Bitcoin Updates: Major Institutions and Companies Drive $429 Million Bitcoin Rally as Whales Employ Advanced Hedging Strategies

- BlackRock deposited $314M Bitcoin and $115M Ethereum into Coinbase Prime, signaling institutional trust in crypto custody solutions. - BTC OG whale executed $593M Bitcoin transfers across major exchanges, employing a $1.18B short position in complex hedging strategies. - Strategy's 640,418 BTC ($71.1B) reserves now control 3% of Bitcoin's supply, surpassing peers despite 36% stock price decline. - A 14.4-year dormant Satoshi-era wallet moved $16.56M Bitcoin, sparking liquidity speculation amid mixed mark

Large-scale moves by institutions and whales are significantly influencing the market, as recent on-chain data highlights a notable increase in major crypto adoption.

At the same time, the so-called “BTC OG” whale—renowned for holding Bitcoin long-term—has shifted $593.67 million in Bitcoin across Coinbase, Binance, and Kraken over the last two weeks. The most recent move was a 100

Corporate accumulation of Bitcoin is also gaining momentum. Strategy, a publicly listed company focused on Bitcoin, has increased its holdings to 640,418 BTC ($71.1 billion), with an average purchase price of $112,051 per Bitcoin, as reported by

In a notable development, a long-dormant Bitcoin wallet from the Satoshi era—unused for 14.4 years—became active again on October 24, moving 150 BTC ($16.56 million) to a new wallet, according to

Market sentiment is currently mixed. Bitcoin’s price fell to $107,800 on Tuesday, but derivatives data points to a neutral-to-positive outlook as funding rates turned positive and futures open interest climbed to $26.06 billion, as reported by

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Long Signal That Preceded 370% Move Is About To Go Off Again — What To Know

Next Crypto to Explode: DeepSnitch AI Crushes XAI And GLMR With 100x Upside As Belgium Banking Giant Fuels Bull Run

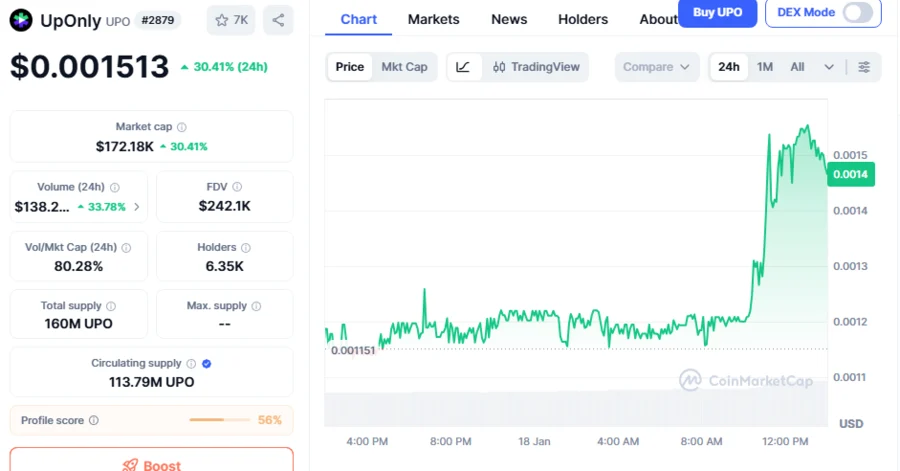

UPO Climbs Above $0.001500, Sets to Explode Amid Incoming Mega Pump, Whale Accumulation: Analyst

Ethereum staking just hit a $118B record at 30% of all coins, but one whale might be skewing the signal