Altcoin that Whales Accumulated Immediately After the Drop Is a Surprise

Following the recent drop in the cryptocurrency market, four major whale investors have staked a total of 48 million Falcon Finance (FF) tokens (approximately $6.47 million).

According to onchain data:

- Address 0xDda6 has staked 15 million FF ($2.3 million) from Bitget in the last 5 hours.

- 0x484F withdrew and staked 15 million FF ($1.84 million) from MEXC two days ago.

- 0xBbB9 staked 10 million FF ($1.15 million) from Gate two days ago.

- 0xf68C has withdrawn and staked 8 million FF ($1.18 million) from KuCoin in the last 7 hours.

However, the on-chain activity wasn't limited to the FF token. A new wallet, likely belonging to Bitmine, purchased 26,199 ETH (approximately $108 million) through FalconX.

Institutional mobility also attracted attention:

- Grayscale deposited 1,856 BTC ($205.8 million), 29,718 ETH ($151.2 million), and 10,516 SOL ($2 million) into Coinbase Prime.

- BlackRock transferred 93,158 ETH ($364 million) and 704 BTC ($77.67 million) to the same platform.

- Wallets linked to Matrixport have withdrawn 4,000 BTC (approximately $454 million) from Binance in the last 20 hours.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

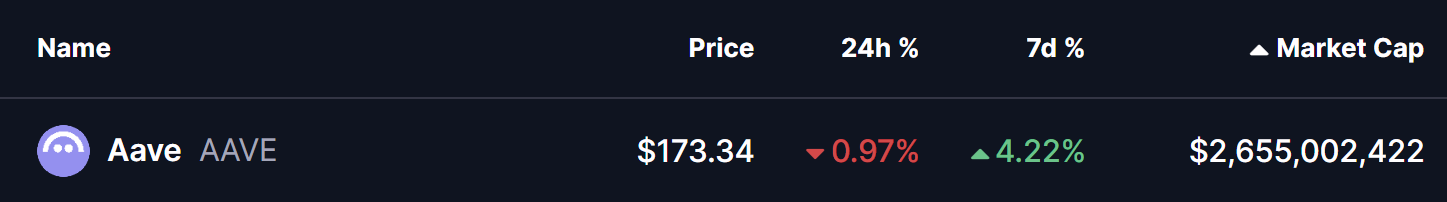

Is Aave (AAVE) Setting Up for a Potential Breakout Next Week? Key Emerging Pattern in Focus

Altcoin XRP Setting Up for the C Wave Push, Ripple’s Native Asset Prepares for Bullish Ascent

Sequoia to join GIC, Coatue in Anthropic investment, FT reports