Bitcoin ETFs Lead With BlackRock’s $1.2B Inflow

- BlackRock’s ETF sees unprecedented $1.2B inflow.

- Larry Fink leads strategic developments.

- Impacts Bitcoin and related market dynamics.

BlackRock’s iShares Bitcoin Trust ETF (IBIT) experienced significant growth, reaching a $1.2 billion inflow, marking a notable event for the ETF industry in October 2025.

These inflows underscore heightened interest in Bitcoin ETFs, potentially impacting Bitcoin’s market performance and influencing institutional investment trends.

BlackRock’s iShares Bitcoin Trust ETF (IBIT) has recorded a significant $1.2 billion inflow, marking a notable event in the crypto sector. This influx is attributed primarily to investor confidence in digital assets.

The ETF seeks to mirror Bitcoin’s price performance, and is currently managed under the leadership of Larry Fink, CEO of BlackRock. Recent data confirms IBIT’s position as a leader in Bitcoin investments .

The massive inflow into BlackRock’s ETF underscores a growing acceptance of Bitcoin as a mainstream investment. Larry Fink, Chairman and CEO, BlackRock, noted,

Bitcoin is an international asset… And we believe if we can create more securitization of that, more safety for it, I think a lot more people are going to feel comfortable with it.

The financial implications of this development suggest increased investor attention to low-expense ratio products, with IBIT’s 0.25% expense ratio being a noted factor in its popularity.

Historical precedents show similar ETFs have previously led to substantial market activities. This inflow into IBIT mirrors past events but on a larger scale, reflecting heightened investor enthusiasm.

The recent inflow points to potential regulatory reassessments and technological advancements as the market adapts to increased interest. Bitcoin’s stability as an investment option is supported by consistent positive returns since IBIT’s inception. For more detailed information, you can explore investing in Bitcoin with iShares ETF .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Weekly Highlights Propel Cryptocurrency Trends

Google search traffic to news sites plunges by one-third globally

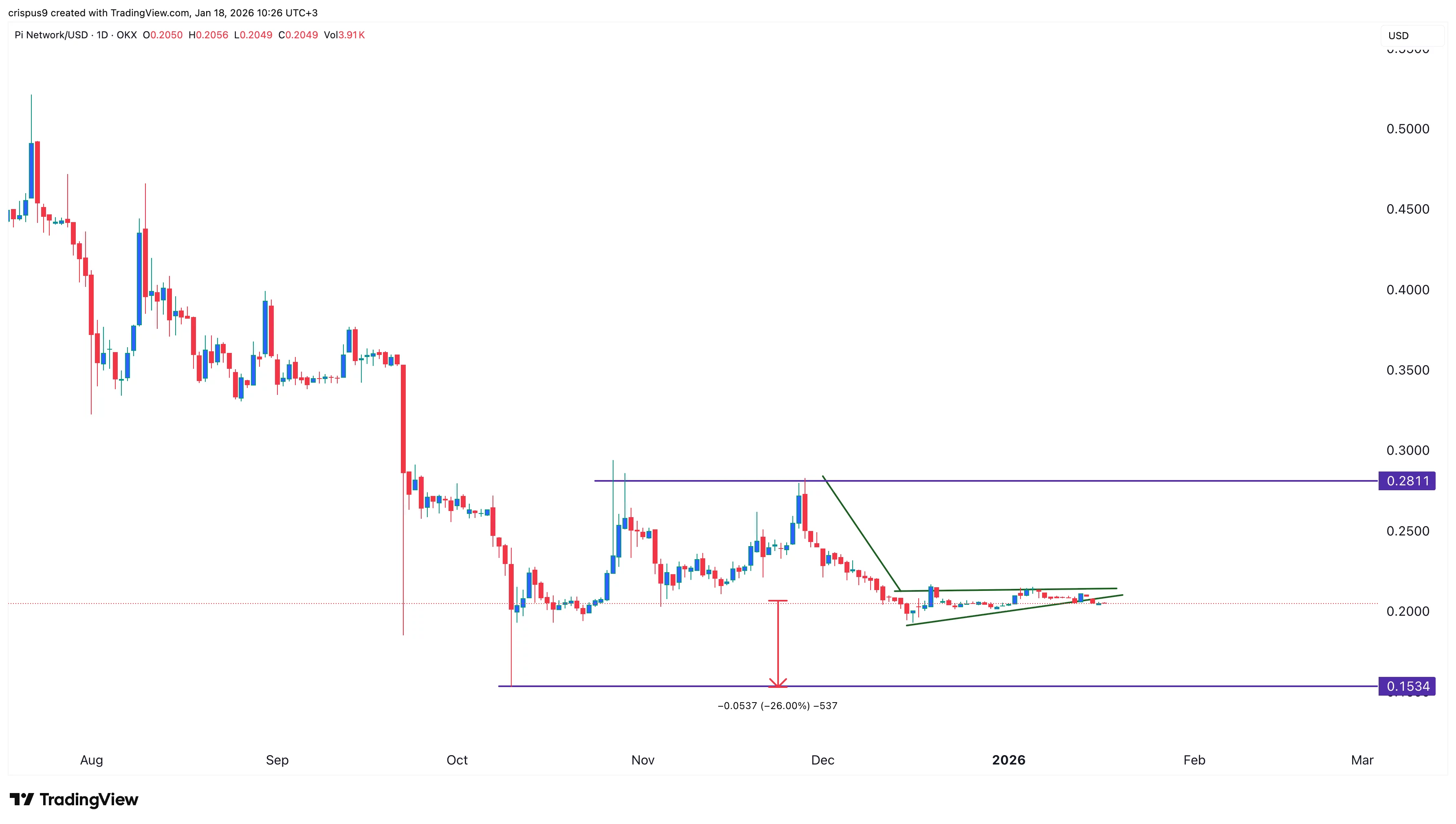

Pi Network price remains calm: will it rebound or crash?

Outrageous levels of student debt are putting immense pressure on the UK’s economy