Linea launches ETH-backed loan with Maple Finance

Key Takeaways

- Linea has partnered with Maple Finance to offer ETH-backed institutional loans on its layer-2 blockchain.

- This collaboration enables users to use Ethereum as collateral to access liquidity on the Linea network.

Share this article

Linea, a layer-2 scaling solution, has launched an ETH-backed loan product in partnership with Maple Finance, an onchain platform that provides institutional credit products.

The collaboration brings institutional lending capabilities to Linea’s blockchain network, allowing users to access liquidity using Ethereum as collateral.

Maple Finance has been actively deploying institutional lending solutions on emerging chains as part of its expansion strategy.

The ETH-backed loan offering represents Linea’s entry into institutional financial products, leveraging its layer-2 infrastructure to provide enhanced liquidity access for users seeking credit against their Ethereum holdings.

Share this article

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

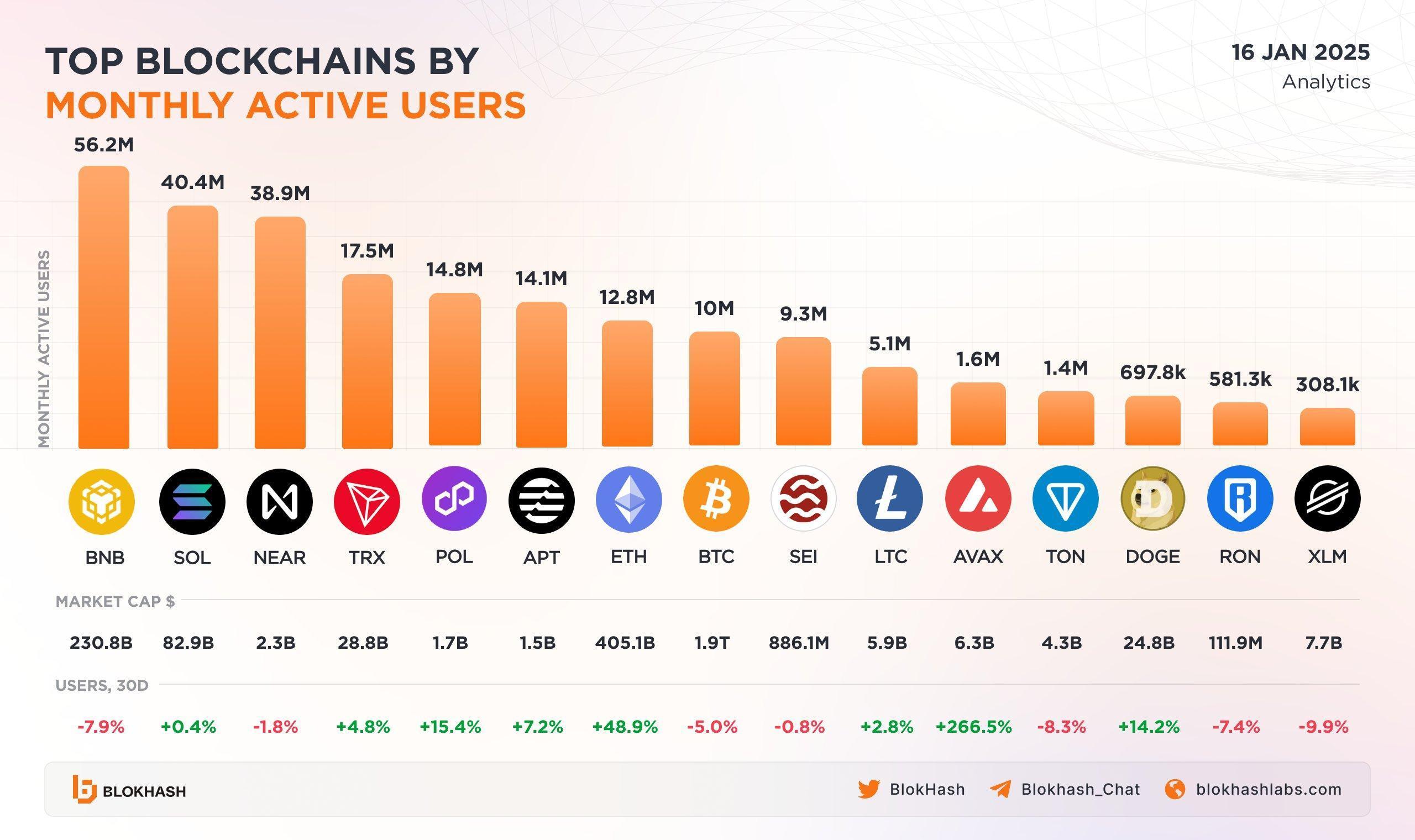

Solana (SOL) Leads Among Top Blockchains by Active Users — Will It Rise Higher?

The Saturday Spread: Leveraging the Markov Principle to Identify Undervalued Prospects (PANW, NTES, DKS)

AVAX Pushes Toward $18 As Key Resistance Looms: Analyst

Why writing open-source code is suddenly an existential risk, and the five-page bill designed to fix it