Thailand Launches Raid on Unauthorized Biometric Crypto Transactions Involving Iris Scans

- Thailand's SEC and CCIB raided a Worldcoin iris scanning facility on October 24, 2025, investigating unlicensed WLD token distribution through biometric verification. - Authorities examine if exchanging tokens for iris scans violates Thailand's digital asset laws, with 102 scanning sites under scrutiny. - Worldcoin claims compliance in eligible regions but faces global scrutiny over biometric data security in Indonesia, Germany, Kenya, and Brazil. - Thai regulators arrested suspects, emphasizing strict e

On October 24, 2025, Thailand's Securities and Exchange Commission (SEC) collaborated with the Cyber Crime Investigation Bureau (CCIB) to carry out a coordinated raid on an

This operation highlights the mounting regulatory hurdles for ventures merging blockchain technology with biometric identification. World’s system employs orb devices to authenticate users through iris scans and allocates WLD tokens in regions where it asserts compliance with local laws,

Worldcoin asserts that its token distribution is limited to areas "where laws allow," with requirements based on location and age,

This event reflects a wider trend of regulatory action against

For cryptocurrency participants, the incident serves as a reminder of the dangers tied to unregulated digital asset dealings. Regulators emphasize the necessity of adhering to legal standards to safeguard consumers and uphold market stability. As Thailand’s SEC pursues its investigation, the results may influence future regulatory approaches to biometric-based crypto initiatives in Southeast Asia and elsewhere, Coinotag reported.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana Sees 740% Surge in Buying Pressure Amid ETF Buzz — What’s Next for the Price?

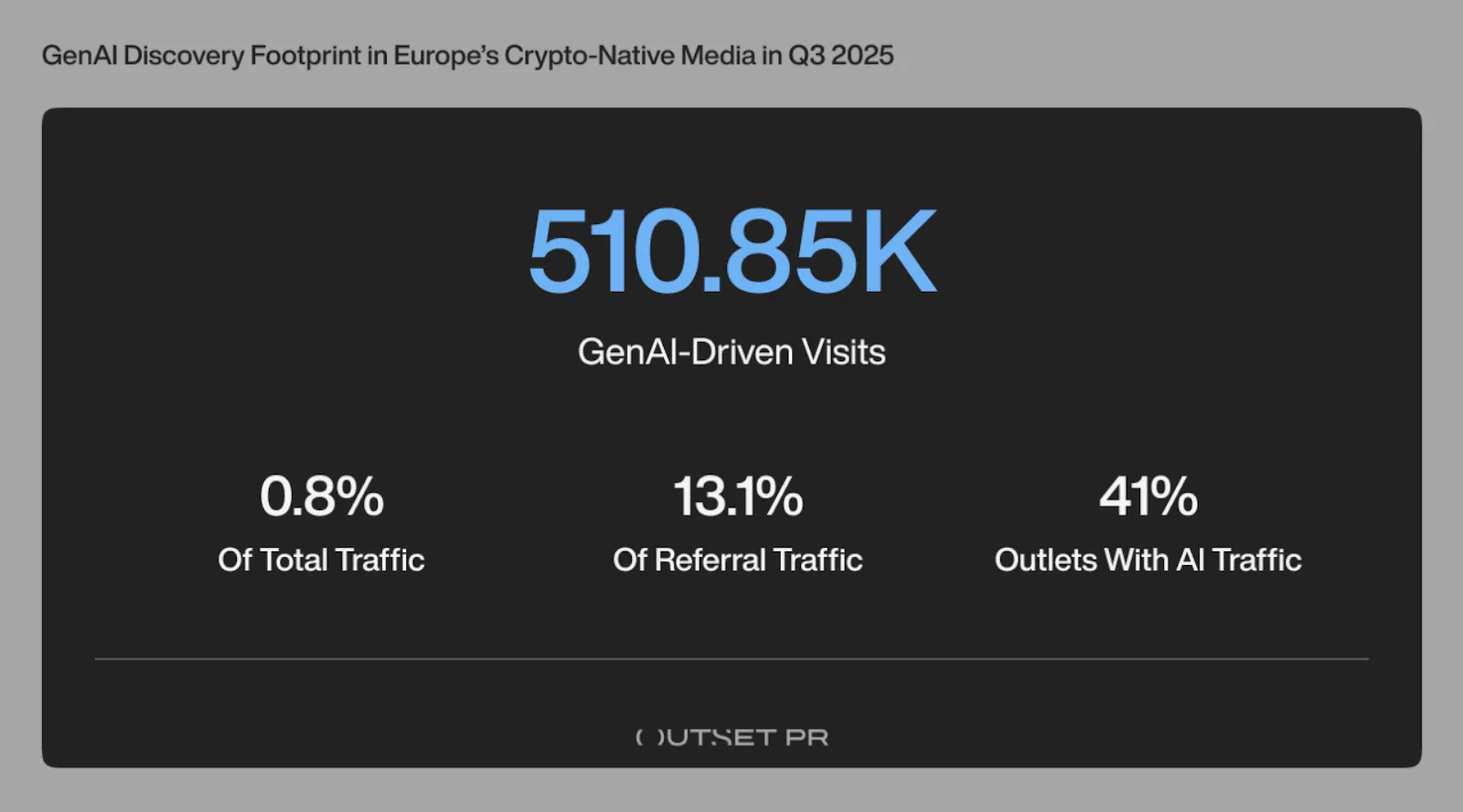

5 countries dominate Europe’s crypto media traffic in Q3

Economic Calendar: Here Are the Government Data Releases Still Pending Following the Shutdown