Tether Gold Nears $1.5 Billion After Tokenized Treasury Move

Tether's deepening ties to gold—spanning mining investments and redemption-backed vaults—signal a major strategic shift beyond stablecoins.

Tether Gold (XAUt), the gold-backed digital token issued by stablecoin giant Tether, is closing in on a $1.5 billion market capitalization.

According to data released by the company, Tether Gold’s market capitalization currently stands at about $1.46 billion, supported by 966 gold bars weighing 11,693.4 kilograms.

Digital Gold Rush Pushes Tether’s XAUt Toward $1.5 Billion

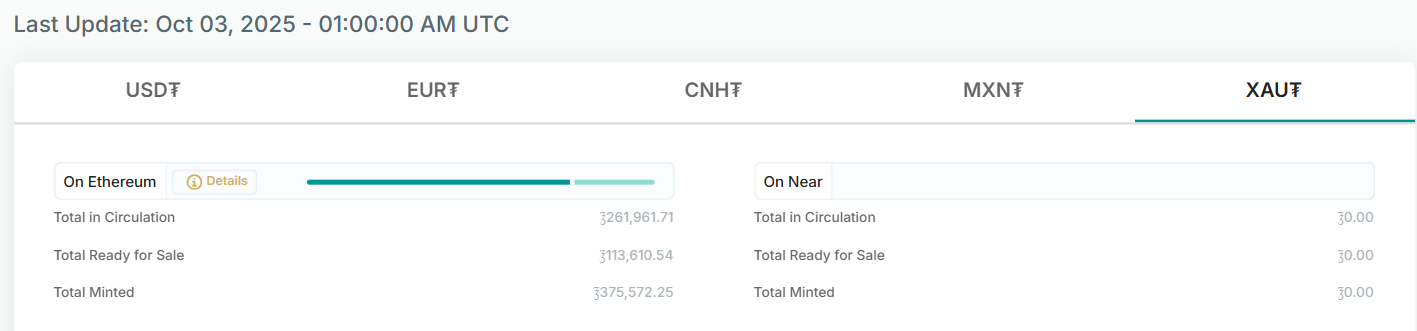

The firm said the token’s total minted supply amounts to 375,572.25 ounces, of which 261,961.71 ounces—worth roughly $1.01 billion—are in circulation, while 113,610.54 ounces remain available for sale.

Tether XAUt Token Supply. Source:

Tether

Tether XAUt Token Supply. Source:

Tether

The token’s market value rise mirrors gold’s record-breaking rally. Indeed, spot gold price recently climbed to an all-time high of $3,896.49, marking its seventh consecutive weekly gain.

Market analysts attribute this climb to investors seeking safety amid fears of a prolonged US government shutdown and mounting expectations of the Federal Reserve cutting interest rates.

As gold prices soar, digital representations like XAUt have benefited from parallel demand. Investors increasingly view tokenized gold as a more liquid, accessible alternative to traditional holdings.

Consequently, Tether Gold has appreciated by nearly 46% over the past year and 10% in the past month, earning it a place among the world’s 100 largest cryptocurrencies by market capitalization.

Tether to Deepen Gold Strategy

Tether’s ambitions in tokenized assets extend well beyond XAUt’s market performance.

The USDT issuer is reportedly working to raise at least $200 million for a new Digital Asset Treasury Company (DATCO) focused on tokenized gold. On this venture, it is partnering with Antalpha, a firm linked to Bitcoin hardware maker Bitmain.

According to the report, the DATCO will hold Tether’s XAUt tokens and open the door for broader institutional participation in tokenized gold.

Meanwhile, this venture builds on a series of earlier collaborations between Tether and Antalpha.

In June, Tether acquired an 8.1% equity stake in the company. By September, the two firms had expanded their partnership to improve access to XAUt through collateralized lending and vault services across major financial centers.

These arrangements allow investors to redeem tokens directly for physical gold bars, reinforcing the token’s real-world value proposition.

Moreover, Tether has also diversified deeper into the gold industry by investing in mining and royalty companies.

The firm has invested over $200 million in Toronto-listed Elemental Altus and is reportedly in talks with other global mining and royalty groups.

Collectively, these initiatives mark one of Tether’s boldest strategic shifts since it established dominance in the stablecoin sector.

As CEO Paolo Ardoino often emphasizes, Bitcoin, gold, and land remain the company’s ultimate hedges “against incoming darker times.” As of June, the firm held over $8.7 billion worth of gold on its balance sheet.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

High‑valuation equity markets hinge on strong Q4 profit beat or risk volatility spike

Ethereum Proof-of-Stake Deposit Contract Spikes to 77.85M $ETH, Retaining 46.59% of Supply

Overview of Zero Knowledge Proof and Data Verification

Still Flying Under the Radar: Zero Knowledge Proof’s $100M Network Build Sparks 300x to 10,000x Projections!