpicked team's tech focus raises questions about balancing legacy value strategies with AI-era growth opportunities. - Alphabet's 46% 2025 stock surge, driven by cloud/AI leadersh

Aster News Today: Aster Moves Tokens to Public Wallet Address to Address Community Uncertainty

- Aster clarified token unlock date adjustments were due to miscommunication, confirming no policy changes to tokenomics despite CMC/Binance listing discrepancies. - 6.06 billion ASTER remain locked, with unused tokens now transferred to a public wallet to enhance transparency and address dilution concerns. - ASTER price surged 10% to $1.12 amid Binance CZ's $2.5M holding disclosure and a $860K short liquidation, despite declining protocol fees and open interest. - Project maintains 20% supply allocation f

Aster News Today: Aster's Public Wallet Initiative Seeks to Restore Confidence in DeFi Following Data Confusion

- Aster clarified its tokenomics remain unchanged after CoinMarketCap's data update caused confusion over delayed ASTER token unlocks. - The project will transfer unused tokens to a public wallet for transparency, addressing concerns about supply shocks and miscommunication. - ASTER's price briefly rose 10% post-clarification, while experts praised its proactive governance approach in rebuilding DeFi trust. - The incident highlights crypto data reporting vulnerabilities, with delayed unlocks on aggregators

Ethereum Latest Updates: Major Holders and Institutions Accumulate ETH While Individual Investors Exit

- Ethereum long-term holders are selling at 2021's fastest pace as macroeconomic uncertainty and weak institutional demand drive ETH below $3,500. - Institutional investors and whales are accumulating ETH via leveraged stablecoin loans and OTC channels, including a $1.33B whale purchase from Aave . - Market analysts note divergent dynamics between retail exodus and institutional buying, with whale activity often preceding market bottoms according to SynFutures CEO Rachel Lin. - U.S. spot ETH ETF outflows a