Why Dogecoin Could Revisit Its 13-Month Low Despite a 5% Recovery

Dogecoin’s short-lived bounce may be losing steam as network activity declines and long-term holders take profits, raising the risk of another dip toward its yearly lows.

Leading meme coin Dogecoin has staged a modest 5% rebound. This comes after the meme coin’s price briefly crashed to a September 2024 low during last week’s Black Friday sell-off.

With the broader crypto market attempting to recover from the sharp downturn, DOGE’s price has trended slightly upward in recent days. Yet, on-chain data suggests that this recovery may lack real conviction. This analysis explains why.

Dogecoin Recovery May Be Short-Lived

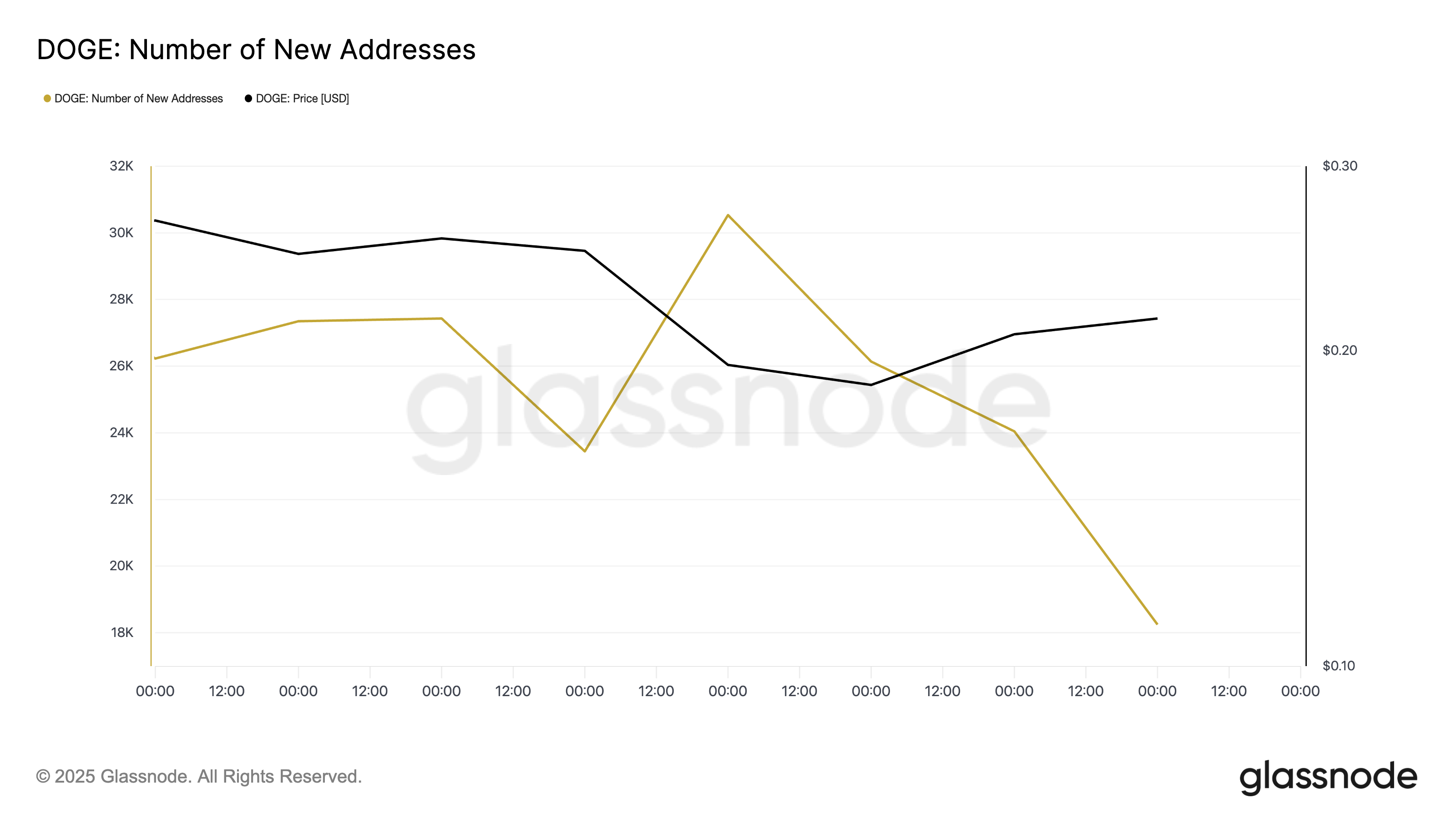

According to Glassnode’s data, new demand for DOGE continues to decline steadily, with fewer new addresses interacting with the asset daily since last Friday.

Yesterday, 18,251 unique addresses appeared for the first time in a DOGE transaction on the network. This marked a 40% drop from the 30,534 active addresses that traded the meme coin during the Black Friday liquidation event.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

DOGE Number of New Addresses. Source:

Glassnode

DOGE Number of New Addresses. Source:

Glassnode

The drop signals that DOGE’s 5% rebound may be driven more by short-term market relief than by genuine investor demand for the altcoin, which puts its price at risk of a correction in the near term.

