DoubleZero co-founder confirms no tokens sold by foundation

Key Takeaways

- DoubleZero Foundation has not sold any of its tokens, confirmed by co-founder Austin Federa.

- The statement addresses community concerns about foundation token sales following the launch of DoubleZero's mainnet beta.

DoubleZero co-founder Austin Federa confirmed today that the DoubleZero Foundation has not sold any tokens. DoubleZero is a blockchain protocol focused on building a dedicated high-performance physical data network to enhance global connectivity for high-speed applications.

The clarification addresses potential concerns about foundation token movements. The DoubleZero Foundation operates as an entity supporting the development, decentralization, security, and adoption of the DoubleZero network.

DoubleZero recently received confirmation from the SEC that its native token flows to network contributors are not subject to securities registration requirements, marking a key milestone for the protocol’s compliance efforts.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Best Crypto to Buy: PEPE Consolidates, Etherna Pepe Stalls, While ZKP Targets 100x–10,000x

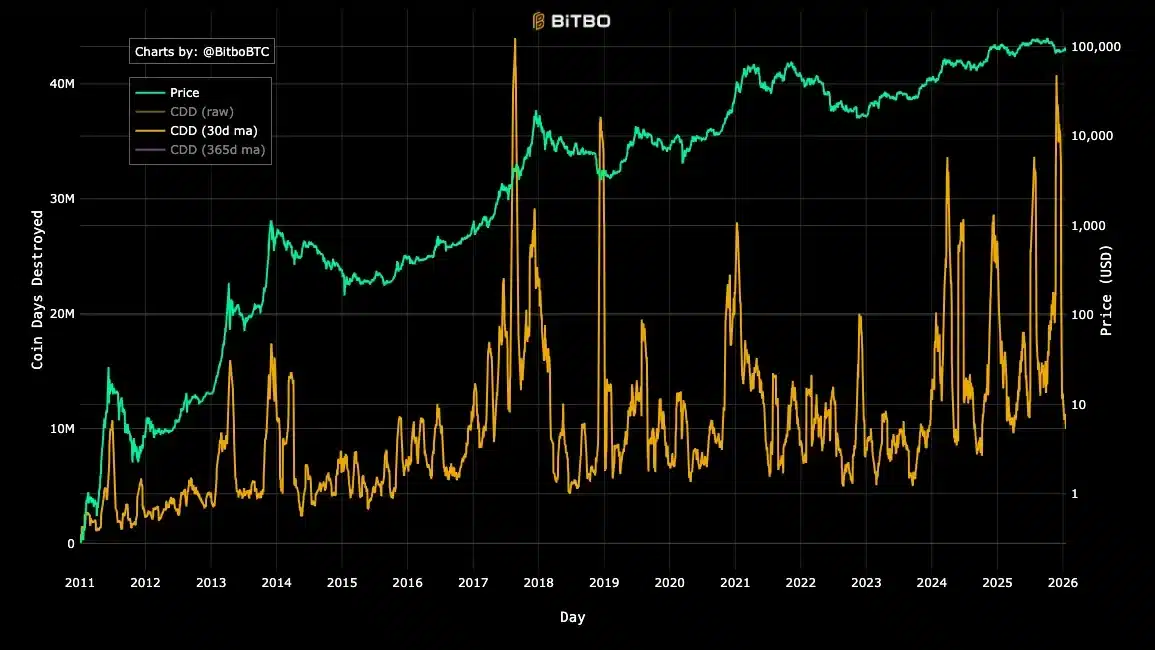

A 12-year Bitcoin OG is selling – But the market isn’t panicking

Mark Cuban's investment has played a significant role in reshaping Indiana's football program