China Financial Leasing to Raise $11 Million for Crypto-AI Platform

- Raising US$11 million for cryptocurrency and AI platform

- Innoval Capital acquires 69 million shares of the company

- Shares rise 25% after announcement of new initiative

China Financial Leasing Group, a Hong Kong-listed investment firm, announced plans to raise approximately US$11,1 million in a private placement. The proceeds will be used to create a new cryptocurrency and artificial intelligence investment platform, solidifying the company's interest in the digital asset sector.

Second company statement , the transaction will be conducted with Innoval Capital, which will purchase 69,38 million new shares at HK$1,25 per share. This represents approximately 20% of the current share capital and approximately 16,7% after issuance, reinforcing the group's commitment to expanding its business focused on the digital economy.

In an official statement, China Financial Leasing highlighted that “the company intends to focus on establishing a Crypto-AI digital asset investment platform within the group, investing in digital asset exchanges (including stablecoins, BTC, ETH, RWA, NFT, DEFI, Depin and other new digital assets) and building a digital asset management platform.”

Innoval Capital, responsible for underwriting the shares, is an investment company based in the British Virgin Islands, founded by Moore Xin Jin, current CEO of Antalpha Platform Holding Company (ANTA). ANTA, listed on the Nasdaq, manages over US$1,6 billion in assets, and Jin's experience in the cryptocurrency and fintech markets should add solidity to the project.

The company also emphasized that the plan is in line with the guidelines of the Hong Kong government, which in June reinforced its commitment to stimulating the development of the cryptoasset market and the adoption of blockchain-based technologies. The goal is to transform the group into an innovation hub focused on digital assets and artificial intelligence.

Following the announcement, China Financial Leasing Group's shares rose 25% around 14 p.m., according to local market data. The company's market value reached approximately HK$555 million, equivalent to US$71,3 million, reflecting investor optimism about the new crypto initiative.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

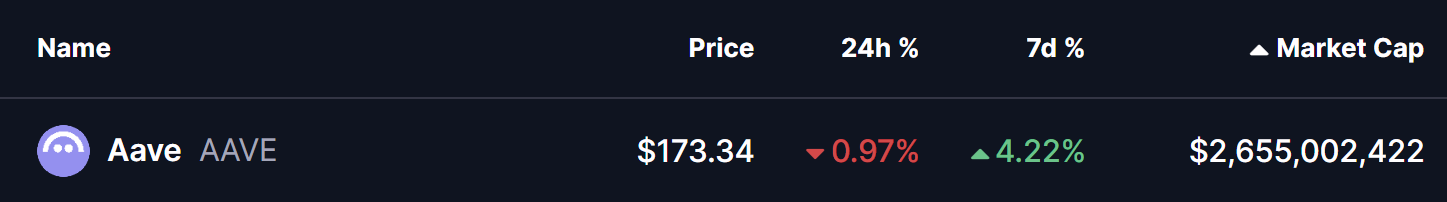

Is Aave (AAVE) Setting Up for a Potential Breakout Next Week? Key Emerging Pattern in Focus

Altcoin XRP Setting Up for the C Wave Push, Ripple’s Native Asset Prepares for Bullish Ascent

Sequoia to join GIC, Coatue in Anthropic investment, FT reports