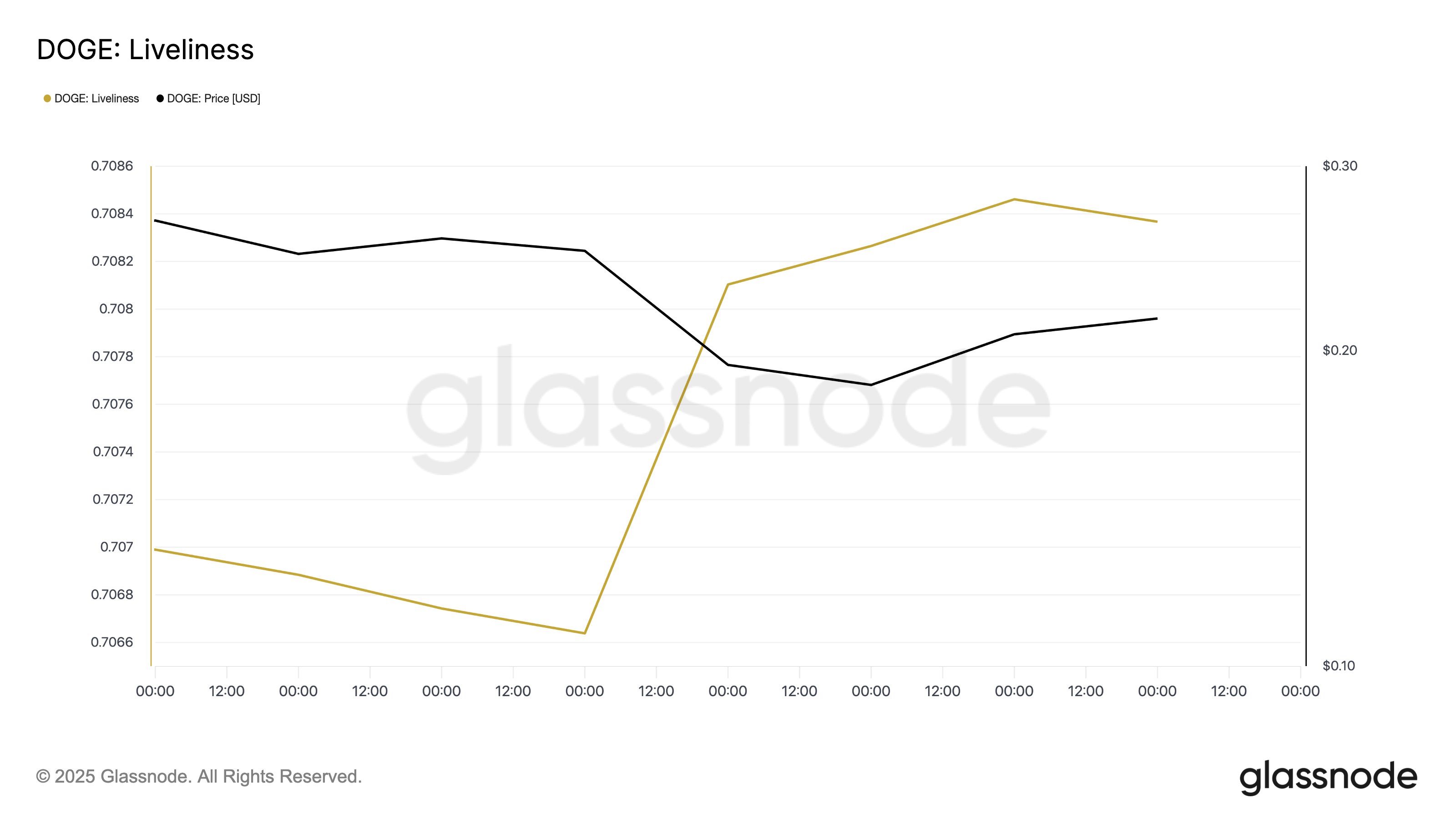

Furthermore, DOGE’s liveliness has risen steadily over the past few trading sessions, suggesting that its long-term holders (LTHs) view the price rebound as an opportunity to offload their holdings.

According to Glassnode, the metric closed October 13 at 0.708.

DOGE Liveliness. Source:

Glassnode

DOGE Liveliness. Source:

Glassnode

The Liveliness metric tracks the movement of long-held/dormant tokens or coins. When its value falls, LTHs are removing their assets from exchanges, which is usually a bullish sign of accumulation.

On the other hand, when an asset’s liveliness climbs, as with DOGE, more long-held coins are being moved or sold, signaling increased profit-taking by long-term holders.

For DOGE, readings from its Liveliness suggest that its LTHs are taking advantage of the ongoing rebound to sell their holdings. This further increases the likelihood of a near-term correction.

Is $0.095 Back on the Cards?

On the daily chart, DOGE continues to face downward pressure, trading below its 20-day Exponential Moving Average (EMA). The 20-day EMA currently forms dynamic resistance at $0.249, while DOGE trades around $0.199 at the time of writing.

The 20-day EMA measures an asset’s average price over the past 20 trading sessions, giving more weight to recent prices. When the price remains below this line, it signals that bears maintain control, and short-term sentiment is tilted toward the downside.

Without renewed buyer interest or an uptick in network activity, DOGE risks sliding toward the next support level at $0.167.

Failure to defend this price floor could open the door for a deeper correction. It could potentially retest its 13-month low of $0.095, recorded during the recent market crash.

DOGE Price Analysis. Source:

TradingView

DOGE Price Analysis. Source:

TradingView

However, if sentiment improves and bullish momentum returns, DOGE could stage a breakout above $0.224. This will invalidate the bearish setup and pave the way for a rally toward $0.264.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Politician Gilbert Cisneros Recently Sold Shares of Cameco. Is It Time for You to Do the Same?

A business that scales with the value of intelligence

NEAR and BGB Sit Idle While BlockDAG’s $0.001 Presale Enters Its Final Countdown

From $0.001 to $0.05: Here’s How BlockDAG’s Locked ROI is Crushing Render & Bonk This Week!