Crypto’s Landscape Transforms: Altcoins Surpass Bitcoin While MoonBull 1000x Presale Attracts Investment

- MoonBull 1000x's presale attracts early investors as Altcoin Season gains momentum, with the Altcoin Season Index hitting 80 points. - Bitcoin dominance drops to 54%, signaling capital rotation into altcoins, while Ethereum ETF inflows exceed $4B, boosting high-cap tokens. - NFT projects like Pudgy Penguins (+23%) and Dogwifhat (+119%) reflect growing demand for meme/utility tokens during this altseason. - Technical indicators confirm altseason conditions, with Bitcoin dominance forming a bear flag patte

MoonBull 1000x Crypto Draws Early Backers as Altcoin Season Accelerates

The project’s appeal is further boosted by its model, which promises early participants a potential 1000x return. This fits within a wider trend of institutional investments and ETF approvals driving greater interest in altcoins. Projects built on Ethereum have especially seen renewed enthusiasm, with the ETH/BTC ratio stabilizing at 0.058 after a lengthy decline. This technical shift is viewed as an early sign that capital is moving toward tokens with practical use cases, such as MoonBull [ 2 ].

Pudgy Penguins and

Technical signals further support the case for an altcoin surge. Bitcoin’s dominance has formed a bearish flag on the weekly charts, suggesting its market share may continue to shrink. At the same time, the Altcoin Season Index, which tracks the top 100 altcoins’ performance against Bitcoin, has surpassed 75%, confirming an ongoing altseason. This pattern is consistent with previous cycles where altcoins like

Institutional participation is also playing a key role.

Market experts warn that, despite favorable conditions for an altseason, there are still risks. Regulatory changes and broader economic instability could impact the rally. Still, the current landscape is reminiscent of 2021, when Ethereum and other altcoins surged following Bitcoin’s initial gains. With Bitcoin’s dominance at multi-year lows and altcoin trading volumes reaching their highest in five months, the market appears primed for a continued run in mid- and small-cap assets [ 6 ].

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

US Government Reopens After 41 Days – What It Means for Bitcoin, Crypto, and Global Markets

Dogecoin Price Prediction: Can DOGE Reach $0.40 Before 2025 Ends?

Enterprise AI’s Upheaval Drives Crypto’s Push into Private Markets

- C3 AI faces potential sale after founder Thomas Siebel's health-related CEO exit triggered a 6% stock surge. - The company reported $116.8M Q1 losses and 54% share price decline, now exploring private capital raises under new CEO Stephen Ehikian. - IPO Genie's $0.0012 presale token aims to bridge crypto and private markets using AI-driven deal-screening, attracting 300,000+ participants. - With $500M in regulated assets and CertiK-audited security, IPO Genie contrasts C3 AI's struggles by targeting 750×

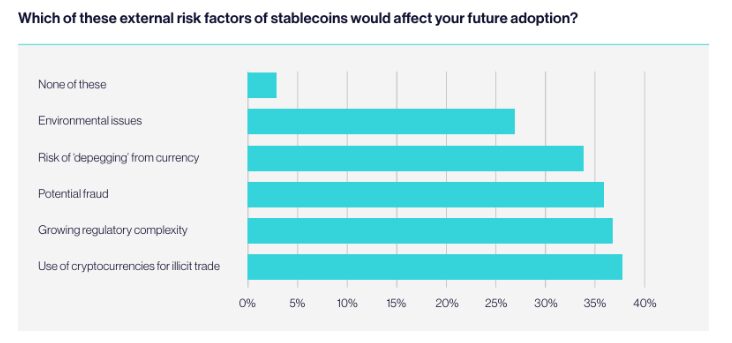

European Tech Startups Eye Stablecoins, But Risks Stall Adoption