NYC Opens Digital Assets Office to Boost Bitcoin

New York City has taken a decisive leap toward becoming a global crypto powerhouse with the creation of the New York City digital assets office. The move underscores the city’s growing commitment to innovation, financial technology, and the evolving blockchain economy. As the financial hub of the world, NYC’s entry into structured digital asset governance sends a strong signal about where the future of finance is heading.

This strategic decision comes at a time when global markets are embracing cryptocurrency integration across payments, investments, and public infrastructure. By formally launching the New York City digital assets office, the city aims to streamline the structure. Structure are policy coordination, encourage responsible innovation, and attract crypto-related enterprises to set up base in the United States.

JUST IN: NEW YORK CITY JUST ESTABLISHED THE OFFICE OF DIGITAL ASSETS TO PROMOTE CRYPTO

— The Bitcoin Historian (@pete_rizzo_) October 15, 2025

FINANCE HUB OF THE WORLD OPENLY EMBRACING #BITCOIN 🔥 pic.twitter.com/UXdDaQLvb7

Why New York City Created the Office of Digital Assets

The newly formed New York City digital assets office is designed to build trust, transparency, and efficiency around blockchain adoption. It will act as a liaison between the city’s policymakers, financial regulators, and the private sector to align innovation with regulation.

Among the office’s objectives is encouraging the adoption of Bitcoin. It promotes safe use of crypto, and exploring blockchain technology for government purposes. From digital payments for municipal services to blockchain for records, the office intends to use crypto technologies for practical applications in the world around us.

City officials believe this office can also help attract global fintech startups, venture investors, and developers seeking a secure yet progressive environment to build blockchain solutions. This approach could reinforce New York’s standing as the world’s leading finance and innovation capital.

How the Move Impacts the Future of Crypto Regulation

As federal crypto regulation is still being established, NY’s move is a proactive effort to start the conversation around sensible governance to achieve fairness and transparency. The crypto regulation framework proposed by the new office will aim to protect consumers while promoting innovation.

By engaging both state and private sector leaders, the office is likely to provide influence on broader, national policy on digital assets. Experts think that NYC’s effort could serve as a model for other American cities to consider or to establish similar digital asset offices. It’s a good first step toward enabling innovation but also protecting investors and financial stability.

Strengthening Bitcoin’s Role in Global Finance

The creation of the digital assets office in New York City also signifies the increase in mainstream legitimacy of Bitcoin. It is no longer a fringe experience. Bitcoin is now part of the conversation surrounding economic sovereignty and transferring value digitally.

The fact NYC is embracing the adoption of Bitcoin reaffirms its growth into a legitimate financial asset. The city’s institutions, banks, fintechs, and investment firms, are anticipated to work more closely with blockchain projects. This will create room for further digital payments and decentralized finance applications.

The Road Ahead

New York’s new initiative signifies a bold declaration of purpose, surpassing policy. The establishment of the New York City digital assets office demonstrates blockchain is not merely a niche idea, but a key foundational pillar of modernization in finance.

By signaling this evolution, NYC strengthens its status as a global financial capital. All of this while paving the way for Bitcoin innovation within an equitable sustainable structure. This project opens various avenues to potential renewed optimism around digital assets, while demonstrating how cities can react to emerging technologies.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Sequoia plans to fund Anthropic, defying the venture capital norm against supporting competitors: FT

Best Crypto to Buy: PEPE Consolidates, Etherna Pepe Stalls, While ZKP Targets 100x–10,000x

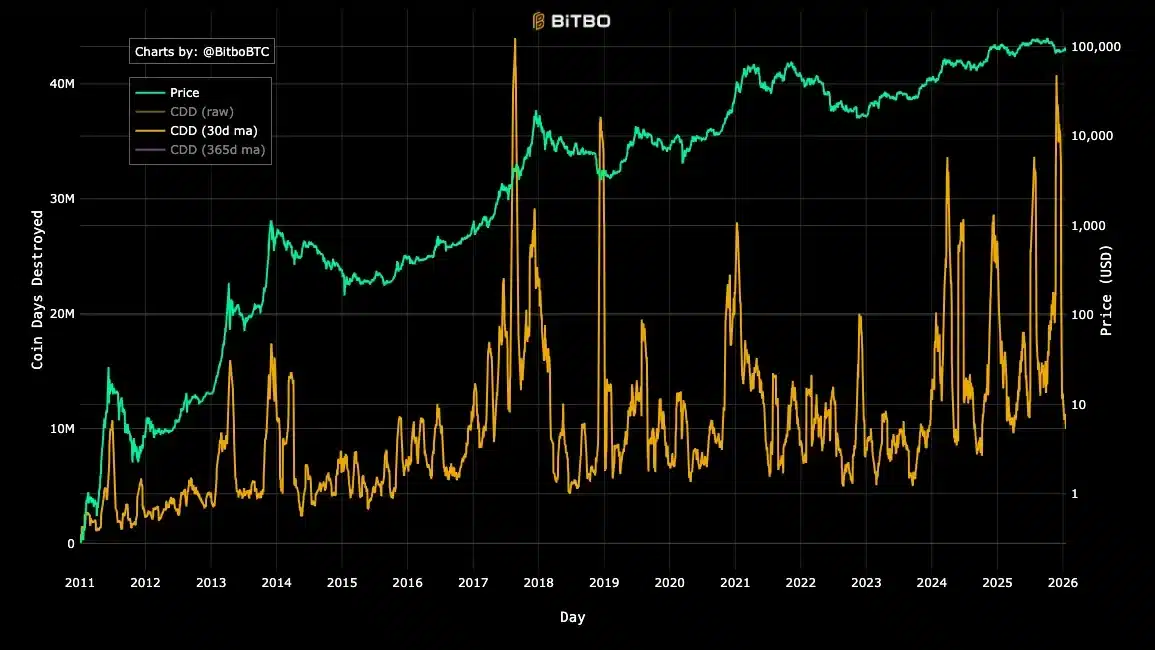

A 12-year Bitcoin OG is selling – But the market isn’t panicking